- United States

- /

- Healthcare Services

- /

- NasdaqGS:HQY

HealthEquity (HQY) Margins Strengthen, Reinforcing Bullish Profitability Narrative Despite Slower Revenue Trajectory

Reviewed by Simply Wall St

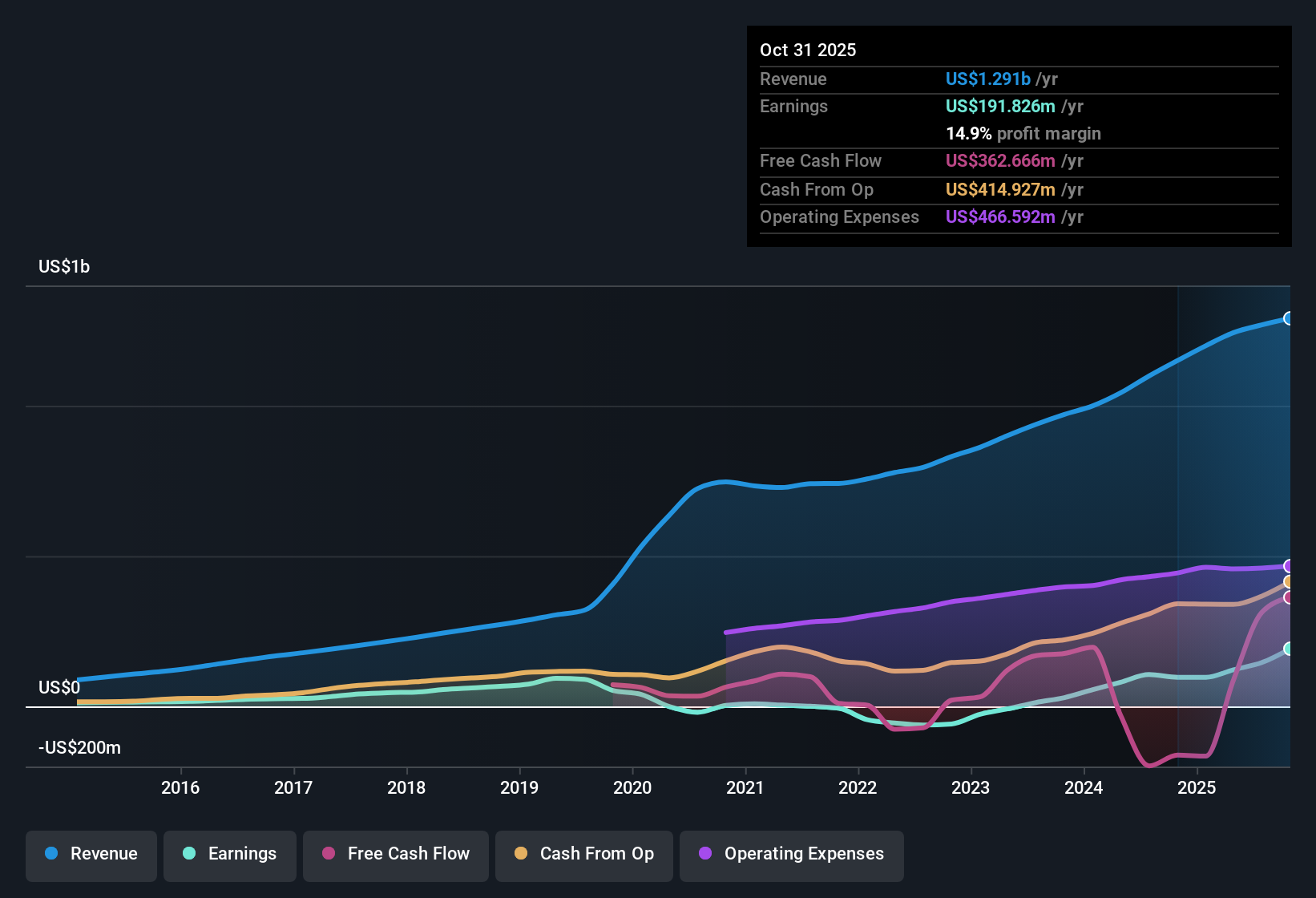

HealthEquity (HQY) just posted its Q3 2026 print, with revenue of about $322 million and basic EPS of $0.60, against a trailing twelve month backdrop of $1.29 billion in revenue and $2.22 in EPS that has seen earnings climb 98.4% year over year. Over the past few quarters, the company has seen revenue move from roughly $300 million in Q2 2025 to the low $320 million range in Q3 2026, while quarterly EPS has stepped up from $0.07 in Q3 2025 to the $0.60 to $0.69 band this year, setting the stage for investors to focus on how its fatter 14.9% net margin shapes sentiment around the latest release.

See our full analysis for HealthEquity.With the headline numbers on the table, the next step is to see how this earnings trajectory lines up with the big narratives around HealthEquity, and where the latest margin story might confirm or challenge what investors think they know.

See what the community is saying about HealthEquity

98% Earnings Growth Meets Slower 7.7% Revenue Path

- Over the last 12 months, net income rose from about $96.7 million to $191.8 million, while revenue is only forecast to grow 7.7% per year compared with the US market’s 10.6% revenue growth forecast.

- Analysts' consensus narrative argues that regulatory changes and digital innovation can support long term growth. However, the current 7.7% annual revenue growth forecast and trailing 14.9% net margin mean investors have to weigh strong profit expansion against a revenue trajectory that is still expected to trail the broader market.

- The consensus view highlights market expansion from new HSA eligible members, but the 7.7% revenue growth forecast shows that this is not being modeled as hyper growth relative to the 10.6% US market benchmark.

- At the same time, trailing net margin moving to 14.9% versus 8.4% a year ago supports the idea of a structurally more profitable business, which is a key pillar of the consensus growth story.

14.9% Net Margin Supports Bullish Profit Story

- Trailing 12 month net profit margin sits at 14.9%, up from 8.4% last year, and analysts expect profit margins to rise further from 11.5% to 20.4% over the next three years.

- Supporters of the bullish narrative point to regulatory expansion and digital efficiencies as drivers of higher margins, and the move from 8.4% to 14.9% net margin combined with EPS climbing to $2.22 over the trailing 12 months strongly backs the idea that HealthEquity is already capturing operating leverage while setting expectations for margins to potentially reach that 20.4% target.

- Consensus narrative notes that automation, fraud reduction, and a shift to a cloud platform are lowering service costs, which lines up with net income roughly doubling from $96.7 million to $191.8 million on revenue rising from about $1.15 billion to $1.29 billion.

- Diversified revenue streams such as custodial yield and fees help explain how earnings grew 98.4% year over year, even though revenue growth has been more modest, reinforcing the bullish focus on margin expansion rather than purely on top line growth.

42.6x P/E Premium Versus 121.14 Target

- HealthEquity trades at about $95.67 per share on a 42.6x P/E, compared with peer and US Healthcare industry averages of 20.8x and 22.3x respectively, while the referenced analyst price target of $121.14 and a DCF fair value of roughly $177.13 both sit above the current price.

- Bears focus on that 42.6x multiple as a key risk, and the fact that it is nearly double peer and industry levels means the stock is priced for continued strong earnings growth, even though revenue is forecast to grow only 7.7% annually, so any slowdown from the current 98.4% trailing earnings growth could make the high multiple harder to justify despite the gap to the $121.14 analyst target and the higher DCF fair value.

- Critics highlight that to reach projected 2028 earnings of $325.3 million and EPS of $3.46, valuation models still assume a P/E above the current 21.0x industry level, echoing today’s premium 42.6x multiple.

- At the same time, the stock trading below the stated DCF fair value of $177.13 indicates that valuation models see upside if earnings keep compounding near the forecast 18.2% annual rate, which partially offsets bearish concerns about the headline P/E.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for HealthEquity on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Use that lens to build your own take in just a few minutes and shape how the story reads, Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding HealthEquity.

See What Else Is Out There

HealthEquity’s rich 42.6x P/E multiple, slower 7.7% revenue growth, and premium versus peers highlight valuation risk if earnings momentum cools.

If that stretched pricing gives you pause, use our these 908 undervalued stocks based on cash flows today to quickly zero in on companies where cash flow and upside look far more balanced.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HealthEquity might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HQY

HealthEquity

Provides technology-enabled services platforms to consumers and employers in the United States.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026