- United States

- /

- Medical Equipment

- /

- NasdaqGS:GEHC

GE HealthCare Technologies (NasdaqGS:GEHC) Unveils Next-Gen MRI Innovations At ISMRM 2025

Reviewed by Simply Wall St

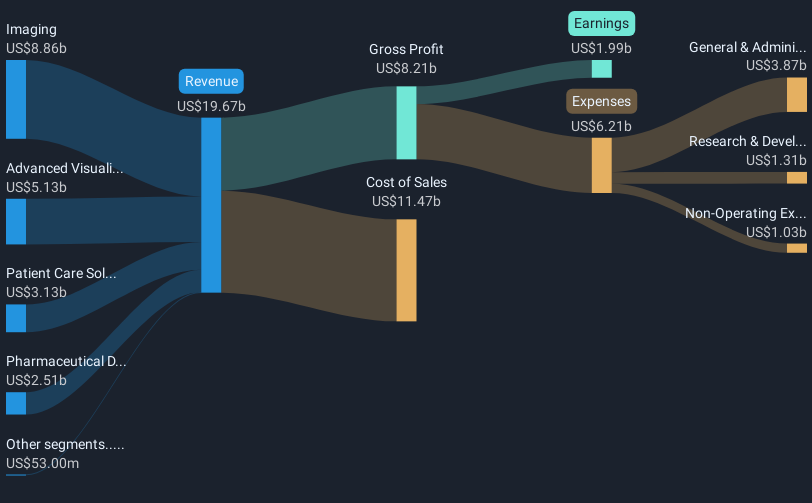

GE HealthCare Technologies (NasdaqGS:GEHC) recently made headlines with the launch of its SIGNA™ Sprint MRI system, a significant advancement in medical imaging, which may have added positive weight to its share price performance. Over the past month, GE HealthCare's stock rallied 11%, potentially reflecting investor optimism around such product innovations and strong Q1 earnings, where revenue and net income saw appreciable growth year-over-year. This price move aligns with broader market trends, including a surge in major indices like the Dow Jones, suggesting that the company's developments may have complemented the overall market momentum.

The launch of GE HealthCare Technologies' SIGNA™ Sprint MRI system has sparked enthusiasm among investors, as evidenced by its 11% share price rally in the past month. This innovation, combined with positive Q1 earnings, underscores the potential for increased revenue and earnings. Analysts anticipate that the enhanced product pipeline and strategic partnerships will bolster future financial performance. However, a significant factor to monitor is how these developments align with the company's ongoing efforts to mitigate tariff impacts and address competitive pressures, which may influence earnings and margin projections.

Over the last year, GE HealthCare Technologies' total return, including dividends, declined by 13.63%. This underperformance contrasts with the broader U.S. medical equipment industry, which achieved a more favorable return of 8.2% during the same period. The current share price of US$67.09 is trading at a 24.88% discount to the consensus analyst price target of US$87.25. This reflects an optimistic outlook for possible growth from new products and strategic acquisitions. Despite the recent uptick, investors might examine future revenue growth forecasts of 4% annually, particularly in light of competitive and regulatory challenges. Understanding these dynamics will be crucial for evaluating whether the current market sentiment aligns with future financial expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade GE HealthCare Technologies, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GEHC

GE HealthCare Technologies

Engages in the development, manufacture, and marketing of products, services, and complementary digital solutions used in the diagnosis, treatment, and monitoring of patients in the United States, Canada, and internationally.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives