- United States

- /

- Medical Equipment

- /

- NasdaqGS:LIVN

LivaNova (NASDAQ:LIVN investor three-year losses grow to 44% as the stock sheds US$141m this past week

Many investors define successful investing as beating the market average over the long term. But if you try your hand at stock picking, you risk returning less than the market. Unfortunately, that's been the case for longer term LivaNova PLC (NASDAQ:LIVN) shareholders, since the share price is down 44% in the last three years, falling well short of the market return of around 17%. Furthermore, it's down 11% in about a quarter. That's not much fun for holders.

Since LivaNova has shed US$141m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

See our latest analysis for LivaNova

Given that LivaNova didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over three years, LivaNova grew revenue at 5.7% per year. That's not a very high growth rate considering it doesn't make profits. Indeed, the stock dropped 13% over the last three years. If revenue growth accelerates, we might see the share price bounce. But the real upside for shareholders will be if the company can start generating profits.

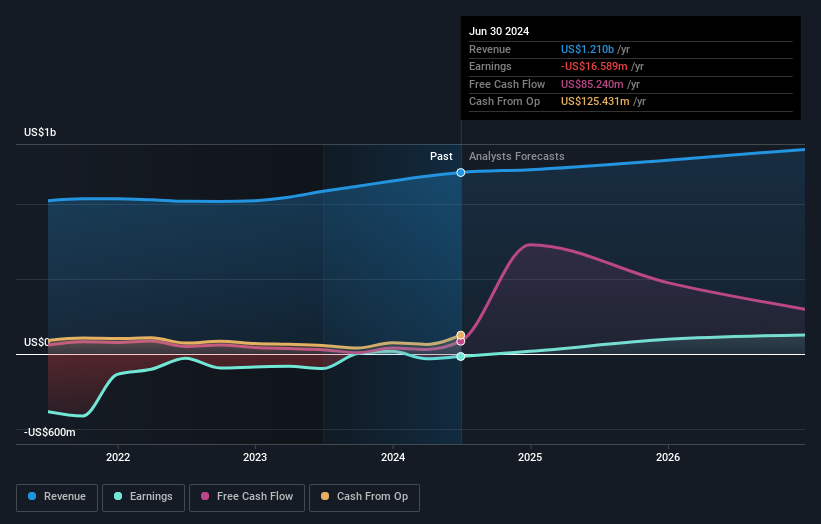

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on LivaNova's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

LivaNova shareholders are down 14% for the year, but the market itself is up 22%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 7% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

Of course LivaNova may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:LIVN

LivaNova

A medical device company, designs, develops, manufactures, and sells therapeutic solutions worldwide.

Excellent balance sheet with proven track record.