- United States

- /

- Medical Equipment

- /

- NasdaqGS:INMD

InMode (INMD): Is There More Value to Uncover After Shares Rebound 9% This Month?

Reviewed by Simply Wall St

See our latest analysis for InMode.

While InMode shares have gained nearly 9% over the past month, momentum is just beginning to build after a tough stretch. The current share price of $16.01 leaves the one-year total shareholder return at -13%, reminding investors that the recent uptrend is still set against a much longer-term decline. Signs of renewed interest could hint at shifting sentiment or improving fundamentals, but there is still ground to recover from deeper losses seen over recent years.

If InMode's move has you thinking about other opportunities in the sector, take a moment to see the full range of healthcare stocks in our discovery screener. See the full list for free.

With shares still well off their highs and modest financial growth, investors have to ask whether InMode is undervalued in the current market or if the recent optimism has already priced in the company’s future prospects.

Most Popular Narrative: 1.5% Undervalued

With InMode’s fair value estimated at $16.25, just above the latest close of $16.01, the narrative suggests investors see hidden value even as the market hesitates to follow. This close alignment sets the stage for debate about whether modest growth and sector moves can lift the share price beyond recent sluggishness.

Expansion of direct operations in emerging international markets like Thailand and Argentina, along with a rapidly growing European presence, is expected to drive continued growth in non-U.S. sales. This leverages increasing access to healthcare and higher disposable incomes globally to boost revenue and diversify geographic risk.

Curious how international expansion and bold new product bets could tip the scales? This narrative’s forecast hinges on a few make-or-break financial shifts buried in the projections. If you want to uncover what could send InMode soaring or stalling, dig deeper into these influential assumptions now.

Result: Fair Value of $16.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory delays or a further drop in consumer demand could quickly undermine the optimism that is driving InMode’s current narrative.

Find out about the key risks to this InMode narrative.

Another View: Discounted Cash Flow Model

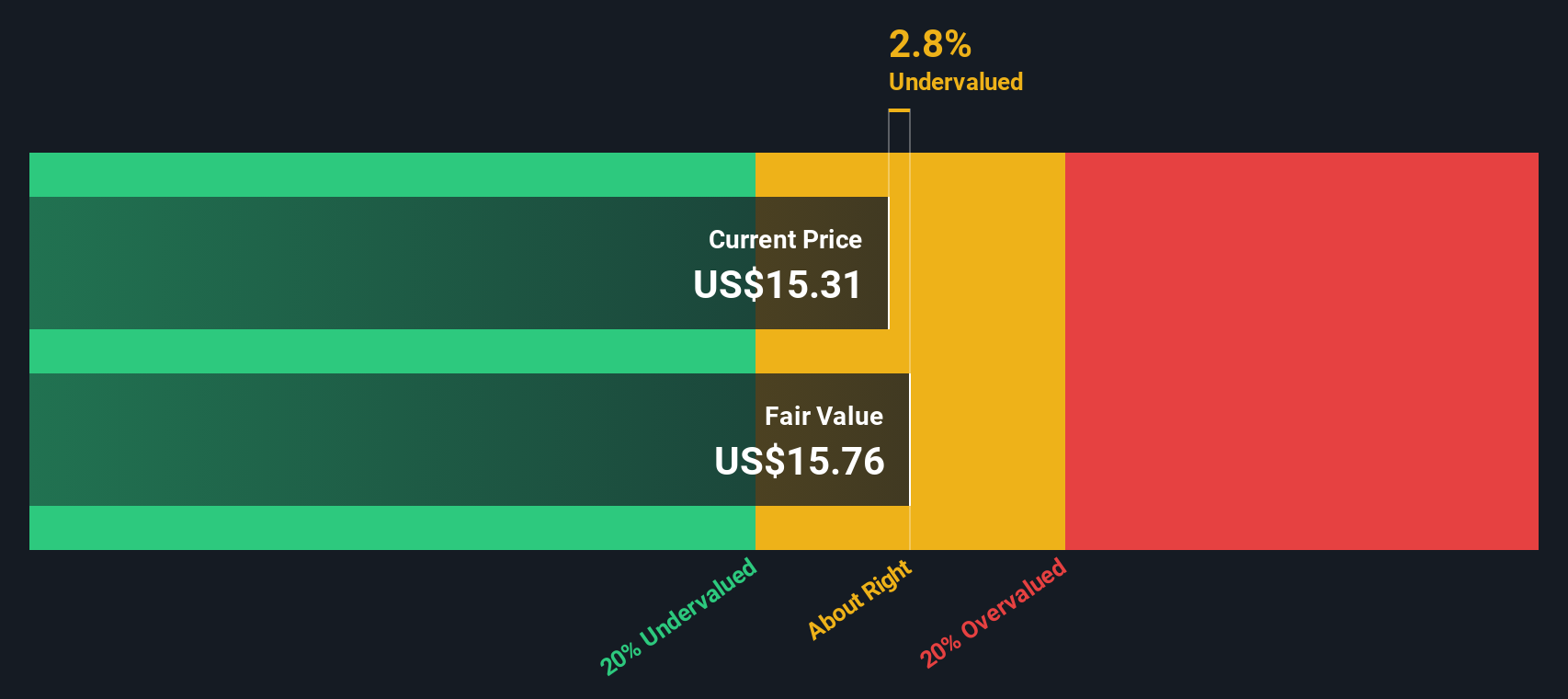

While the consensus price target points to InMode being slightly undervalued, our SWS DCF model sets fair value at $15.71, just below today’s price of $16.01. This suggests the market could be slightly optimistic, especially if long-term declines continue. Does this cast doubt on the recent uptrend, or is it overlooking hidden strengths?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out InMode for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own InMode Narrative

If this perspective does not match yours, or you want to shape your own view based on the full set of data, you can quickly create a personal narrative in just a few minutes. Do it your way

A great starting point for your InMode research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let great opportunities pass you by. Turbocharge your strategy with unique stocks picked by the Simply Wall Street Screener.

- Unlock reliable income streams when you examine these 17 dividend stocks with yields > 3% featuring robust yields over 3% and the fundamentals to back them up.

- Catch the latest waves in digital innovation by following these 24 AI penny stocks, your ticket to companies at the forefront of artificial intelligence breakthroughs.

- Position yourself ahead of the crowd by targeting these 881 undervalued stocks based on cash flows offering strong potential for upside based on rigorous cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INMD

InMode

Designs, develops, manufactures, and markets minimally invasive aesthetic medical products based on its proprietary radio frequency assisted lipolysis and deep subdermal fractional radiofrequency technologies in the United States, Europe, Asia, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026