- United States

- /

- Medical Equipment

- /

- NasdaqGM:HYPR

Hyperfine, Inc. (NASDAQ:HYPR) Looks Just Right With A 30% Price Jump

Despite an already strong run, Hyperfine, Inc. (NASDAQ:HYPR) shares have been powering on, with a gain of 30% in the last thirty days. The last 30 days bring the annual gain to a very sharp 49%.

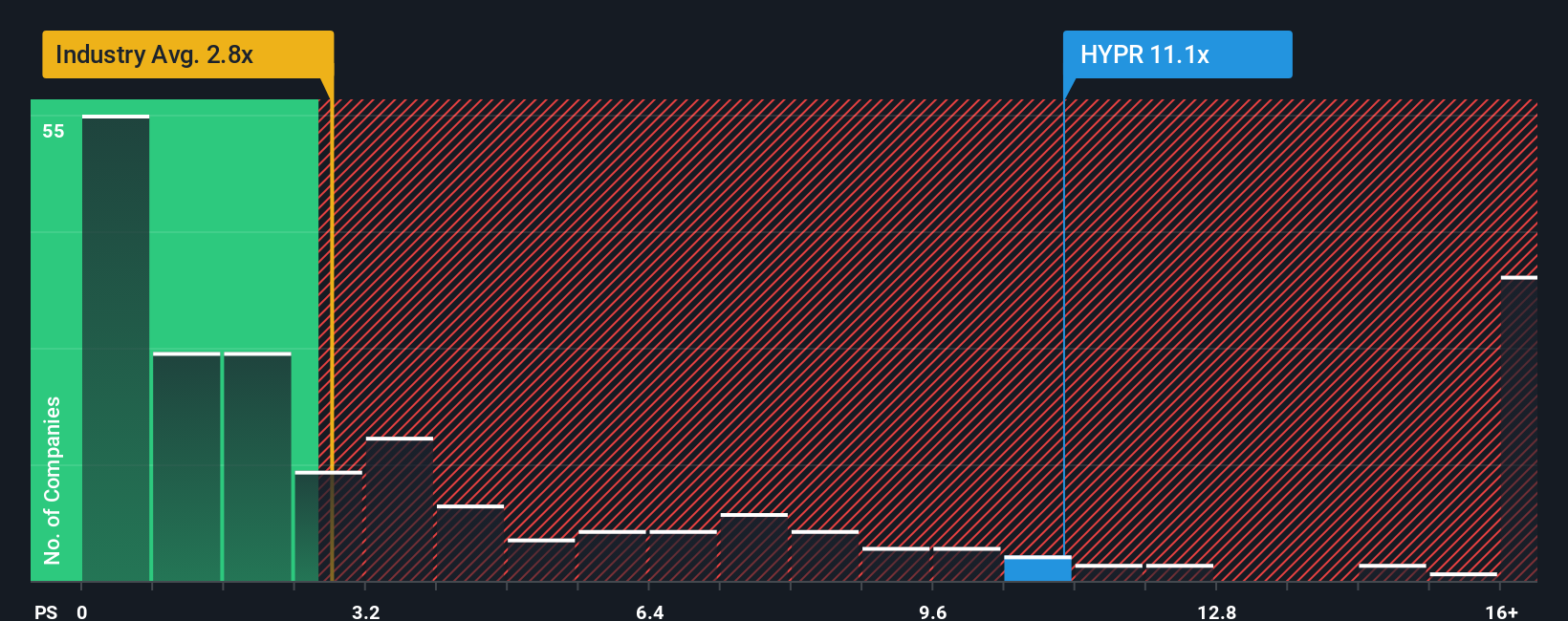

After such a large jump in price, given around half the companies in the United States' Medical Equipment industry have price-to-sales ratios (or "P/S") below 2.8x, you may consider Hyperfine as a stock to avoid entirely with its 11.1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Hyperfine

What Does Hyperfine's P/S Mean For Shareholders?

Hyperfine could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Hyperfine will help you uncover what's on the horizon.How Is Hyperfine's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Hyperfine's is when the company's growth is on track to outshine the industry decidedly.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 9.6%. Even so, admirably revenue has lifted 181% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 28% per annum as estimated by the three analysts watching the company. That's shaping up to be materially higher than the 9.2% per annum growth forecast for the broader industry.

With this information, we can see why Hyperfine is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Hyperfine's P/S

The strong share price surge has lead to Hyperfine's P/S soaring as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Hyperfine's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

You need to take note of risks, for example - Hyperfine has 3 warning signs (and 1 which shouldn't be ignored) we think you should know about.

If you're unsure about the strength of Hyperfine's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Hyperfine might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:HYPR

Hyperfine

A health technology company, engages in the production, supply, service, and commercialization of magnetic resonance imaging (MRI) products.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026