- United States

- /

- Healthcare Services

- /

- NasdaqGS:LFST

Will Insider Buying and New Leadership Shift LifeStance Health Group's (LFST) Profitability Outlook?

Reviewed by Sasha Jovanovic

- LifeStance Health Group recently reported steady revenue growth and increased investor confidence, highlighted by insider buying and the appointment of experienced leaders to its board.

- Investor optimism is being driven by the company's outlook for profitability within three years and visible support from company insiders.

- We'll explore how analyst expectations for future profitability are reinforced by recent insider buying and leadership changes at LifeStance Health Group.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

LifeStance Health Group Investment Narrative Recap

To be a shareholder in LifeStance Health Group, investors must be confident in the continued demand for mental health services and the company’s ability to achieve profitability within three years. While steady revenue growth and insider buying have buoyed short-term optimism, the most important near-term catalyst remains progress toward sustainable margins, with persistent competition from larger entrants posing the current biggest risk; the recent news does not fundamentally alter this risk profile.

Among the recent announcements, the appointment of Sarah Personette to the board stands out, as her extensive background in customer experience and media could strengthen LifeStance’s focus on patient engagement, a crucial piece in driving both visit volumes and margin expansion as the company pursues its profitability targets.

However, as investor optimism grows, it is important not to lose sight of intensifying competition from better-capitalized players, because if rivals succeed in eroding market share, then...

Read the full narrative on LifeStance Health Group (it's free!)

LifeStance Health Group's outlook anticipates $2.0 billion in revenue and $111.7 million in earnings by 2028. This is based on a projected annual revenue growth rate of 14.6% and an increase in earnings of $127.9 million from the current level of -$16.2 million.

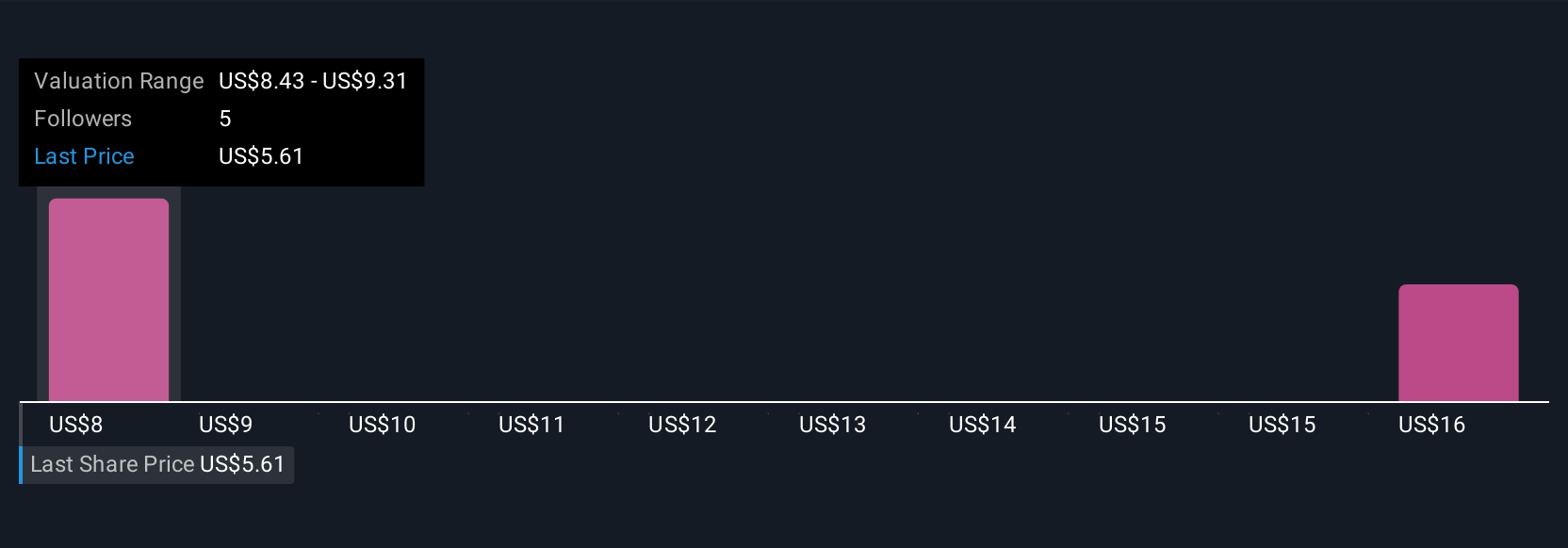

Uncover how LifeStance Health Group's forecasts yield a $8.43 fair value, a 58% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have produced three fair value estimates for LifeStance, ranging from US$8.43 to US$10.23 per share. Despite this consensus on potential undervaluation, persistent competition from larger healthcare and tech companies continues to shape the outlook for future growth and profitability, explore how varied opinions can impact your view.

Explore 3 other fair value estimates on LifeStance Health Group - why the stock might be worth as much as 91% more than the current price!

Build Your Own LifeStance Health Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LifeStance Health Group research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free LifeStance Health Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LifeStance Health Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LFST

LifeStance Health Group

Through its subsidiaries, provides outpatient mental health services to children, adolescents, adults, and geriatrics in the United States.

Excellent balance sheet and good value.

Market Insights

Community Narratives