- United States

- /

- Medical Equipment

- /

- NasdaqGM:HYPR

What You Can Learn From Hyperfine, Inc.'s (NASDAQ:HYPR) P/S After Its 28% Share Price Crash

Hyperfine, Inc. (NASDAQ:HYPR) shares have had a horrible month, losing 28% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 19% in that time.

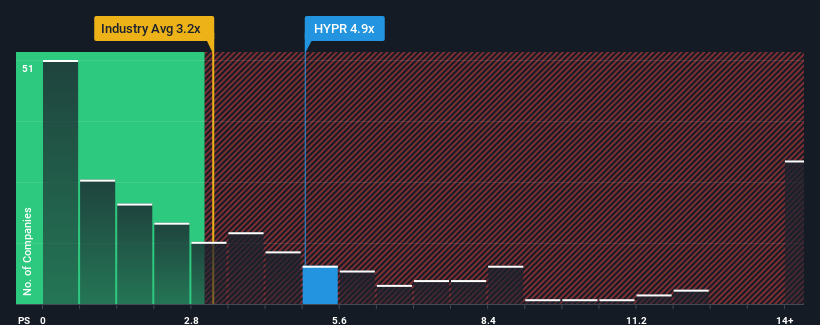

Even after such a large drop in price, Hyperfine's price-to-sales (or "P/S") ratio of 4.9x might still make it look like a sell right now compared to the wider Medical Equipment industry in the United States, where around half of the companies have P/S ratios below 3.2x and even P/S below 1.1x are quite common. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Hyperfine

How Has Hyperfine Performed Recently?

With revenue growth that's superior to most other companies of late, Hyperfine has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Hyperfine will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Hyperfine?

In order to justify its P/S ratio, Hyperfine would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 17%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 21% each year over the next three years. With the industry only predicted to deliver 9.0% per year, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Hyperfine's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Hyperfine's P/S

There's still some elevation in Hyperfine's P/S, even if the same can't be said for its share price recently. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Hyperfine's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Hyperfine (1 shouldn't be ignored!) that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Hyperfine might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:HYPR

Hyperfine

A health technology company, engages in the production, supply, service, and commercialization of magnetic resonance imaging (MRI) products.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026