- United States

- /

- Medical Equipment

- /

- NasdaqGS:IDXX

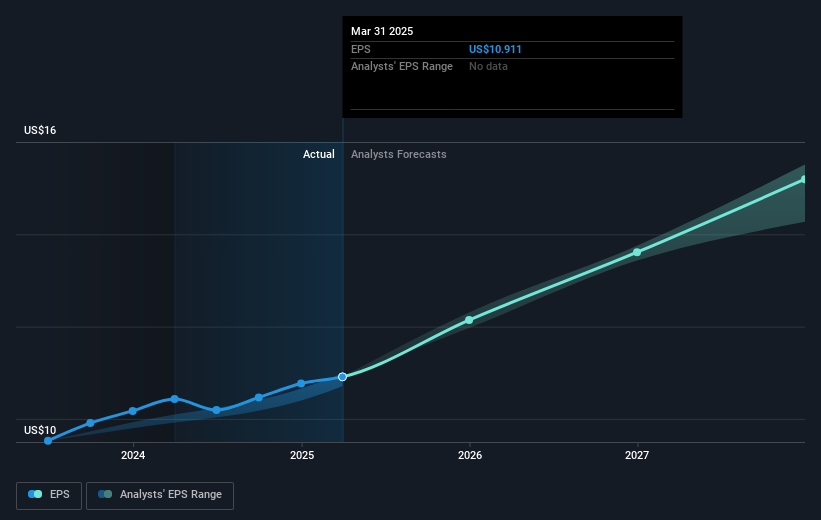

IDEXX Laboratories [NasdaqGS:IDXX] Raises 2025 Guidance and Reports Q1 Growth in Revenue and EPS

Reviewed by Simply Wall St

IDEXX Laboratories (NasdaqGS:IDXX) experienced a 13% price increase over the last month, spurred by robust first-quarter earnings results and an optimistic upward revision in corporate guidance. The company reported an increase in sales and net income compared to the previous year, projecting confidence for the remainder of 2025. These positive events coincided with a broader market uptick, including a strong U.S. jobs report and potential trade talk optimism, both bolstering the S&P 500's performance. While these market conditions supported IDEXX's rise, the company's own positive announcements likely added weight to its strong performance.

IDEXX Laboratories' recent 13% share price increase stems from strong first-quarter earnings and optimistic guidance revisions, positioning the company well for revenue and earnings growth in 2025. These developments align with their narrative of expanding international markets and enhancing software platforms. The investment in innovative diagnostic tools like inVue Dx and Cancer Dx appears to support these growth forecasts.

Over the past five years, IDEXX's total shareholder return, accounting for both share price and dividends, rose 60.19%. This demonstrates a solid performance, though the company's 1-year return lagged behind the US Medical Equipment industry, which saw a 6.3% gain.

The company's projected revenue growth of 7.3% per year, driven by increased international presence and strategic customer agreements, aligns with the recent earnings report results. However, challenges such as rising operating costs and unfavorable currency rates could impact these projections. The share price, currently at US$436.97, shows a discount compared to the consensus analyst price target of US$486.12, indicating potential room for growth if analysts' forecasts hold true.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade IDEXX Laboratories, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IDXX

IDEXX Laboratories

Develops, manufactures, and distributes products for the companion animal veterinary, livestock and poultry, dairy, and water testing industries in the United States and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives