- United States

- /

- Medical Equipment

- /

- NasdaqCM:KRMD

Returns On Capital At Repro Med Systems (NASDAQ:KRMD) Paint An Interesting Picture

To find a multi-bagger stock, what are the underlying trends we should look for in a business? Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. Although, when we looked at Repro Med Systems (NASDAQ:KRMD), it didn't seem to tick all of these boxes.

Understanding Return On Capital Employed (ROCE)

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. To calculate this metric for Repro Med Systems, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.08 = US$3.2m ÷ (US$45m - US$5.4m) (Based on the trailing twelve months to September 2020).

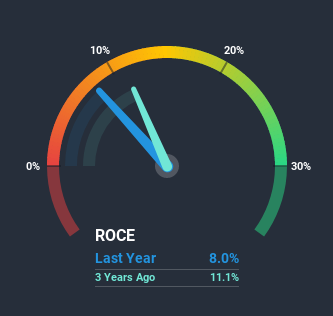

So, Repro Med Systems has an ROCE of 8.0%. In absolute terms, that's a low return but it's around the Medical Equipment industry average of 10.0%.

View our latest analysis for Repro Med Systems

Above you can see how the current ROCE for Repro Med Systems compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like, you can check out the forecasts from the analysts covering Repro Med Systems here for free.

What Does the ROCE Trend For Repro Med Systems Tell Us?

Unfortunately, the trend isn't great with ROCE falling from 15% five years ago, while capital employed has grown 479%. That being said, Repro Med Systems raised some capital prior to their latest results being released, so that could partly explain the increase in capital employed. It's unlikely that all of the funds raised have been put to work yet, so as a consequence Repro Med Systems might not have received a full period of earnings contribution from it. Also, we found that by looking at the company's latest EBIT, the figure is within 10% of the previous year's EBIT so you can basically assign the ROCE drop primarily to that capital raise.

The Key Takeaway

While returns have fallen for Repro Med Systems in recent times, we're encouraged to see that sales are growing and that the business is reinvesting in its operations. And long term investors must be optimistic going forward because the stock has returned a huge 830% to shareholders in the last five years. So while the underlying trends could already be accounted for by investors, we still think this stock is worth looking into further.

Repro Med Systems does have some risks though, and we've spotted 2 warning signs for Repro Med Systems that you might be interested in.

While Repro Med Systems may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

When trading Repro Med Systems or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if KORU Medical Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:KRMD

KORU Medical Systems

Develops and manufactures medical devices and supplies in the United States and internationally.

Excellent balance sheet with concerning outlook.