- United States

- /

- Medical Equipment

- /

- NasdaqGS:LIVN

Does LivaNova's (NASDAQ:LIVN) Share Price Gain of 27% Match Its Business Performance?

When you buy and hold a stock for the long term, you definitely want it to provide a positive return. But more than that, you probably want to see it rise more than the market average. But LivaNova PLC (NASDAQ:LIVN) has fallen short of that second goal, with a share price rise of 27% over five years, which is below the market return. Zooming in, the stock is up just 4.2% in the last year.

Check out our latest analysis for LivaNova

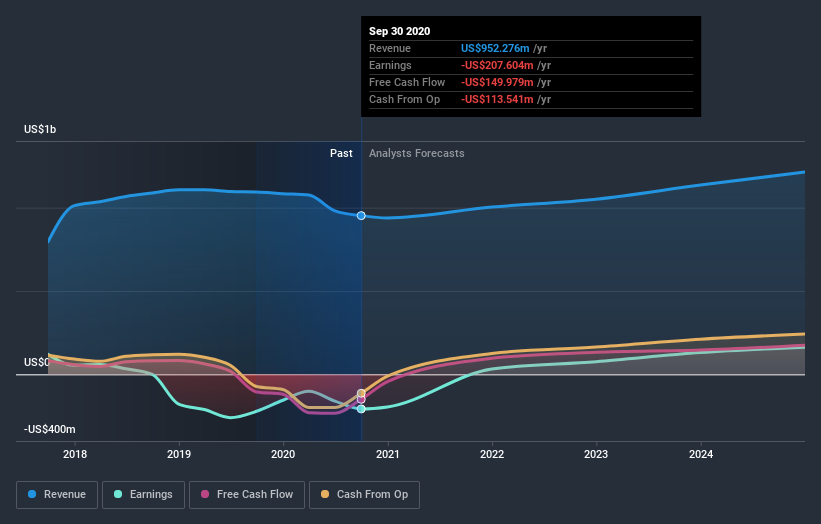

Given that LivaNova didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 5 years LivaNova saw its revenue grow at 12% per year. That's a pretty good long term growth rate. While the share price has gained 5% per year for five years, that's hardly amazing considering the market also rose. Arguably, that means, the market (previously) expected stronger growth from the company.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

LivaNova provided a TSR of 4.2% over the last twelve months. Unfortunately this falls short of the market return. It's probably a good sign that the company has an even better long term track record, having provided shareholders with an annual TSR of 5% over five years. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that LivaNova is showing 1 warning sign in our investment analysis , you should know about...

Of course LivaNova may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you’re looking to trade LivaNova, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:LIVN

LivaNova

A medical technology company, designs, develops, manufactures, markets, and sells products and therapies for neurological and cardiac conditions worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives