- United States

- /

- Healthtech

- /

- NasdaqGS:HCAT

It's A Story Of Risk Vs Reward With Health Catalyst, Inc. (NASDAQ:HCAT)

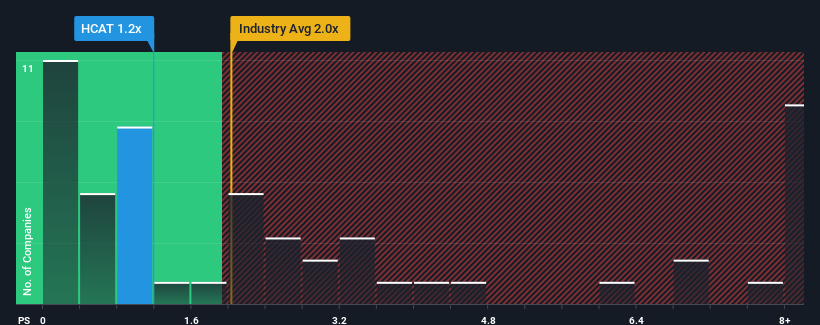

Health Catalyst, Inc.'s (NASDAQ:HCAT) price-to-sales (or "P/S") ratio of 1.2x might make it look like a buy right now compared to the Healthcare Services industry in the United States, where around half of the companies have P/S ratios above 2x and even P/S above 7x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Health Catalyst

What Does Health Catalyst's Recent Performance Look Like?

Recent times haven't been great for Health Catalyst as its revenue has been rising slower than most other companies. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Health Catalyst's future stacks up against the industry? In that case, our free report is a great place to start.How Is Health Catalyst's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Health Catalyst's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a decent 4.2% gain to the company's revenues. The latest three year period has also seen an excellent 31% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 10% each year over the next three years. That's shaping up to be similar to the 11% per annum growth forecast for the broader industry.

With this in consideration, we find it intriguing that Health Catalyst's P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Bottom Line On Health Catalyst's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It looks to us like the P/S figures for Health Catalyst remain low despite growth that is expected to be in line with other companies in the industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Before you take the next step, you should know about the 2 warning signs for Health Catalyst that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Health Catalyst might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:HCAT

Health Catalyst

Provides data and analytics technology and services to healthcare organizations in the United States.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives