- United States

- /

- Medical Equipment

- /

- NasdaqGM:KIDS

Getting In Cheap On OrthoPediatrics Corp. (NASDAQ:KIDS) Might Be Difficult

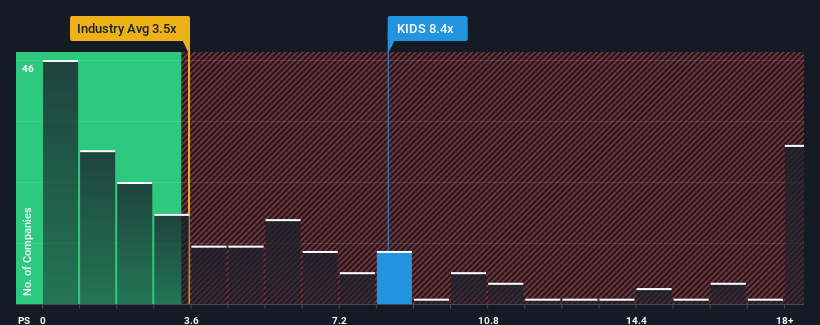

You may think that with a price-to-sales (or "P/S") ratio of 8.4x OrthoPediatrics Corp. (NASDAQ:KIDS) is a stock to avoid completely, seeing as almost half of all the Medical Equipment companies in the United States have P/S ratios under 3.5x and even P/S lower than 1.4x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for OrthoPediatrics

How OrthoPediatrics Has Been Performing

Recent times have been advantageous for OrthoPediatrics as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on OrthoPediatrics will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as OrthoPediatrics' is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 30% last year. The latest three year period has also seen an excellent 76% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 20% as estimated by the seven analysts watching the company. That's shaping up to be materially higher than the 8.0% growth forecast for the broader industry.

In light of this, it's understandable that OrthoPediatrics' P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that OrthoPediatrics maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Medical Equipment industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for OrthoPediatrics (1 shouldn't be ignored) you should be aware of.

If these risks are making you reconsider your opinion on OrthoPediatrics, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:KIDS

OrthoPediatrics

A medical device company, engages in designing, developing, and marketing anatomically appropriate implants, instruments, and specialized braces for children with orthopedic conditions in the United States and internationally.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives