- United States

- /

- Medical Equipment

- /

- NasdaqGS:ISRG

Intuitive Surgical (ISRG): Evaluating Valuation After New da Vinci 5 Software Features and Regulatory Wins

Reviewed by Kshitija Bhandaru

If you have been tracking Intuitive Surgical (ISRG), you have probably noticed this week’s buzz following the company’s major product event. The latest announcement introduced new da Vinci 5 software capabilities, including Force Gauge, In-Console Video Replay, and remote software updates. Each feature is designed to make robotic-assisted surgery smarter and more efficient. With FDA clearance now on the books, these upgrades are more than just splashy headlines; they underscore Intuitive’s intent to set the bar for surgical innovation.

These advances could not come at a more interesting time for ISRG shareholders. Even as Intuitive’s business posted double-digit growth in both revenue and net income last year, and the company secured important regulatory milestones, the stock has drifted down by 10% over the past year. Short-term trends paint a similar picture, with declines seen in recent months despite expansion efforts and product unveilings. Over the long term, however, shareholders have seen strong gains, pointing to a business that keeps finding ways to grow, even if the market’s enthusiasm has cooled lately.

This raises an important question: with these innovations and recent price action, is Intuitive Surgical trading at a discount, or has the market already factored in the next wave of growth?

Most Popular Narrative: 9% Overvalued

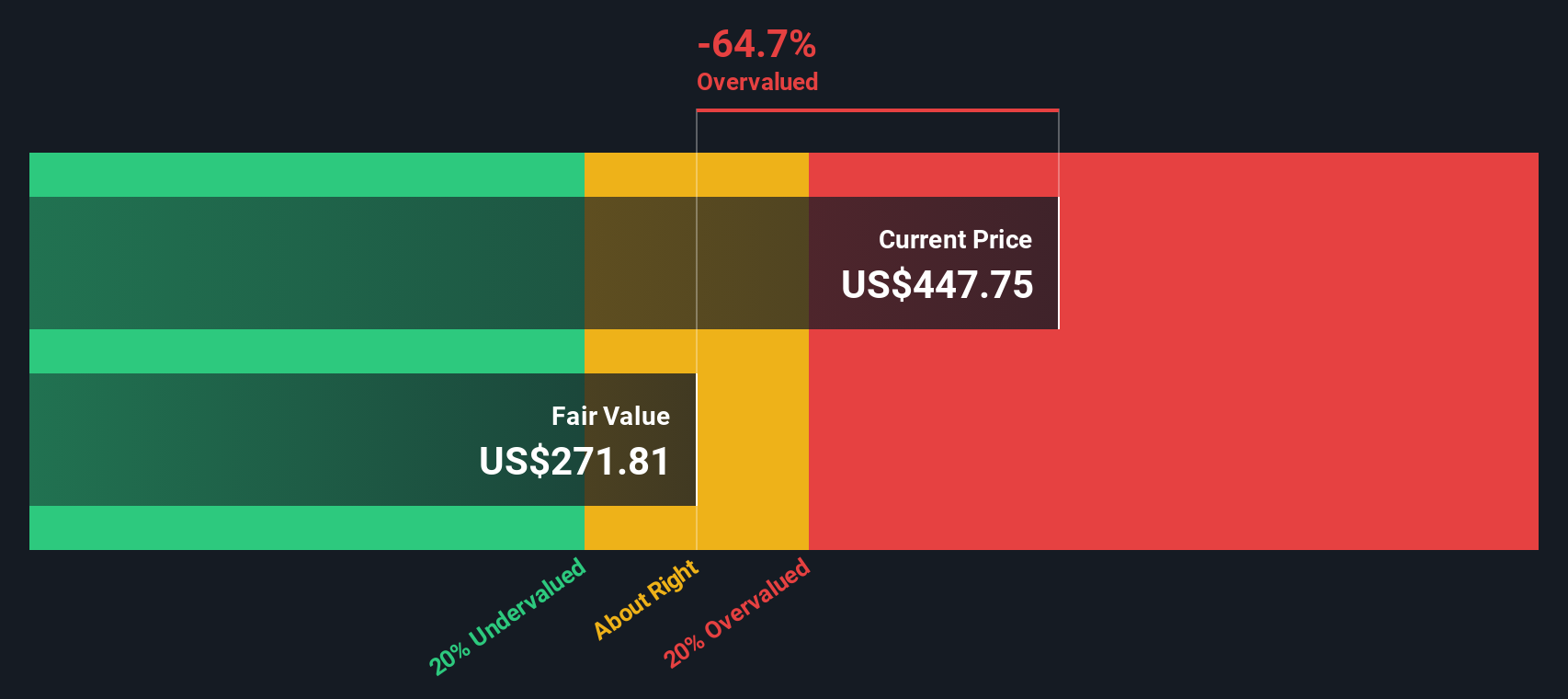

According to Tokyo, Intuitive Surgical is currently trading above their estimate of fair value. The narrative outlines a cautious stance toward the stock, even after its recent price decline, and suggests the company is priced above what fundamentals may justify.

The introduction of the “da Vinci Surgical System” began in 2000 (FDA approval in USA). The system was initially used for heart surgery and then primarily for urological procedures. In 2009 they introduced an updated model da Vinci S / Si, followed by da Vinci X / Xi in 2014. Recently (12.2024) they introduced the most advanced system, da Vinci 5, with several advancements, for example, force feedback for sensing force at the instrument tip and feedback to the operator.

Want to know why Tokyo calls it overvalued despite impressive innovation and consistent double-digit growth? Here’s a hint: the real reason lies hidden in a set of aggressive assumptions about future profit margins, cash flow, and sustainable growth. The next part of the narrative reveals the numbers and logic that led to this calculated fair value. Ready for the inside story behind the price?

Result: Fair Value of $400.91 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, breakthroughs in reimbursement policies or an unexpected acceleration in procedure adoption could quickly change the outlook and challenge the overvaluation argument.

Find out about the key risks to this Intuitive Surgical narrative.Another View: Discounted Cash Flow Takes Center Stage

Looking at Intuitive Surgical through our SWS DCF model, the story continues to be one of caution. The DCF approach also suggests the shares are trading at a premium to their intrinsic value. However, does this model capture the company's potential for ongoing growth, or is it focused solely on past performance?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Intuitive Surgical for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Intuitive Surgical Narrative

Don’t forget, the numbers can tell different stories depending on your perspective. Digging into the data yourself takes just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Intuitive Surgical.

Looking for More Investment Ideas?

Don’t let opportunities pass you by. The Simply Wall Street screener helps you quickly spot promising stocks that match your strategy and personal investing style.

- Target solid returns and long-term security as you hunt for dividend stocks with yields > 3%, which deliver attractive yields and steady growth.

- Find tomorrow’s growth engines by checking out AI penny stocks, driving innovation at the intersection of artificial intelligence and industry change.

- Tap into hidden gems backed by strong fundamentals using our pathway to undervalued stocks based on cash flows, which could be trading at compelling prices right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ISRG

Intuitive Surgical

Develops, manufactures, and markets products that enable physicians and healthcare providers to enhance the quality of and access to minimally invasive care in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives