- United States

- /

- Medical Equipment

- /

- NasdaqGM:LNTH

Lantheus Holdings (LNTH): Valuation Perspectives Following Class Action Lawsuits Over Pylarify Disclosures

Reviewed by Kshitija Bhandaru

If you’re holding Lantheus Holdings (LNTH) or considering a purchase, the past few weeks have likely increased your attention to the stock. Several law firms have announced class action lawsuits alleging that Lantheus misled investors regarding the growth outlook and competitive risks surrounding its leading prostate cancer imaging product, Pylarify. The lawsuits claim management presented too optimistic a view of Pylarify’s prospects, only for reality to fall short. That disparity is now under legal scrutiny.

This wave of litigation followed a challenging period for the company in both performance and sentiment. Over the past year, Lantheus shares have fallen by more than 54 percent, with momentum turning sharply downward since the spring, accelerated by successive quarterly disappointments and increased legal risk. While Pylarify had been a source of optimism in earlier years, recent results have required downward revisions for both near-term growth and profit expectations, leading to larger questions about future value creation.

With the stock trading well below previous highs and a significant drop already reflected in the price, some may wonder if this presents a rare value opportunity for Lantheus or if investors are simply adjusting to the challenging path ahead.

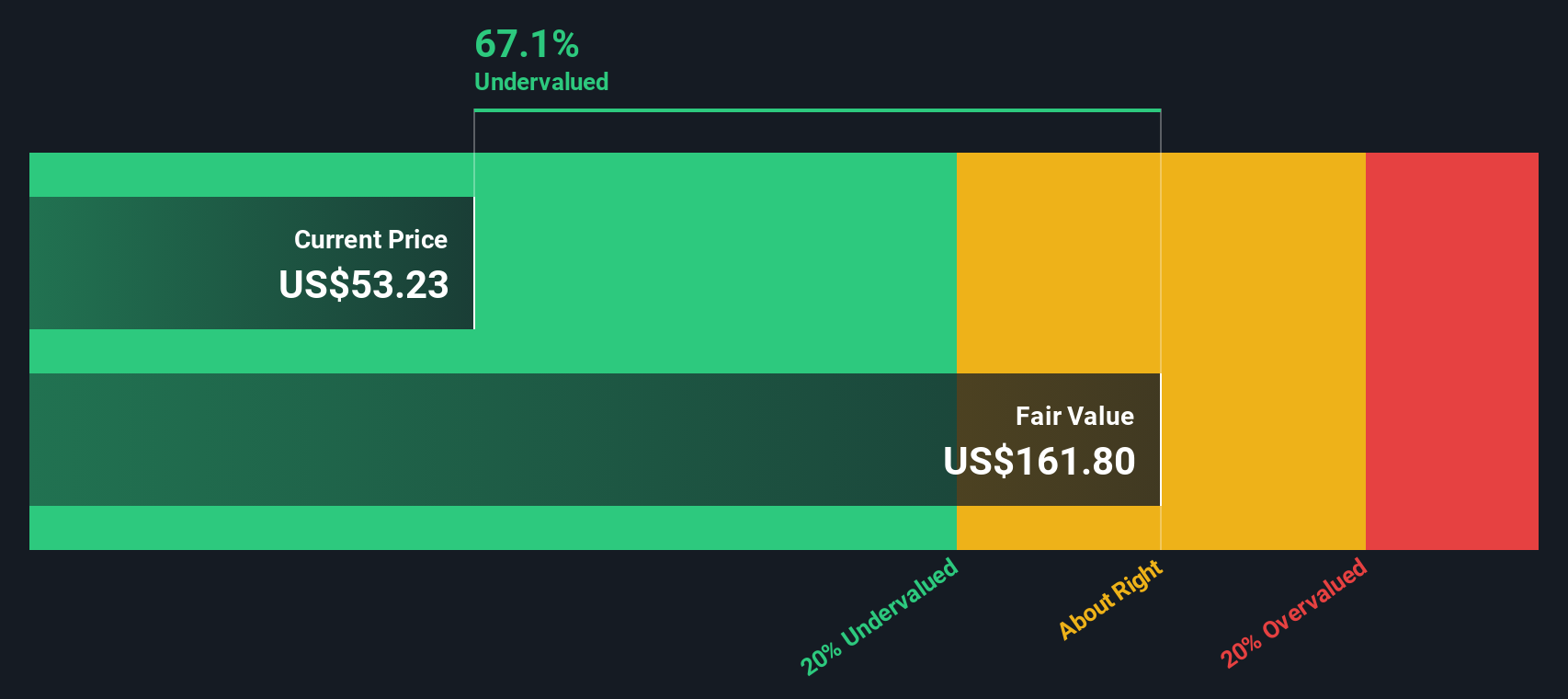

Most Popular Narrative: 41.8% Undervalued

According to the most widely followed narrative, shares of Lantheus Holdings are currently trading far below their estimated fair value. This suggests significant upside potential if expectations are met.

The expansion of Lantheus's Alzheimer's disease imaging franchise, including the recent FDA label expansion for Neuraceq and late-stage tau-targeted radiodiagnostic MK-6240, positions the company to capture accelerating demand. This demand is driven by broader adoption of amyloid-targeted therapies and an increased focus on early diagnosis. As a result, revenue growth is likely to be strong as the U.S. PET imaging market for Alzheimer's is expected to exceed $1.5 billion by 2030.

Curious about the numbers behind this steep undervaluation? This narrative includes a bold mix of growth predictions and industry tailwinds, with some forward-looking profit and revenue targets that might surprise you. Wondering what assumptions could move Lantheus Holdings' stock closer to its potential? The secret behind this valuation could change your view of the company's trajectory.

Result: Fair Value of $86.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing pricing pressure in the prostate cancer imaging market and heavy reliance on Pylarify could quickly challenge the current bullish outlook.

Find out about the key risks to this Lantheus Holdings narrative.Another View: SWS DCF Model

While some see Lantheus Holdings as deeply undervalued based on earnings comparisons to the industry, our DCF model tells a similar story. This approach weighs future cash flows, and both methods point to upside. Could both really be right?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Lantheus Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Lantheus Holdings Narrative

If your perspective differs from the ones shared here or you’d like to dig deeper on your own, it’s easy to craft your own analysis in just a few minutes. Do it your way.

A great starting point for your Lantheus Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t wait on the sidelines while the market moves. Powerful stock opportunities are waiting for you. Use the Simply Wall Street Screener to target the sectors and breakthroughs shaping tomorrow’s leaders.

- Unlock the potential of undervalued stocks based on cash flows by starting with undervalued stocks based on cash flows. Position yourself ahead of value-driven rallies.

- Tap into the rise of quantum innovation, where breakthroughs in computing power are fueling the next wave of disruptors through quantum computing stocks.

- Boost your income strategy by tracking companies offering dividend yields above 3 percent. All selections are sourced from dividend stocks with yields > 3% and designed to enhance long-term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LNTH

Lantheus Holdings

Develops, manufactures, and commercializes diagnostic and therapeutic products that assist clinicians in diagnosis and treatment of heart, cancer, and other diseases worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives