- United States

- /

- Medical Equipment

- /

- NasdaqGS:IART

A Fresh Look at Integra LifeSciences Holdings (IART) Valuation After Recent Share Price Momentum

Reviewed by Simply Wall St

Is Integra LifeSciences Holdings Starting to Turn a Corner?

Integra LifeSciences Holdings (IART) has recently piqued the interest of investors after a period of intense volatility. There is no single headline event making waves this week, but the movement in IART’s share price is enough to get anyone watching the healthcare sector asking if something is brewing beneath the surface. For those trying to decide whether to make a move on this medical device maker, it is a natural time to take stock of what is really driving value here.

After a challenging stretch, IART’s stock has staged a sharp rebound over the past month, climbing nearly 12%. That uptick stands out against a tough year. Shares are still down 13% over the past twelve months, and the longer-term performance leaves plenty to be desired. Brief rallies have not erased the deep declines seen over three and five years, but recent momentum may suggest a shift in how investors are assessing risk and growth potential for this business.

With these swings in mind, the real question is whether Integra LifeSciences Holdings is finally trading at a discount or if the market is simply adjusting to new expectations for future growth.

Most Popular Narrative: 3.1% Undervalued

The latest and most widely followed narrative suggests Integra LifeSciences Holdings may be trading slightly below its estimated fair value. The consensus among analysts points to an undervaluation, but the margin is not large, highlighting just a subtle gap between market price and expectations.

The ongoing demographic shift toward an aging global population and higher incidence of chronic diseases is expected to sustain and expand demand for surgical procedures, neurosurgery, and advanced wound care. These are areas where Integra maintains leading positions and is poised to grow its addressable market, supporting long-term revenue growth.

What hidden engine is powering this almost-fair valuation? Behind the scenes, analysts are betting big on a turnaround in earnings, improvements in profit margins, and sharp gains in revenue. Curious about the bold financial assumptions and future profit metrics that shape this narrative? The full story reveals eye-opening projections and benchmarks that might explain why the gap between today’s price and future value remains so close. Do not miss what is under the hood of this fair value call.

Result: Fair Value of $15.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing product delays and high leverage could easily disrupt the recovery story. This may leave Integra’s current growth projections at risk.

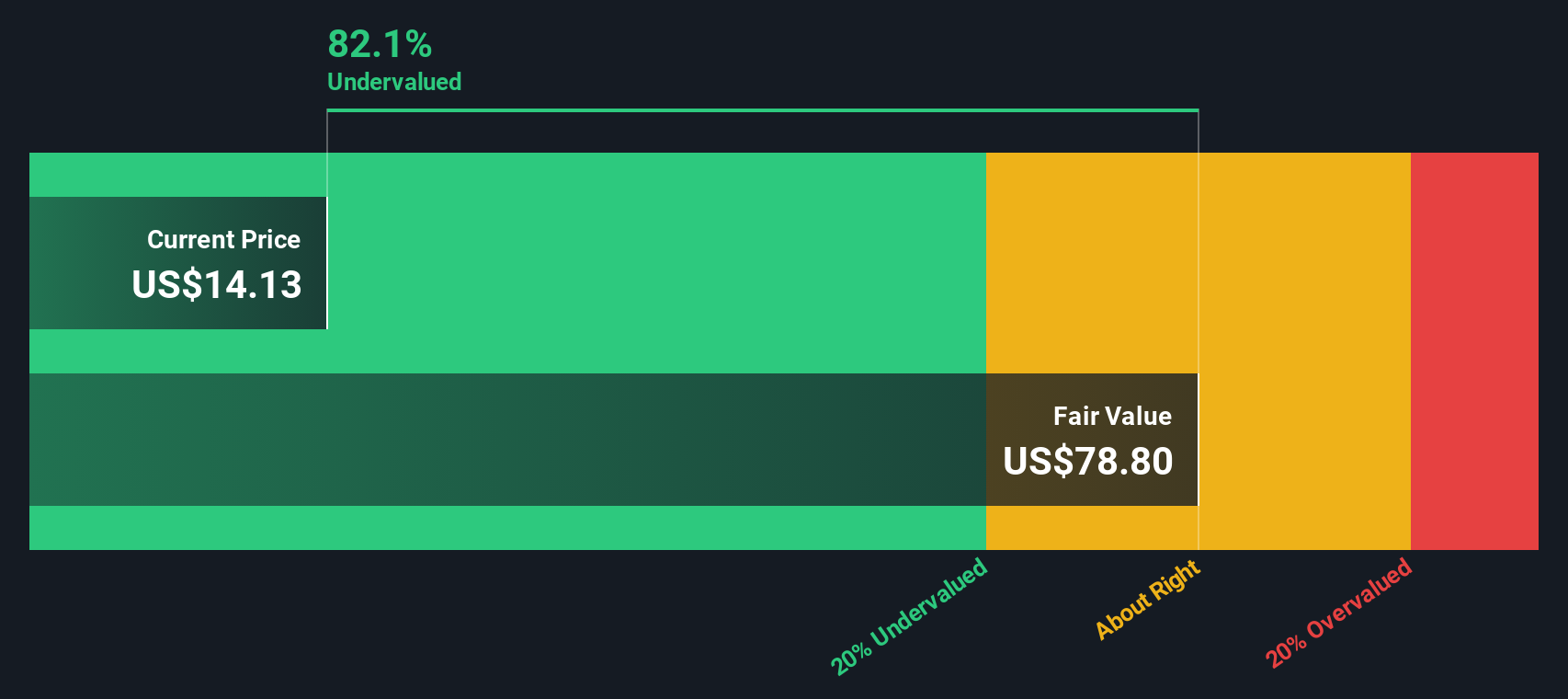

Find out about the key risks to this Integra LifeSciences Holdings narrative.Another View: SWS DCF Model Tells a Different Story

While the first approach points to shares trading near fair value, the SWS DCF model paints a sharply undervalued picture for Integra LifeSciences Holdings. Why is there such a big gap between these methods?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Integra LifeSciences Holdings Narrative

If you are not quite persuaded by these viewpoints, or prefer to dig into the numbers yourself, you have the freedom to build your own take on Integra’s future outlook in just a few minutes. Do it your way

A great starting point for your Integra LifeSciences Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Expand your opportunities by searching for stocks that meet your investing style and goals. The right screener does the work for you so you do not miss out.

- Unlock cash flow bargains and spot assets that might be trading below their true worth by using our undervalued stocks based on cash flows.

- Capture tomorrow’s healthcare breakthroughs with access to potential leaders in medical innovation via our healthcare AI stocks.

- Boost your income portfolio and find companies offering attractive yields and stable returns through our dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IART

Integra LifeSciences Holdings

Manufactures and sells surgical instrument, neurosurgical, ear, nose, throat, and wound care products for use in neurosurgery, neurocritical care, and otolaryngology.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives