- United States

- /

- Medical Equipment

- /

- NasdaqCM:KRMD

KORU Medical Systems (NASDAQ:KRMD) adds US$11m to market cap in the past 7 days, though investors from five years ago are still down 76%

It's nice to see the KORU Medical Systems, Inc. (NASDAQ:KRMD) share price up 10% in a week. But that doesn't change the fact that the returns over the last half decade have been stomach churning. In fact, the share price has tumbled down a mountain to land 76% lower after that period. So we don't gain too much confidence from the recent recovery. The real question is whether the business can leave its past behind and improve itself over the years ahead.

Although the past week has been more reassuring for shareholders, they're still in the red over the last five years, so let's see if the underlying business has been responsible for the decline.

We check all companies for important risks. See what we found for KORU Medical Systems in our free report.KORU Medical Systems wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over five years, KORU Medical Systems grew its revenue at 6.7% per year. That's a pretty good rate for a long time period. So the stock price fall of 12% per year seems pretty steep. The truth is that the growth might be below expectations, and investors are probably worried about the continual losses.

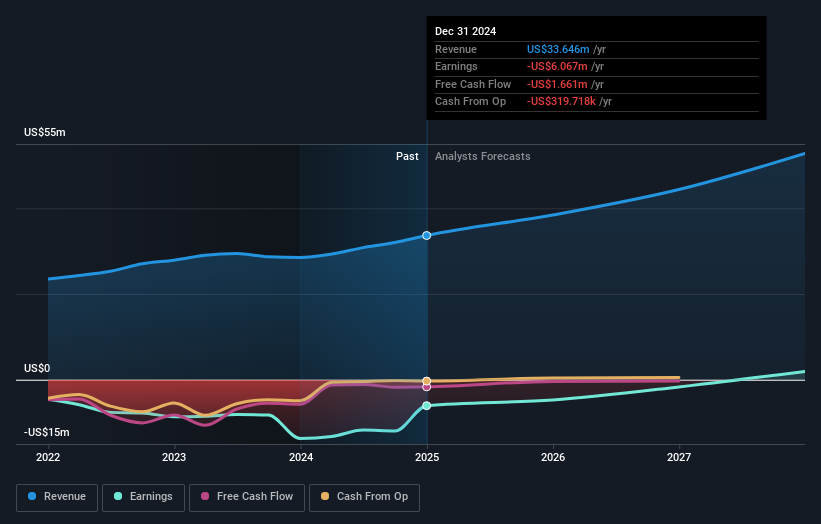

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on KORU Medical Systems' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that KORU Medical Systems shareholders have received a total shareholder return of 11% over one year. That certainly beats the loss of about 12% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. You could get a better understanding of KORU Medical Systems' growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if KORU Medical Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:KRMD

KORU Medical Systems

Develops, manufactures, and commercializes subcutaneous infusion solutions primarily for the subcutaneous drug delivery market in the United States and internationally.

Excellent balance sheet with concerning outlook.

Market Insights

Community Narratives