- United States

- /

- Medical Equipment

- /

- NasdaqCM:IRIX

Even after rising 13% this past week, IRIDEX (NASDAQ:IRIX) shareholders are still down 64% over the past five years

IRIDEX Corporation (NASDAQ:IRIX) shareholders should be happy to see the share price up 13% in the last week. But don't envy holders -- looking back over 5 years the returns have been really bad. In that time the share price has delivered a rude shock to holders, who find themselves down 64% after a long stretch. Some might say the recent bounce is to be expected after such a bad drop. We'd err towards caution given the long term under-performance.

Although the past week has been more reassuring for shareholders, they're still in the red over the last five years, so let's see if the underlying business has been responsible for the decline.

View our latest analysis for IRIDEX

Given that IRIDEX didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last half decade, IRIDEX saw its revenue increase by 0.8% per year. That's not a very high growth rate considering it doesn't make profits. This lacklustre growth has no doubt fueled the loss of 10% per year, in that time. We'd want to see proof that future revenue growth is likely to be significantly stronger before getting too interested in IRIDEX. When a stock falls hard like this, some investors like to add the company to a watchlist (in case the business recovers, longer term).

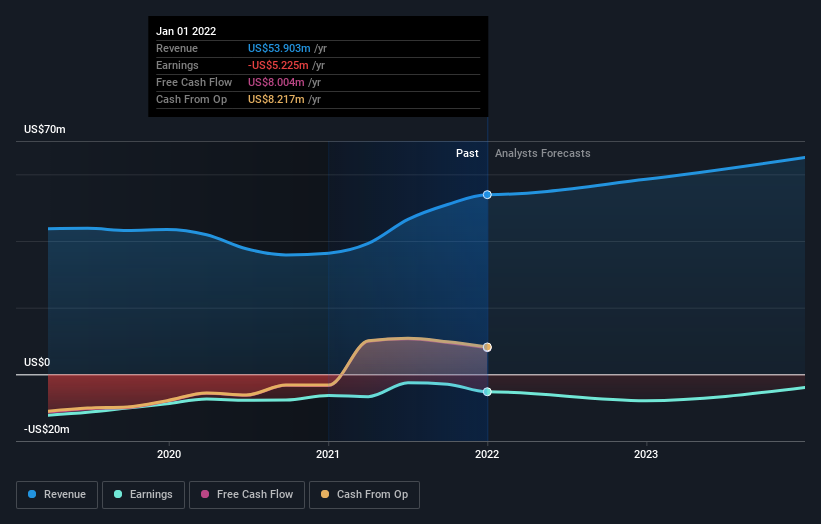

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on IRIDEX's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market gained around 6.0% in the last year, IRIDEX shareholders lost 37%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 10% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that IRIDEX is showing 4 warning signs in our investment analysis , you should know about...

But note: IRIDEX may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:IRIX

IRIDEX

An ophthalmic medical technology company, provides therapeutic based laser systems, delivery devices, and consumable instrumentation to treat sight-threatening eye diseases in ophthalmology.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion