- United States

- /

- Medical Equipment

- /

- NasdaqGS:IDXX

Where Does IDEXX Stand After Its 55% Surge in 2025?

Reviewed by Bailey Pemberton

Trying to figure out what to do with IDEXX Laboratories stock? You’re not alone, and for good reason. With shares recently closing at $635.40, IDEXX has been on a solid upward trajectory. Year-to-date returns are an impressive 55.4%, and over the past year, the stock is up by 38.8%. Even with a small dip of 0.9% over the last month, IDEXX has continued to outpace many peers. The stock has shown an 88.2% rise in three years, and a notable 47.9% gain over the last five years. When the market’s mood shifts or sentiment around growth and innovation in pet health care changes, IDEXX often finds itself in the spotlight. These numbers reflect just how much investor appetite the company can command.

With all this momentum, you might wonder if IDEXX is actually undervalued, or if the market is already pricing in all that good news. According to traditional valuation checks, IDEXX scores a 0 out of 6, meaning it isn't considered undervalued by any of the main metrics we typically use. That might surprise some, particularly given its strong track record. But what do these valuation methods really tell us? In the next section, I’ll walk you through the specific approaches analysts use to size up a stock's worth, and hint at a unique perspective on valuation you won’t want to miss later in the article.

IDEXX Laboratories scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: IDEXX Laboratories Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by forecasting its future free cash flows and then discounting those projections back to their present value. This approach helps investors determine what a business is truly worth, based on its actual ability to generate cash.

For IDEXX Laboratories, the most recent Free Cash Flow was $755.66 million. Analysts forecast this figure will rise significantly over the coming years, reaching $1.59 billion by 2029. While analysts provide detailed projections only for the next five years, further cash flows are extrapolated by Simply Wall St to form a longer-term estimate.

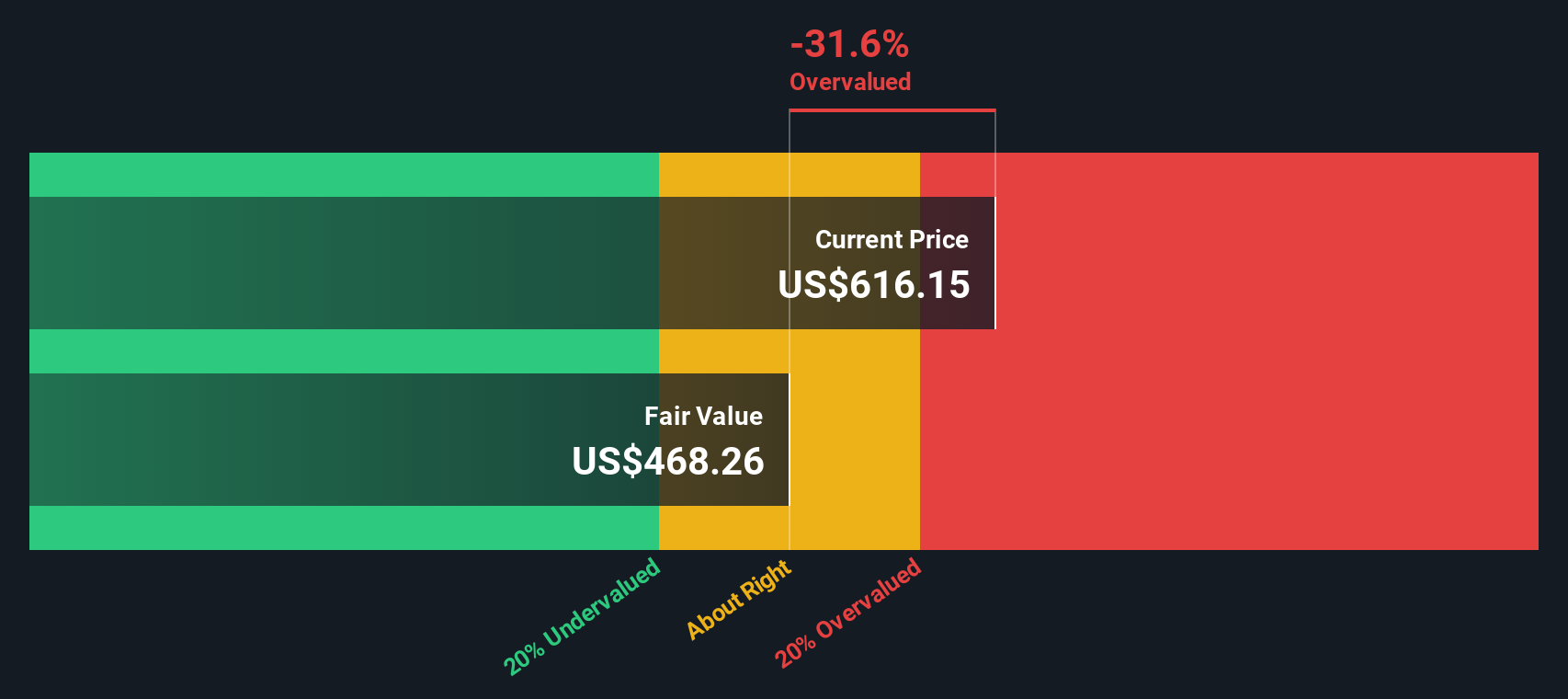

After applying the 2 Stage Free Cash Flow to Equity valuation method, the DCF model values IDEXX at $467.15 per share. With IDEXX's current share price at $635.40, the DCF suggests the stock is 36.0% above its estimated intrinsic value. This suggests the market is pricing in substantial optimism for IDEXX's future growth or that shares may be overvalued compared to fundamental cash flow generation.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests IDEXX Laboratories may be overvalued by 36.0%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: IDEXX Laboratories Price vs Earnings

The Price-to-Earnings (PE) ratio is a popular valuation metric for profitable companies like IDEXX Laboratories because it links a company's share price with its earnings power. Since earnings are a reflection of ongoing business performance, this ratio helps investors gauge how much they are paying for each dollar of profit. For companies with a strong track record of profit and predictable earnings, the PE ratio offers a meaningful way to compare valuations.

Generally, the "right" PE ratio for a company is influenced by expectations for future growth and perceptions of risk. Higher growth prospects or lower-risk profiles can justify a richer PE multiple, while slower growth or greater uncertainty typically lead to lower multiples. So, what does this look like for IDEXX right now?

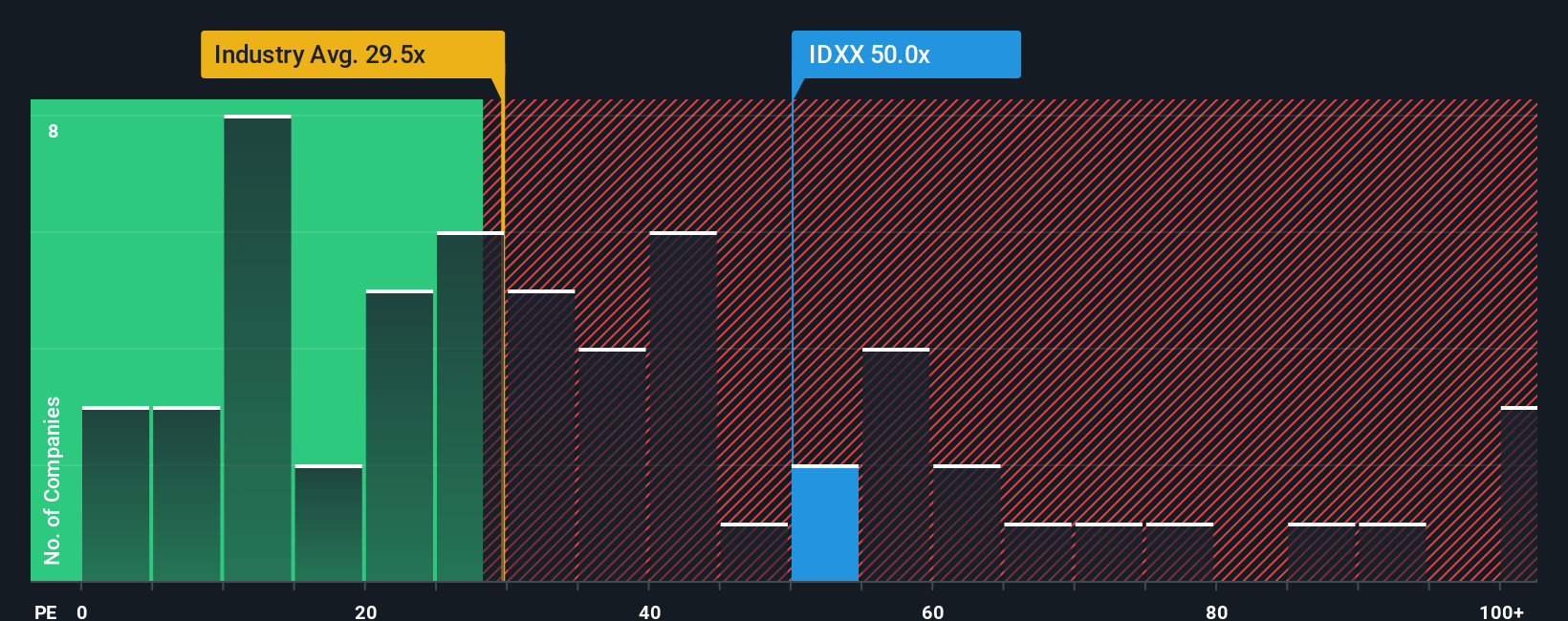

IDEXX Laboratories currently trades at a PE ratio of 51.57x. If we compare that to the medical equipment industry average of 29.12x, or its peer average of 27.06x, IDEXX's valuation appears elevated at first glance. But not all high PE ratios are created equal. This is where the Simply Wall St "Fair Ratio" comes in. For IDEXX, that figure stands at 31.30x.

Simply Wall St's Fair Ratio considers not just the company’s earnings growth and industry but also its profit margins, risk factors, and market cap, creating a more nuanced benchmark. This approach helps account for why a market leader with faster growth or stronger profitability, like IDEXX, might justifiably command a higher multiple than its peers. It is a more holistic gauge of what multiple the market should assign, factoring in what truly sets IDEXX apart.

Comparing IDEXX's actual PE ratio of 51.57x to its Fair Ratio of 31.30x, the stock looks overvalued by this measure. Despite its strong growth profile, today's valuation implies the market is baking in a lot of optimism for the future.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your IDEXX Laboratories Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your way to connect the story you believe about IDEXX Laboratories, including its growth, challenges, and future, with your own financial forecast and fair value estimate. Rather than simply relying on one-size-fits-all valuation models, Narratives encourage you to factor in real business drivers, risks, and opportunities as you see them, and quickly see how these assumptions impact what the company is truly worth.

On Simply Wall St’s Community page, Narratives make it easy to capture and share your unique viewpoint, used by millions of investors who want to personalize their investing decisions. By comparing your Narrative’s Fair Value to today’s share price, you can more confidently decide whether IDEXX is a Buy, Hold, or Sell, all while your assumptions update dynamically as new news and earnings are released.

For example, some investors using Narratives might see IDEXX’s international expansion and innovation fueling recurring growth and estimate a fair value above $780 per share. Others may emphasize competition and margin risks and set their value close to $420. This demonstrates the power of your own perspective in shaping your investment call.

Do you think there's more to the story for IDEXX Laboratories? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IDXX

IDEXX Laboratories

Develops, manufactures, and distributes products for the companion animal veterinary, livestock and poultry, dairy, and water testing industries in the United States and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives