- United States

- /

- Medical Equipment

- /

- NasdaqGM:KEQU

Kewaunee Scientific Corporation (NASDAQ:KEQU) Looks Inexpensive After Falling 25% But Perhaps Not Attractive Enough

The Kewaunee Scientific Corporation (NASDAQ:KEQU) share price has softened a substantial 25% over the previous 30 days, handing back much of the gains the stock has made lately. The good news is that in the last year, the stock has shone bright like a diamond, gaining 100%.

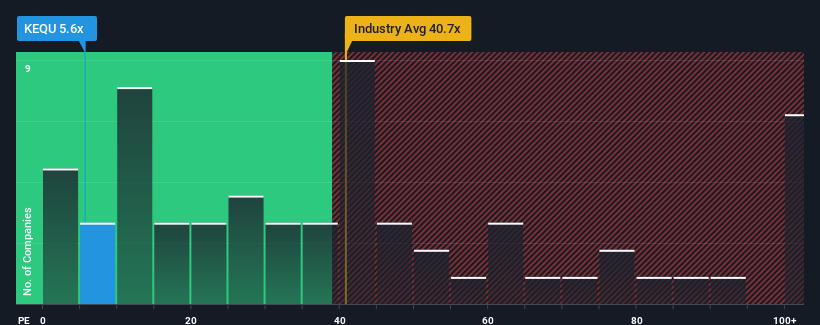

After such a large drop in price, Kewaunee Scientific's price-to-earnings (or "P/E") ratio of 5.6x might make it look like a strong buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 19x and even P/E's above 34x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Kewaunee Scientific certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Kewaunee Scientific

Is There Any Growth For Kewaunee Scientific?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Kewaunee Scientific's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 360% last year. Still, EPS has barely risen at all from three years ago in total, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 15% shows it's noticeably less attractive on an annualised basis.

With this information, we can see why Kewaunee Scientific is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Key Takeaway

Kewaunee Scientific's P/E looks about as weak as its stock price lately. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Kewaunee Scientific maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Kewaunee Scientific you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Kewaunee Scientific might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:KEQU

Kewaunee Scientific

Designs, manufactures, and installs laboratory, healthcare, and technical furniture and infrastructure products.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives