- United States

- /

- Medical Equipment

- /

- NasdaqGS:ISRG

Can Intuitive Surgical Sustain Its Rally After Recent Buyback Authorization in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with your Intuitive Surgical stock? You’re definitely not alone. Many investors are eyeing the company’s recent moves and wondering if it’s a buy, hold, or time to lighten up. After all, the stock posted a 3.9% gain over the last week and is up 2.9% in the past month, even as its year-to-date and one-year returns are still sitting at -14.9% and -14.4%. It’s a story that feels both familiar and a bit perplexing. How can a company ride out such a strong multi-year run, boasting a three-year return of over 100% and an 82.0% gain over five years, yet still find itself with double-digit losses in the short term?

Much of this price action reflects broader shifts in market sentiment and risk appetite as investors reevaluate growth stocks overall. While the healthcare technology space has generally attracted steady interest, Intuitive Surgical’s swings can partly be traced to investor reactions about the pace of adoption for its surgical robots and evolving competitive dynamics.

If you’re focused on fundamentals, valuation becomes the next big question. Our quick check of six popular valuation methods gives Intuitive Surgical a value score of just 1 out of 6, suggesting it’s only considered undervalued on a single metric right now. But before drawing any conclusions, let’s walk through what these different valuation approaches actually show. And, as we dig in, I’ll also share an even better way to think about valuation at the end of this article, so stick around.

Intuitive Surgical scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Intuitive Surgical Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting future free cash flows and then discounting them back to today's value. This approach is especially relevant for companies like Intuitive Surgical, which are expected to generate significant and predictable cash flows in the years ahead.

In the most recent year, Intuitive Surgical reported free cash flow of $1.75 billion. According to analyst projections, that figure is expected to grow steadily, reaching $5.12 billion by the end of 2029. While analysts provide estimates for the next five years, longer-term projections are extrapolated based on industry trends and company history.

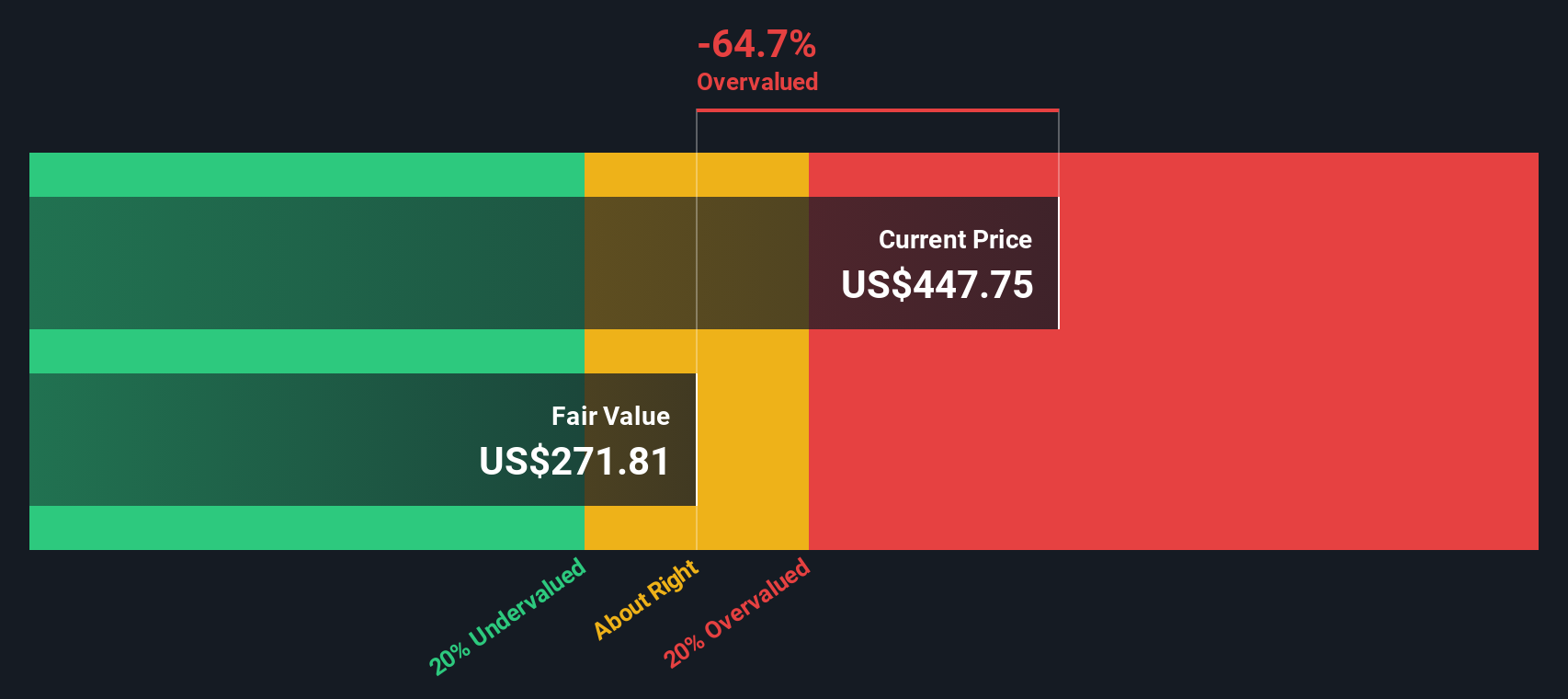

With these projections, the DCF model uses a “2 Stage Free Cash Flow to Equity” approach to calculate an estimated fair value per share of $331.02. Currently, the model suggests the share price is about 34.8% above this intrinsic value. By this method, Intuitive Surgical appears considerably overvalued.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Intuitive Surgical may be overvalued by 34.8%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Intuitive Surgical Price vs Earnings (PE)

For profitable companies like Intuitive Surgical, the Price-to-Earnings (PE) ratio remains one of the most widely used tools for stock valuation. The PE ratio helps investors gauge how much they are paying for each dollar of company earnings, and it is especially useful when a business has a history of steady profitability.

However, what makes a PE ratio “fair” depends on several factors. Expectations around the company’s future earnings growth, its stability, and overall risk will all influence what investors are willing to pay. A fast-growing, innovative business usually commands a higher PE multiple than a mature, slow-growth firm. On the other hand, higher risks or volatility can keep that multiple in check.

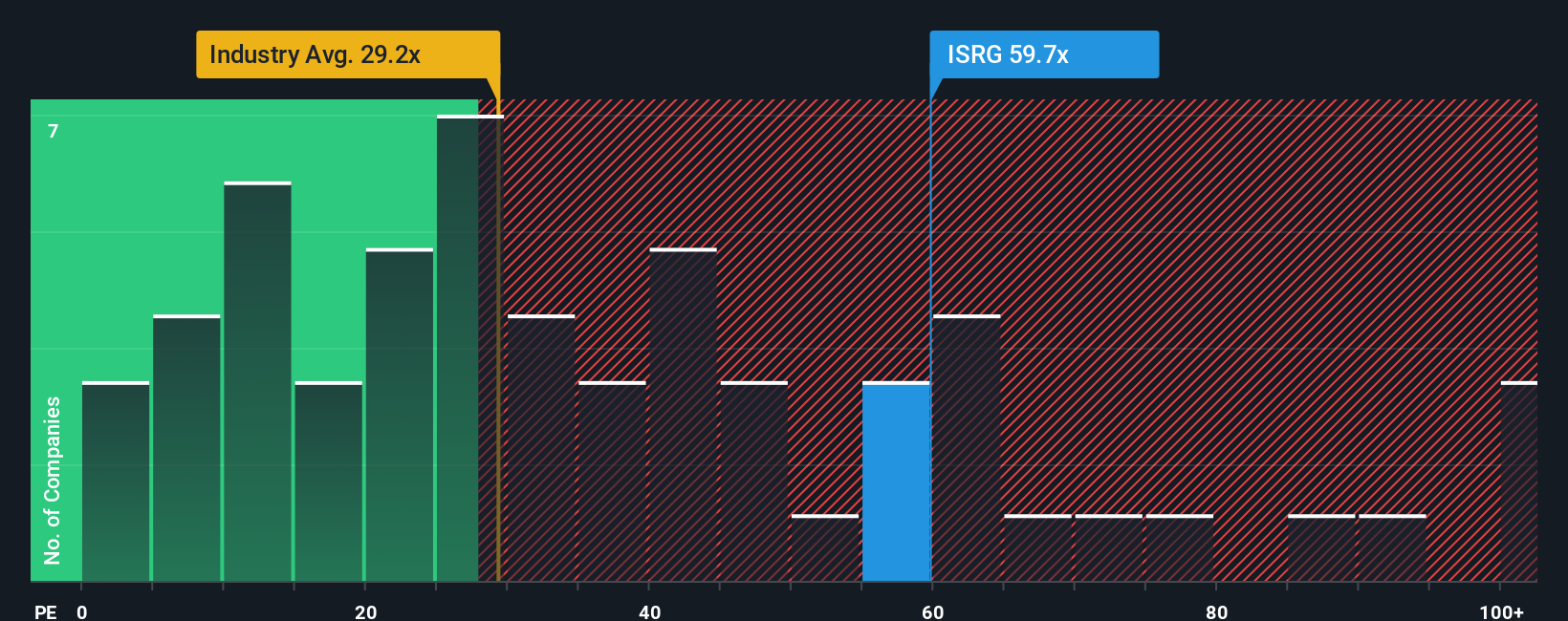

Currently, Intuitive Surgical is trading at a PE ratio of 61.3x. That is noticeably above the Medical Equipment industry average of 29.1x and also above the average among its direct peers at 37.5x. In other words, the market is placing a significant premium on Intuitive’s earnings relative to both the broader sector and its closest competitors.

Rather than relying solely on industry averages or peer multiples, Simply Wall St’s “Fair Ratio” provides a more tailored benchmark. This proprietary metric estimates the PE multiple Intuitive Surgical arguably deserves by factoring in unique elements such as the company's earnings growth outlook, profit margins, market cap, risks, and its position within the industry. With a calculated Fair Ratio of 35.8x, it offers a more nuanced context than general comparisons alone.

Comparing Intuitive Surgical’s current PE of 61.3x to its Fair Ratio of 35.8x, the stock appears to be trading at a meaningful premium. Based on this approach, Intuitive Surgical looks overvalued relative to what would be expected, even after considering its bright prospects and robust profitability.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Intuitive Surgical Narrative

As we hinted earlier, there is an even better way to frame valuation: Narratives. A Narrative is your own story about a company—the context, assumptions, and forecasts that shape how you view its future, including your estimate of fair value and expectations for revenue, earnings, and margins.

Narratives bridge the gap between numbers and beliefs, connecting a company’s story to a financial forecast and, ultimately, to a fair value estimate. On Simply Wall St’s Community page, millions of investors use Narratives as an approachable tool to share and compare perspectives, helping you make buy-or-sell decisions by directly comparing Fair Value with the current share price.

What sets Narratives apart is their dynamic nature. They update automatically as new information, like news or earnings reports, comes in, keeping your investment outlook responsive and current.

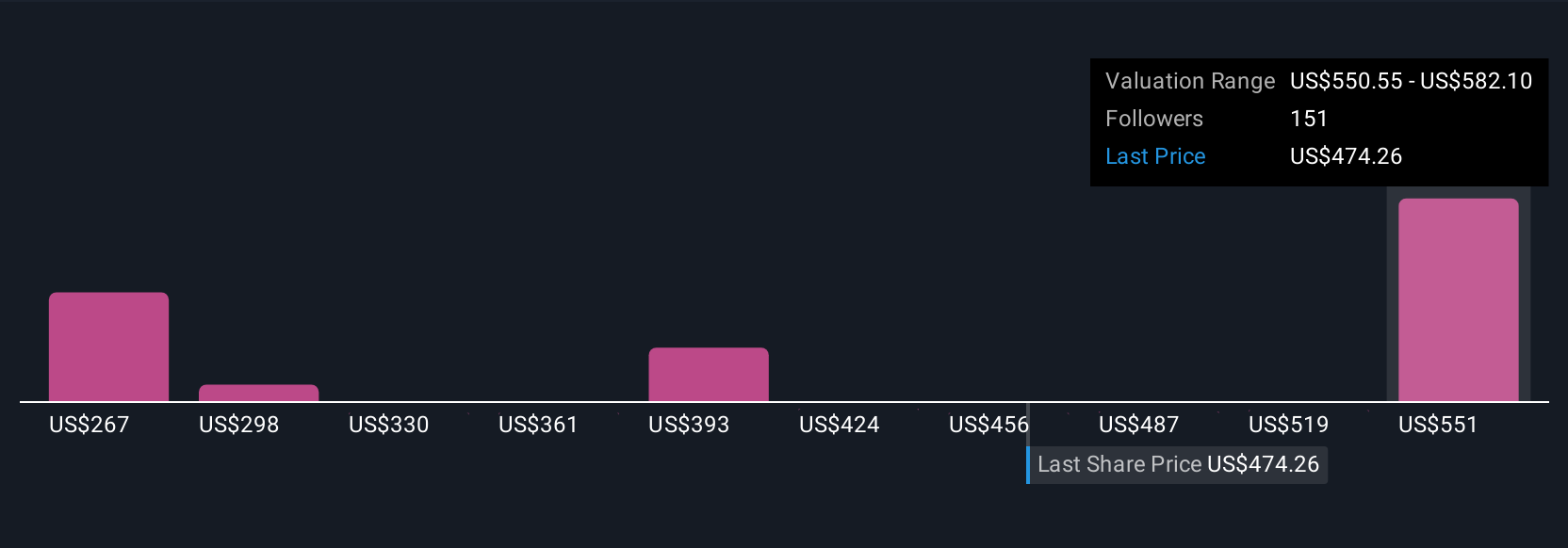

For example, among Intuitive Surgical Narratives, some investors believe fair value is as high as $573, reflecting optimism about growth and global expansion, while others estimate it at $325, citing worries about future margins or competition. This allows you to see the full range of informed perspectives and choose which story you believe.

For Intuitive Surgical, however, we will make it really easy for you with previews of two leading Intuitive Surgical Narratives:

🐂 Intuitive Surgical Bull CaseFair Value: $573.55

Undervalued by 22.2%

Revenue Growth Forecast: 13.5%

- Growth is driven by global expansion, innovative product launches, and rising adoption of robotic-assisted surgery in emerging markets. This reinforces recurring revenues and margin stability.

- Improved clinical outcomes and wider regulatory or payer support are anticipated to accelerate adoption. Risks include international budget constraints and growing competition from remanufactured instruments.

- Consensus analyst price targets see potential upside, assuming continued strong earnings and revenue growth. Bullish analysts highlight the business’s resilience, procedure demand, and expansion opportunities.

Fair Value: $400.91

Overvalued by 11.3%

Revenue Growth Forecast: 12.0%

- The company boasts a large global installed base and a high-margin recurring revenue model from servicing and consumables, creating business resilience.

- Despite strong fundamentals, the current share price is seen as pricey. Buying opportunities are rare, and investor returns at this level are projected to be modest, around 1% annually.

- Patience is required, as the narrative expects that shares are unlikely to drop to an attractive entry level soon. Competition and valuation multiples also pose headwinds.

Do you think there's more to the story for Intuitive Surgical? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ISRG

Intuitive Surgical

Develops, manufactures, and markets products that enable physicians and healthcare providers to enhance the quality of and access to minimally invasive care in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives