- United States

- /

- Medical Equipment

- /

- NasdaqGS:IART

Integra LifeSciences (IART) Is Up 8.7% After Strategic Moves Spotlight Recovery Hopes—Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Integra LifeSciences Holdings recently attracted renewed investor interest due to its perceived upside potential and strategic steps in the medical devices sector, as reported on October 23, 2025.

- An interesting aspect is that this optimism persists despite ongoing financial challenges, with market expectations pointing toward future operational improvements and international growth on the strength of stable free cash flow and product innovation.

- We'll review how investor anticipation of earnings improvement, sparked by Integra's strategic focus, influences the company's updated investment outlook.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

Integra LifeSciences Holdings Investment Narrative Recap

To be a shareholder in Integra LifeSciences Holdings today, you need to believe that its strategic initiatives and strong free cash flow will translate into true earnings recovery and international expansion, even as operational and margin pressures persist. The recent news of renewed investor interest reflects optimism about future improvements but does not meaningfully offset the company's most important short term catalyst, progress on product relaunches and shiphold resolution, or the biggest risk tied to ongoing supply disruptions and margin contraction.

Among this year’s key announcements, Integra’s guidance update on July 31 stands out: management reaffirmed full-year revenue targets and highlighted continuing efforts to stabilize results after recent production setbacks. This update remains closely linked to whether Integra can successfully execute its product relaunches to regain lost market share and restore operating margins.

Yet, despite renewed optimism, investors should be aware of the lingering risk that delays in relaunching PriMatrix and SurgiMend could...

Read the full narrative on Integra LifeSciences Holdings (it's free!)

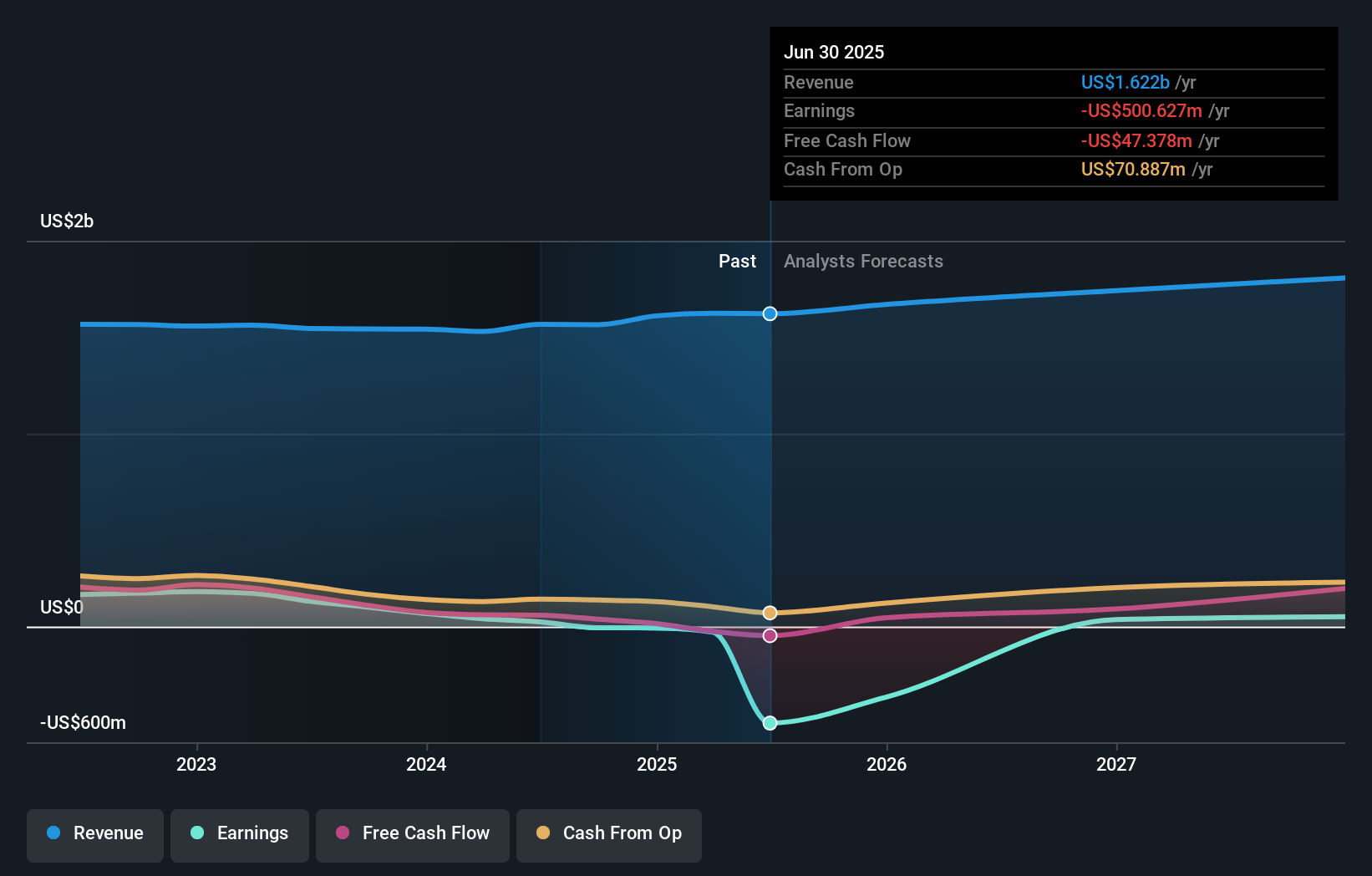

Integra LifeSciences Holdings is projected to achieve $1.9 billion in revenue and $90.9 million in earnings by 2028. This outlook assumes an annual revenue growth rate of 4.5% and an increase in earnings of $591.5 million from the current earnings of -$500.6 million.

Uncover how Integra LifeSciences Holdings' forecasts yield a $15.88 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for Integra LifeSciences span from US$15.88 to US$81.57, reflecting two very different outlooks. Against this backdrop of divided opinions, the unresolved production delays stand out as a key variable shaping future performance, be sure to consider a range of community perspectives.

Explore 2 other fair value estimates on Integra LifeSciences Holdings - why the stock might be worth just $15.88!

Build Your Own Integra LifeSciences Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Integra LifeSciences Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Integra LifeSciences Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Integra LifeSciences Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IART

Integra LifeSciences Holdings

Manufactures and sells surgical instrument, neurosurgical, ear, nose, throat, and wound care products for use in neurosurgery, neurocritical care, and otolaryngology.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives