- United States

- /

- Medical Equipment

- /

- NasdaqGM:LMAT

LeMaitre Vascular (LMAT): Examining Valuation Following Recent Share Price Dip

Reviewed by Kshitija Bhandaru

See our latest analysis for LeMaitre Vascular.

Looking at the last year, LeMaitre Vascular’s share price has sagged in recent months and is currently sitting at $87.85. However, its impressive 3-year total shareholder return of around 86% highlights strong long-term wealth creation, even as near-term momentum appears to be cooling slightly.

If you’re interested in discovering what other healthcare stocks are delivering promising growth, this is a perfect moment to check out See the full list for free.

With the stock trailing its analyst price target by nearly 20 percent and boasting strong multi-year growth, investors have to ask themselves this question: Is LeMaitre Vascular a bargain at these levels, or is future growth already reflected in the price?

Most Popular Narrative: 16.2% Undervalued

Despite trading at $87.85 at the last close, the narrative consensus places LeMaitre Vascular’s fair value significantly higher, signaling an attractive gap for investors seeking growth potential. This perspective hinges on projected momentum and market catalysts, which could reshape the company’s valuation landscape.

“Strong pipeline of innovative biologics and next-generation products, combined with ongoing regulatory wins, enhances pricing power and product mix. This supports premium pricing and improved gross margins, with successful launches expected to materially contribute to long-term earnings growth.”

Curious what bold assumptions power this bullish view? The real story behind this potential lies in a series of ground-shifting expansion strategies and aggressive financial forecasts. But which specific growth levers and key projections make the math add up? Dive into the full narrative to explore the hidden drivers behind the premium fair value assigned here.

Result: Fair Value of $104.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, future growth could falter if recent price hikes prove unsustainable or if international expansion faces prolonged regulatory or supply chain hurdles.

Find out about the key risks to this LeMaitre Vascular narrative.

Another View: Are Shares Priced for Perfection?

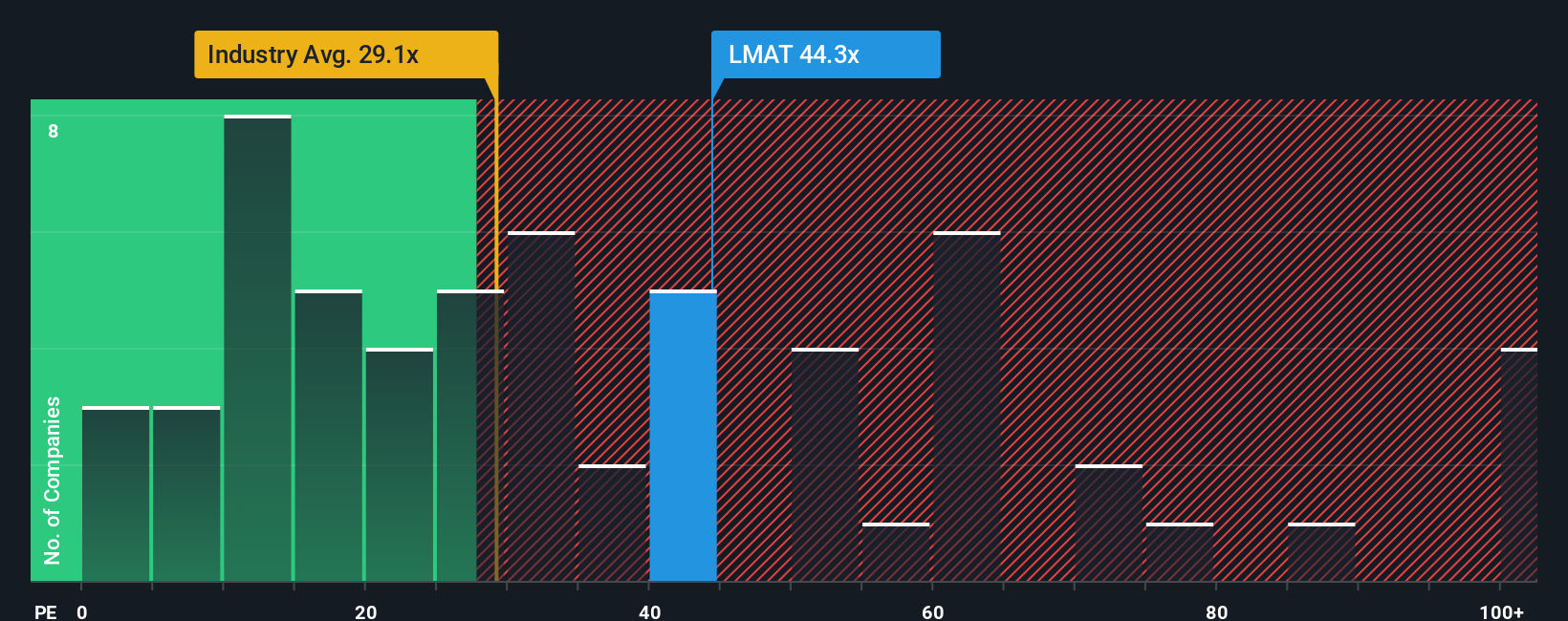

While analyst consensus points to upside, a closer look at the company’s current price-to-earnings ratio suggests caution. LeMaitre Vascular trades at 42.2 times earnings, much higher than the US Medical Equipment industry’s 30.4 times and its peers’ 40.4 times. The fair ratio for LMAT is even lower at 18.3 times.

This gap signals the market is pricing in significant growth or competitive advantages. As a result, there may be less room for error if results disappoint. Is the premium justified, or are investors taking on extra risk at these lofty levels?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own LeMaitre Vascular Narrative

If you have a different outlook or want to dig into the numbers yourself, you can quickly craft your own narrative based on the evidence in just minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding LeMaitre Vascular.

Looking for More Investment Ideas?

Smart investors keep an eye out for unique opportunities across the market. Unlock even more potential for your portfolio by tapping into these powerful strategies today:

- Capture growth by reviewing these 24 AI penny stocks, which are redefining industries with cutting-edge artificial intelligence solutions and automation breakthroughs.

- Start building long-term wealth through these 19 dividend stocks with yields > 3%, which offer attractive yields and consistent income, even when markets get bumpy.

- Seize undervalued opportunities right now by checking out these 901 undervalued stocks based on cash flows, where solid fundamentals meet compelling price points for savvy investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LMAT

LeMaitre Vascular

Develops, manufactures, and markets medical devices and implants used in the field of vascular surgery in the Americas, Europe, the Middle Esat, Africa, and the Asia Pacific.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives