- United States

- /

- Medical Equipment

- /

- NasdaqGS:IDXX

IDEXX Laboratories (IDXX): Evaluating Valuation Following Strong Q2 Results and Upgraded Growth Outlook

Reviewed by Kshitija Bhandaru

IDEXX Laboratories (IDXX) is getting renewed attention after its Companion Animal Group Diagnostics segment drove strong growth. This was capped by upbeat Q2 earnings and an increase in full-year revenue and profit forecasts. Investors are noting several drivers behind this momentum.

See our latest analysis for IDEXX Laboratories.

There has been a noticeable shift in sentiment around IDEXX Laboratories this year, supported by robust earnings and expansion in diagnostics. The company’s recent digital moves, including new software offerings and a strong quarter, have kept momentum building. Over the past year, total shareholder return sits just above break-even, while shares have held steady near all-time highs, reflecting ongoing investor confidence in IDEXX’s long-term growth story.

If you’re interested in discovering other standout healthcare stocks with strong fundamentals, be sure to check out See the full list for free..

Given IDEXX’s steady performance and boosted outlook, the question for investors is whether today’s price already anticipates future growth or if there is still room for upside in the current valuation.

Most Popular Narrative: 9.2% Undervalued

The top-followed narrative pegs IDEXX Laboratories' fair value at $695, which is 9.2% above the last close of $631.19. This sets the stage for a closer look at the financial and strategic catalysts behind the stock's long-term prospects.

“Expansion in innovative diagnostic platforms and international markets is driving recurring revenue growth, margin expansion, and enhanced geographic diversification. Strong customer retention and broader adoption of cloud solutions create stable, high-margin revenue streams and position the company for sustained long-term earnings growth.”

Want to know what's powering this premium valuation? The narrative leans heavily on a few bold projections, such as potentially explosive growth and margin expansion, that set IDEXX apart from its industry. Uncover the surprising assumptions that underpin this consensus price target and see which key financial drivers tip the scales in favor of upside.

Result: Fair Value of $695 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing U.S. clinical visit growth and heightened competition could challenge IDEXX’s ability to sustain projected revenue gains and profit margins in the future.

Find out about the key risks to this IDEXX Laboratories narrative.

Another View: Market Multiples Raise Questions

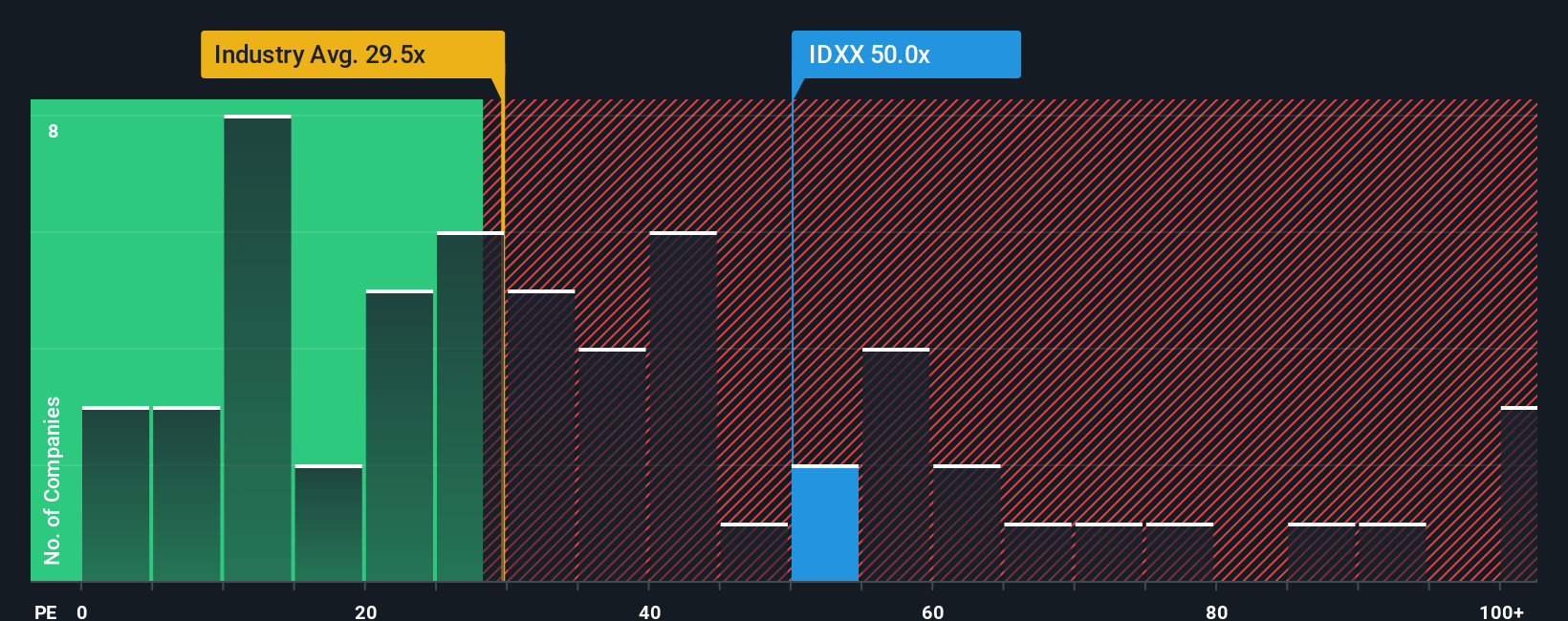

While the consensus suggests IDEXX Laboratories is undervalued, a quick reality check using the price-to-earnings ratio tells a different story. IDEXX trades at 51.2x earnings, well above the industry average of 30.4x and the peer average of 27.9x. Even compared to our calculated fair ratio of 31.3x, IDEXX looks expensive. This wide gap suggests the market is pricing in a lot of future growth. Does this introduce more risk or hint at continued momentum?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own IDEXX Laboratories Narrative

If you see things differently or value doing your own analysis, you can build your own IDEXX Laboratories story in just a few minutes: Do it your way.

A great starting point for your IDEXX Laboratories research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't let opportunity pass you by. Quickly spot companies with hidden potential or strong momentum by using these tailored screeners. Your next big winner might be one click away.

- Jump on companies with surging growth in artificial intelligence by checking out these 24 AI penny stocks and pinpointing those set to outpace the industry.

- Secure your income with generous cash flows and reliability by seeing which businesses stand out for high payouts through these 19 dividend stocks with yields > 3%.

- Give your portfolio an edge by identifying stocks currently priced below their true value. Start with these 901 undervalued stocks based on cash flows and see what others are missing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IDXX

IDEXX Laboratories

Develops, manufactures, and distributes products for the companion animal veterinary, livestock and poultry, dairy, and water testing industries in the United States and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives