- United States

- /

- Medical Equipment

- /

- NasdaqGM:LNTH

Lantheus Holdings (LNTH) To Unveil Florbetaben Data at CTAD 2025 Could Diagnostic Innovation Strengthen Its Edge?

Reviewed by Sasha Jovanovic

- Lantheus Holdings announced it will present new florbetaben F18 data at the Clinical Trials on Alzheimer’s Disease (CTAD) 2025 conference in San Diego, with the presentation scheduled for December 3, 2025.

- This research highlights that florbetaben binding to amyloid plaques is unaffected by commonly used amyloid-targeting antibodies, which could support advances in Alzheimer’s diagnostic imaging.

- We’ll explore how the introduction of clinical data on florbetaben F18 could influence Lantheus’s outlook in Alzheimer’s imaging diagnostics.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Lantheus Holdings Investment Narrative Recap

To be a shareholder in Lantheus Holdings, you need to believe in the company's ability to expand its diagnostic imaging products, particularly in Alzheimer’s and oncology, while managing competitive and pricing pressures in key markets. The recent florbetaben F18 data presentation highlights innovation in Alzheimer's diagnostics but does not materially address the biggest short-term catalyst, the launch of new products to diversify revenue away from PYLARIFY dependency, or the ongoing pricing risks in prostate cancer imaging.

Of the recent company announcements, the FDA's acceptance of the NDA for MK-6240, another PET imaging agent for Alzheimer’s disease, stands out as closely relevant to the new florbetaben data, reinforcing Lantheus’s commitment to growing its neuroimaging franchise. This development could shape future product approvals and market share in the high-growth Alzheimer's diagnostic space, which remains key to offsetting pressures in other segments.

However, investors should be aware that, despite progress in neuroimaging, a major ongoing risk is persistent price compression in the PSMA PET imaging market that continues to affect overall profitability...

Read the full narrative on Lantheus Holdings (it's free!)

Lantheus Holdings' outlook anticipates $1.8 billion in revenue and $419.8 million in earnings by 2028. This projection assumes a 5.7% annual revenue growth rate and a $148.8 million earnings increase from current earnings of $271.0 million.

Uncover how Lantheus Holdings' forecasts yield a $80.93 fair value, a 38% upside to its current price.

Exploring Other Perspectives

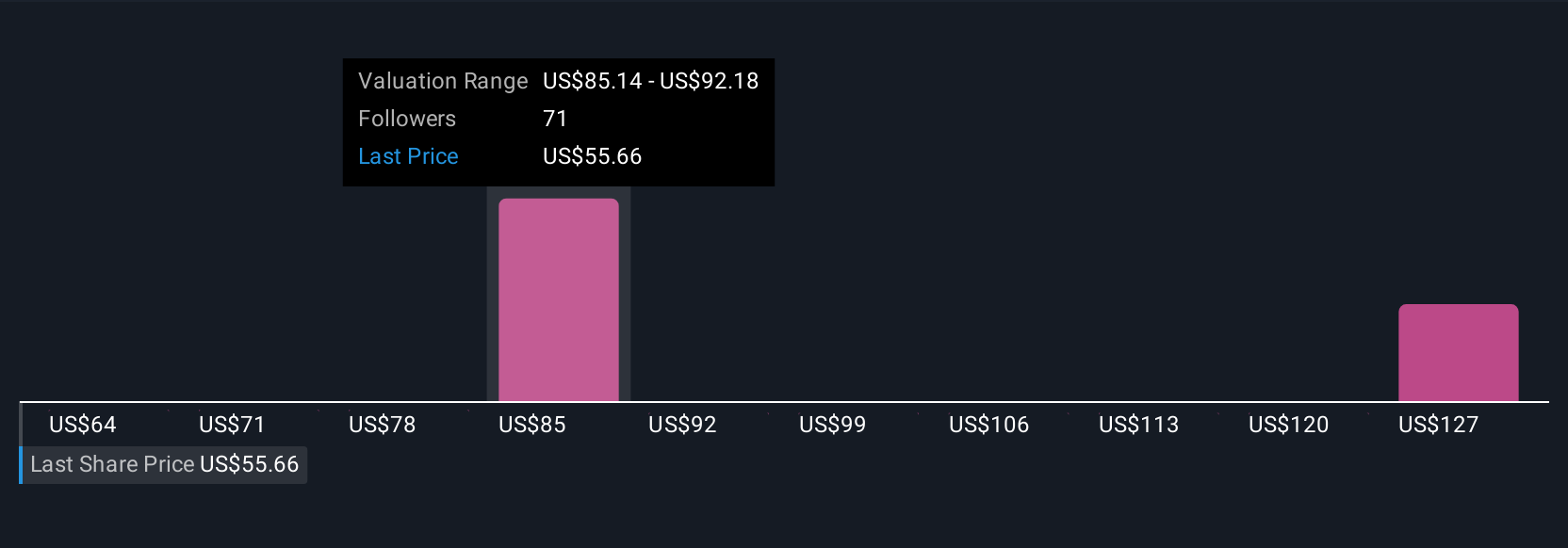

Ten independent fair value estimates from the Simply Wall St Community for Lantheus range from US$63 to US$141.78 per share. Increased risk of price competition in prostate cancer diagnostics remains crucial as you compare these diverse views and consider the company’s earnings prospects.

Explore 10 other fair value estimates on Lantheus Holdings - why the stock might be worth just $63.00!

Build Your Own Lantheus Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lantheus Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Lantheus Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lantheus Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LNTH

Lantheus Holdings

Develops, manufactures, and commercializes diagnostic and therapeutic products that assist clinicians in diagnosis and treatment of heart, cancer, and other diseases worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.