- United States

- /

- Medical Equipment

- /

- NasdaqCM:HLTH

Take Care Before Jumping Onto Cue Health Inc. (NASDAQ:HLTH) Even Though It's 26% Cheaper

Unfortunately for some shareholders, the Cue Health Inc. (NASDAQ:HLTH) share price has dived 26% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 83% share price decline.

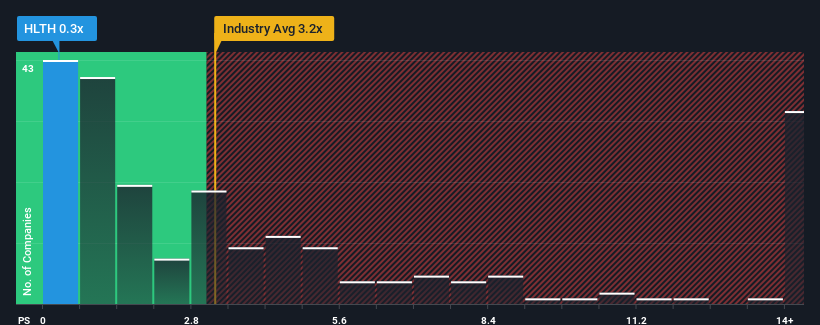

Since its price has dipped substantially, Cue Health may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.3x, since almost half of all companies in the Medical Equipment industry in the United States have P/S ratios greater than 3.2x and even P/S higher than 7x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Cue Health

What Does Cue Health's Recent Performance Look Like?

Cue Health could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Cue Health's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Cue Health?

In order to justify its P/S ratio, Cue Health would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered a frustrating 85% decrease to the company's top line. Even so, admirably revenue has lifted 209% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should generate growth of 43% per annum as estimated by the three analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 10% per annum, which is noticeably less attractive.

With this information, we find it odd that Cue Health is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Having almost fallen off a cliff, Cue Health's share price has pulled its P/S way down as well. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

A look at Cue Health's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Having said that, be aware Cue Health is showing 5 warning signs in our investment analysis, and 1 of those is concerning.

If these risks are making you reconsider your opinion on Cue Health, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:HLTH

Adequate balance sheet and slightly overvalued.