- United States

- /

- Healthcare Services

- /

- NasdaqGS:HSIC

How Investors May Respond To Henry Schein (HSIC) Gaining Exclusive U.S. Rights To Drill-Free Cavity Treatment

Reviewed by Sasha Jovanovic

- Henry Schein, Inc. announced in the past that it expanded its agreement with Swiss firm vVARDIS to secure exclusive U.S. distribution rights for the drill-free Curodont Repair Fluoride Plus product across all dental market segments, effective January 1, 2026.

- This move positions Henry Schein as a key channel for a drill- and needle-free early-cavity treatment, tapping a large pool of previously untreated patients and broadening its role in preventive oral healthcare.

- Next, we’ll examine how nationwide exclusivity for Curodont could influence Henry Schein’s investment narrative around high-margin specialties and digital-led growth.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Henry Schein Investment Narrative Recap

To own Henry Schein, you need to believe it can keep shifting its mix toward higher margin specialties and technology while defending distribution margins in a price sensitive dental market. The expanded Curodont exclusivity could modestly support that narrative over time by adding a differentiated, preventive product, but it does not change the near term focus on execution of cost savings and managing customer pricing pressure, which remain central catalysts and risks for the stock.

In that context, the November 2025 rollout of VideaHealth’s Detect AI “Impact Panel” inside Henry Schein One is especially relevant, because it shows the company pairing clinical innovation like Curodont with digital tools that can lift procedure acceptance and recurring software revenue. Both moves speak to the same catalyst: growing the share of profits from higher margin specialty products and cloud based platforms rather than relying solely on traditional distribution.

Yet, while Curodont and AI tools broaden the growth story, investors should also be aware of the ongoing risk that intense price competition in core dental supplies could...

Read the full narrative on Henry Schein (it's free!)

Henry Schein's narrative projects $14.4 billion revenue and $614.4 million earnings by 2028. This requires 4.0% yearly revenue growth and about a $225 million earnings increase from $389.0 million today.

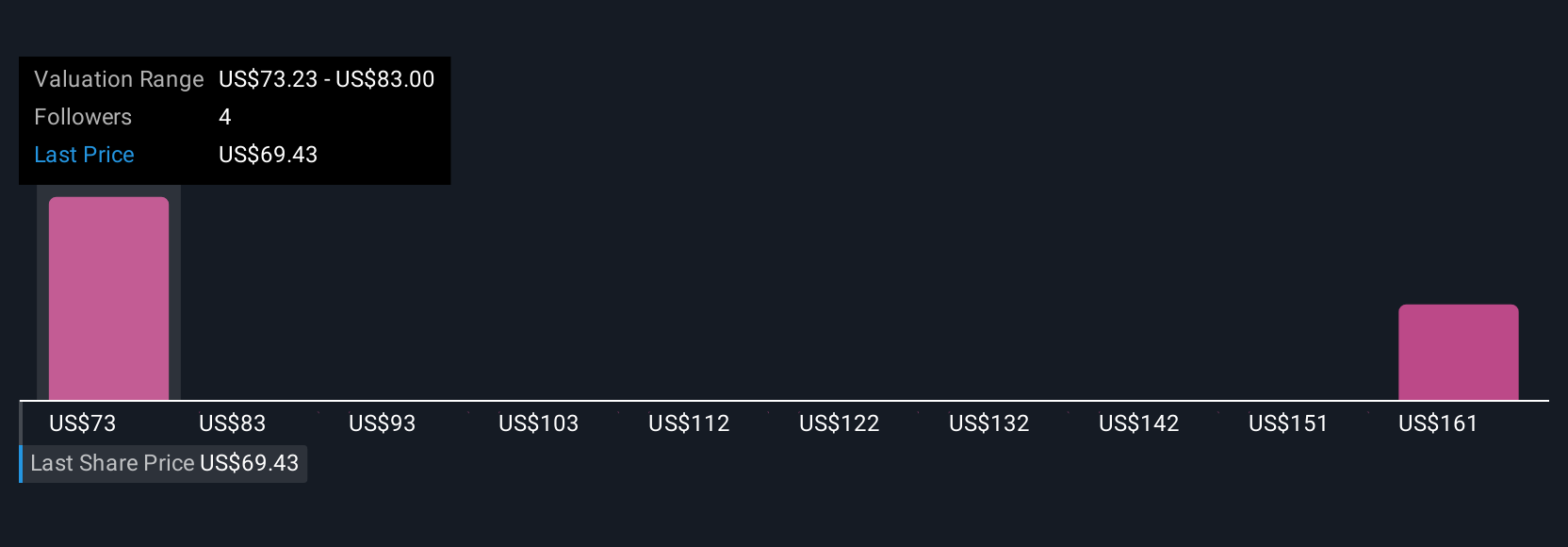

Uncover how Henry Schein's forecasts yield a $77.00 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community span a wide range, from US$77.00 to about US$174.11, showing how far apart individual views can be. As you weigh those perspectives, remember that Henry Schein’s push into higher margin specialties and digital solutions sits alongside persistent competitive pricing pressure in core categories, which could influence how the business actually performs over time.

Explore 2 other fair value estimates on Henry Schein - why the stock might be worth over 2x more than the current price!

Build Your Own Henry Schein Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Henry Schein research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Henry Schein research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Henry Schein's overall financial health at a glance.

No Opportunity In Henry Schein?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Henry Schein might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HSIC

Henry Schein

Provides health care products and services to office-based dental and medical practitioners, and alternate sites of care worldwide.

Undervalued with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026