- United States

- /

- Healthcare Services

- /

- NasdaqGS:HQY

Can New Leadership Help HealthEquity (HQY) Realize Its Technology-Driven Growth Ambitions?

Reviewed by Sasha Jovanovic

- In late September 2025, HealthEquity announced the appointments of Mukund Ramachandran as Chief Marketing Officer and Garett Kitch as Senior Vice President of Client Sales & Relationship Management, bringing deep experience from fintech, insurtech, and technology-driven sales organizations.

- This leadership refresh aims to accelerate HealthEquity's technology-driven market expansion, with a particular focus on enhancing both B2B and B2C engagement and leveraging advanced AI-powered solutions.

- We'll examine how the addition of experienced leaders with strong fintech backgrounds could influence HealthEquity’s long-term growth narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

HealthEquity Investment Narrative Recap

To be a HealthEquity shareholder today, you need confidence in the company’s ability to expand its footprint in the fast-growing health savings account sector as regulatory tailwinds increase its addressable market. The recent appointments of experienced leaders in marketing and sales do not materially impact the biggest near-term catalyst, new HSA account growth driven by regulatory changes, or address the primary risk to the business: volatility in custodial interest income tied to shifting interest rates.

The most pertinent recent announcement is HealthEquity’s steady earnings growth, with Q2 revenue rising to US$325.84 million and net income up to US$59.85 million year over year, reinforcing the company’s ability to convert scale into stronger margins, a critical consideration as it pursues ongoing technology investments and member acquisition goals.

Yet, in contrast to this momentum, investors should not overlook the risk that shifts in interest rates could have a pronounced effect on HealthEquity’s core earnings...

Read the full narrative on HealthEquity (it's free!)

HealthEquity's narrative projects $1.6 billion revenue and $325.3 million earnings by 2028. This requires 7.9% yearly revenue growth and a $179.5 million earnings increase from $145.8 million.

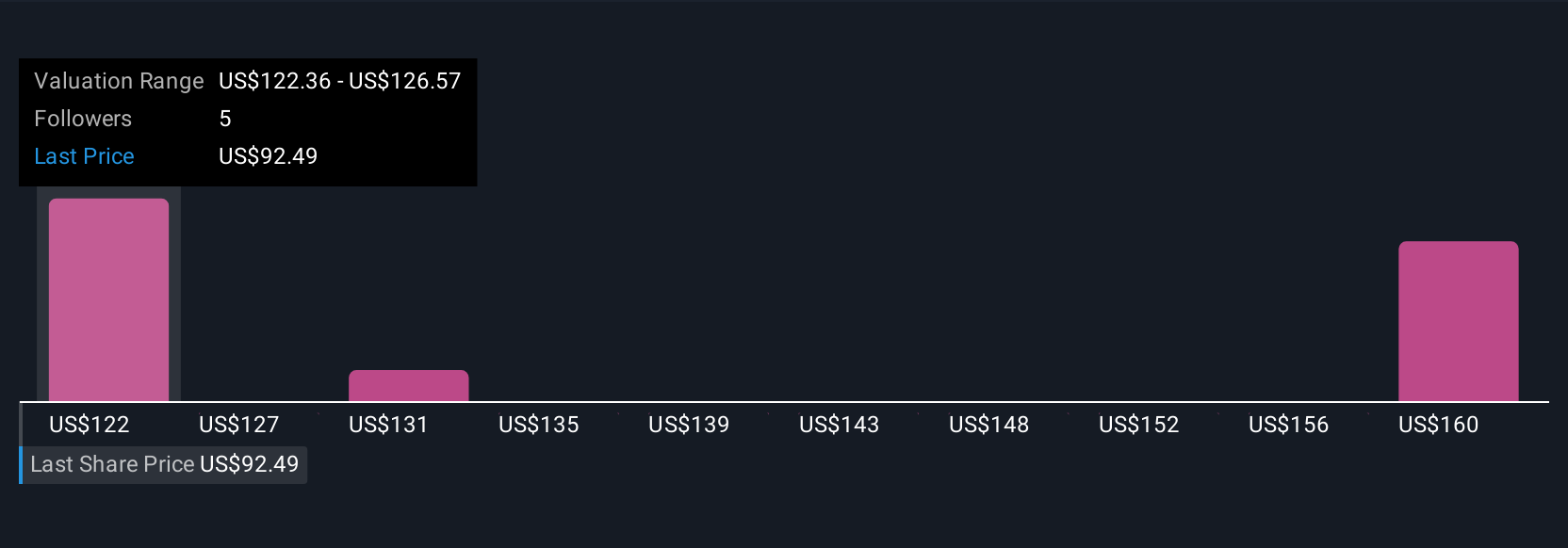

Uncover how HealthEquity's forecasts yield a $122.36 fair value, a 38% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community span US$122.36 to US$168.06, with over US$45,700 difference between the most bearish and bullish views. While regulatory expansion offers room for account growth, the diversity of outlooks highlights how opinions on future performance can sharply diverge, consider exploring several viewpoints before deciding for yourself.

Explore 3 other fair value estimates on HealthEquity - why the stock might be worth as much as 90% more than the current price!

Build Your Own HealthEquity Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your HealthEquity research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free HealthEquity research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HealthEquity's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HealthEquity might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HQY

HealthEquity

Provides technology-enabled services platforms to consumers and employers in the United States.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives