- United States

- /

- Medical Equipment

- /

- NasdaqGS:IRTC

A Look at iRhythm Technologies’s Valuation Following FDA Warning and Securities Lawsuit Progress

Reviewed by Kshitija Bhandaru

If you’ve been following iRhythm Technologies (IRTC), the latest wave of headlines may have you wondering whether to sit tight or take action. The company is navigating fresh turbulence after regulators raised concerns about its Zio AT System, including a Warning Letter from the FDA that flagged issues with medical device regulations. In addition, a recently advanced securities class action lawsuit has emerged, and it’s no surprise investor sentiment has been rattled as legal and regulatory clouds gather overhead.

Despite the noise, iRhythm shares have actually moved higher over the past several months, with a year-to-date return near 96% and a gain of almost 150% compared to this time last year. This suggests the market is weighing longer-term growth prospects, perhaps bolstered by recent annual revenue and earnings growth that outpaced many expectations, against the uncertainty posed by ongoing legal and regulatory scrutiny. The result is a stock where momentum remains strong, even as new risks have entered the picture.

So with legal risks hanging over an otherwise rapidly growing business, is this a case of undervaluation, or is the market already pricing in every bit of future growth?

Most Popular Narrative: 4.2% Undervalued

According to the most widely followed narrative, iRhythm Technologies is viewed as modestly undervalued, with the current share price sitting just below the consensus fair value. This assessment is anchored on strong growth prospects for cardiac monitoring, as well as the company’s expanding presence and innovation in remote diagnostics.

Investment in the Zio ecosystem, including next-generation patches, enhanced form factors, and AI-powered analytics (such as the Lucem Health partnership), is improving product differentiation, diagnostic yield, and workflow efficiency. These improvements are likely leading to higher gross margins and operating leverage as software and data become a larger component of the business.

Want to know the growth blueprint behind this high valuation? The real story is a bold leap in profitability and explosive expansion far beyond the current market. Which breakthrough metric tips the scales for these high expectations? Uncover the hidden financial drivers and ambitious assumptions shaping this fair value. Discover what could set the pace for iRhythm’s next big move.

Result: Fair Value of $182.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing regulatory pressures and intensified competition from new wearable tech could quickly shift sentiment and present challenges to iRhythm’s optimistic outlook.

Find out about the key risks to this iRhythm Technologies narrative.Another View: High Price, Lofty Expectations

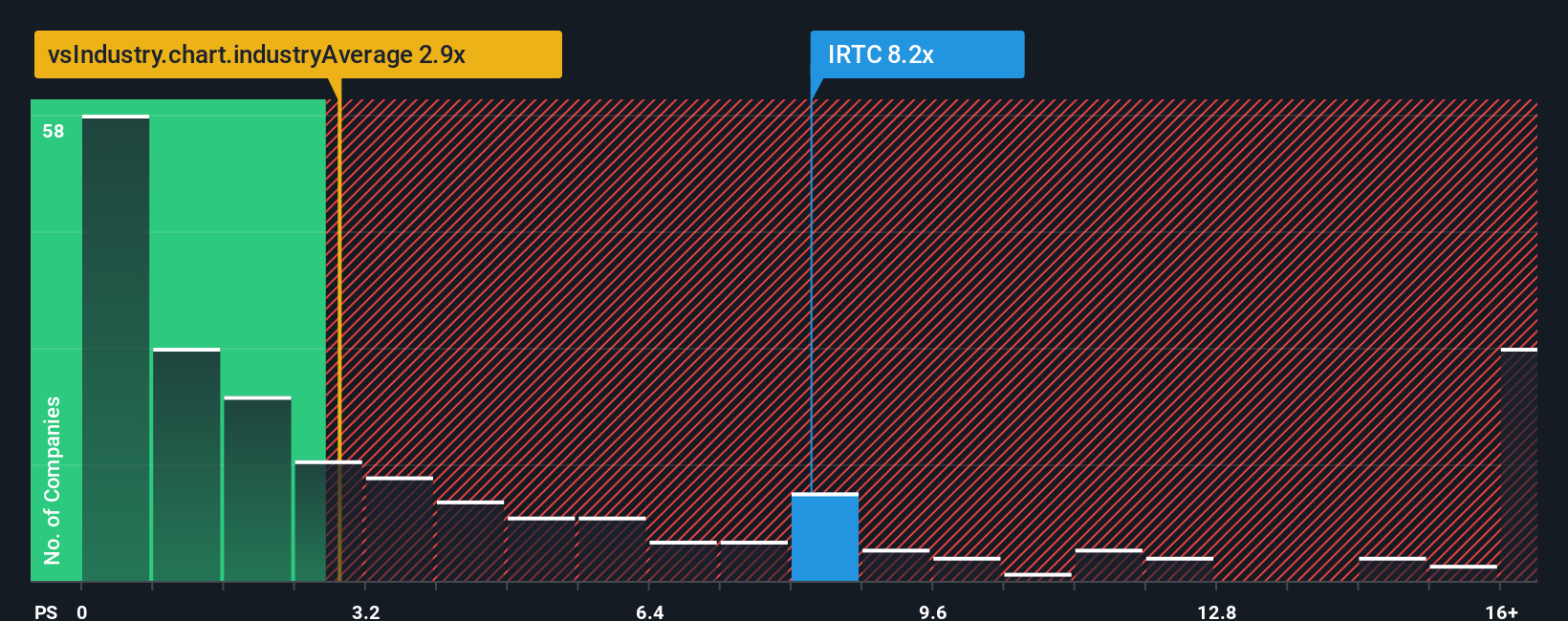

Take a look from a different angle and things look less encouraging. On a sales-based valuation, iRhythm trades well above the industry’s average. This signals that investors are already paying a premium for future growth ambitions. But is that optimism justified, or is the stock simply too pricey if things do not go perfectly?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own iRhythm Technologies Narrative

If you want to put the numbers and story together for yourself, you can analyze the data and shape your own view in just a few minutes. Do it your way.

A great starting point for your iRhythm Technologies research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Sharpen your investment strategy by tapping into unique stock ideas that could change your portfolio’s trajectory. Don’t let these chances slip by while others jump ahead.

- Unleash the potential of up-and-coming businesses with steady balance sheets by jumping into the world of penny stocks with strong financials and finding tomorrow’s leaders before they hit the radar.

- Fuel your search for steady income by zeroing in on dividend stocks with yields > 3% yielding above-average returns and building resilient cash flow into your investments.

- Get ahead of the curve by backing pioneers in artificial intelligence. Start with AI penny stocks to track companies on the forefront of groundbreaking tech advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if iRhythm Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IRTC

iRhythm Technologies

A digital healthcare company, engages in the design, development, and commercialization of device-based technology that provides ambulatory cardiac monitoring services to diagnose arrhythmias in the United States.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives