- United States

- /

- Medical Equipment

- /

- NasdaqGS:GEHC

Does the Recent Share Price Dip Create Opportunity in GE HealthCare Technologies for 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with GE HealthCare Technologies stock? You are definitely not alone. With an impressive history and a footprint spanning medical imaging, diagnostics, and digital solutions, this is a company that always gets investors talking. But with GE HealthCare’s stock closing recently at $75.13 and price performance showing a dip of -0.5% over the past week and -17.1% in the past year, there is understandably some uncertainty about what comes next. Recent shifts across the market, especially in the healthcare sector, have left investors reassessing risk and reward, often driving share prices lower as sentiment changes.

Despite this, the story is not all caution tape and flashing lights. GE HealthCare currently earns a valuation score of 5 out of 6 on our checklist for undervalued companies. This means that on five of the most widely used valuation measures, the stock looks like a deal worth closer inspection. At the same time, one area remains where value hunters may want to pay extra attention.

So, how do we actually break down whether GE HealthCare is a buy based on value? Let us walk through the different lenses investors use to assess valuation. Stay tuned, because at the end, I will share an even more insightful approach to really understanding whether this stock is worth your investment.

Why GE HealthCare Technologies is lagging behind its peers

Approach 1: GE HealthCare Technologies Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting those amounts back to their value in today’s dollars. This approach gives investors a sense of whether the current market price is a bargain or not based on fundamental cash generation.

For GE HealthCare Technologies, the latest trailing twelve months saw Free Cash Flow at $1.59 billion. Looking ahead, analysts forecast FCF growth reaching $2.76 billion by 2028, with longer-term projections extending up to $3.82 billion by 2035. The early years of the forecast rely on analyst estimates, while the out-years are extrapolated for a longer view.

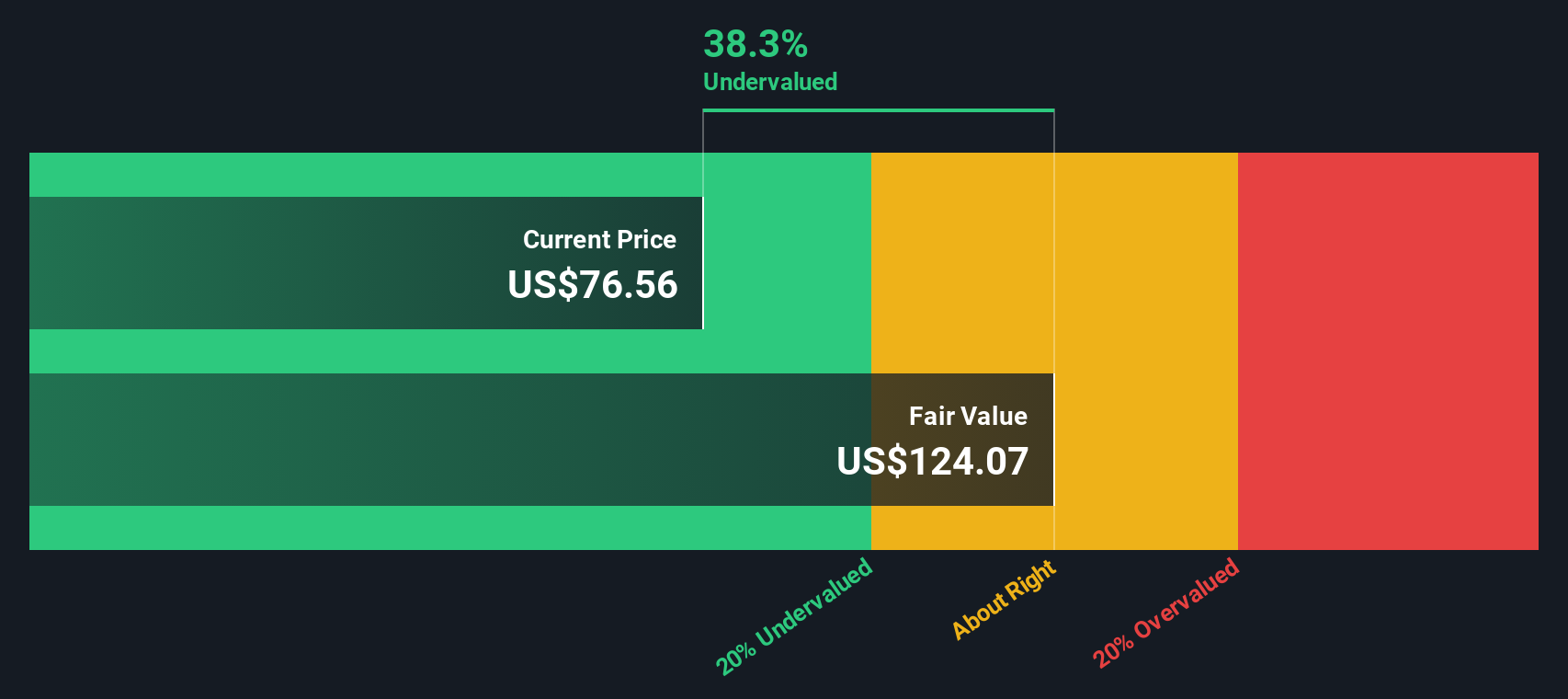

Based on this methodology, the DCF model places the stock’s intrinsic value at $123.61 per share. Compared to the recent share price of $75.13, this suggests that GE HealthCare Technologies is around 39.2% undervalued by the market today.

The clear takeaway is that the market may be pricing in too much caution for GE HealthCare given its solid cash generation outlook.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests GE HealthCare Technologies is undervalued by 39.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: GE HealthCare Technologies Price vs Earnings

For profitable companies like GE HealthCare Technologies, the Price-to-Earnings (PE) ratio is often a go-to yardstick for valuation. This multiple reflects what investors are willing to pay today for a dollar of the company’s earnings and is especially useful when a business consistently generates profits.

Generally, faster growth and lower risk justify a higher PE ratio, while slower growth or more uncertainty usually warrant a lower one. Investors also tend to compare a stock’s PE to industry averages and peers to gauge whether it trades at a premium or a discount.

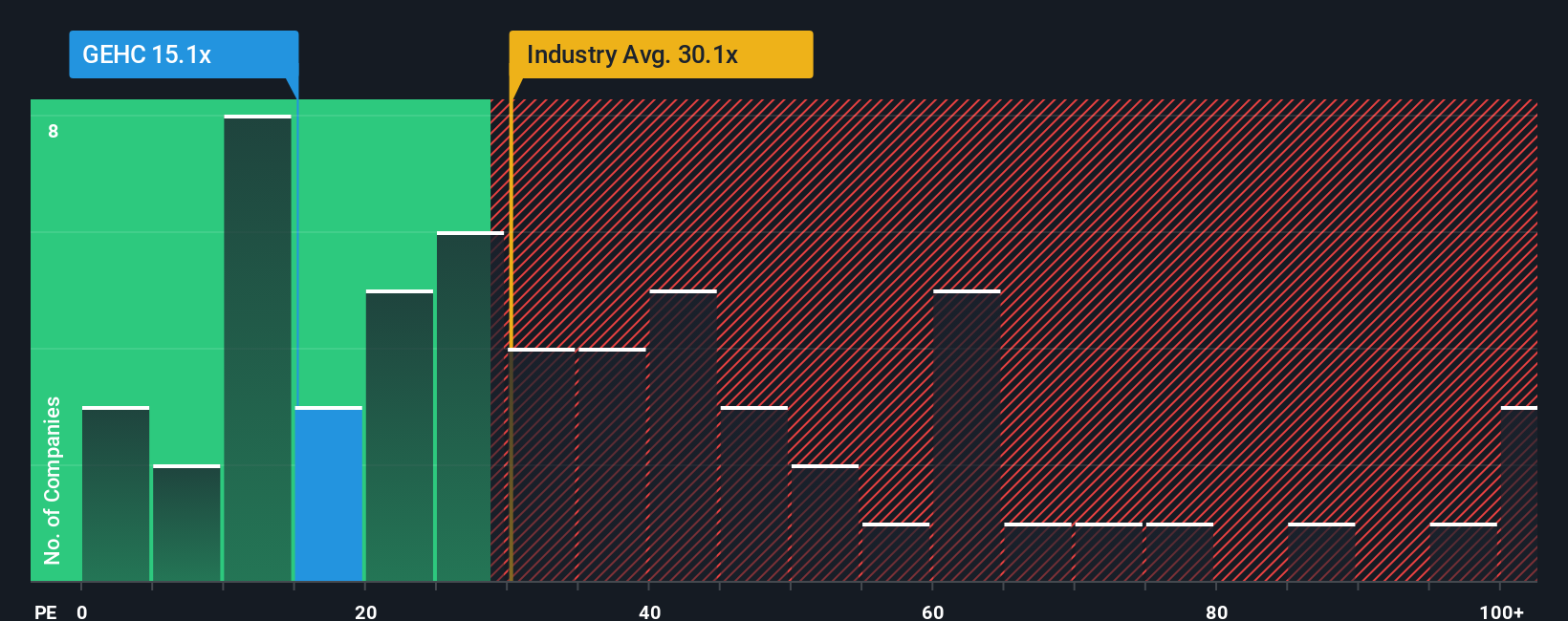

GE HealthCare currently trades at a PE of 15.3x. For context, the average for the Medical Equipment industry sits at 30.5x, while close peers average around 37.2x. At first glance, this suggests the stock is much cheaper than its sector and peer group, possibly reflecting discounted market sentiment or conservatism about future prospects.

However, a more tailored view comes from Simply Wall St’s proprietary "Fair Ratio." This combines factors like earnings growth forecasts, profit margins, industry trends, company size, and risk. GE HealthCare’s Fair PE Ratio is calculated at 24.7x, which gives a more nuanced benchmark than simple peer or industry comparisons.

Because GE HealthCare’s actual PE ratio of 15.3x is well below its Fair Ratio of 24.7x, the shares look undervalued from this angle too.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your GE HealthCare Technologies Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a powerful yet straightforward tool for investors. A Narrative is your story behind the numbers, allowing you to combine your insights about GE HealthCare Technologies' future with your own projections of revenue, earnings, and profit margins.

By tying the company’s story to a financial forecast, Narratives translate your perspective into a clear estimate of fair value. This allows you to see precisely how your views compare to the market price. Narratives are designed to be simple and easy to use, and you can access them right now on the Simply Wall St platform, where millions of investors share their perspectives within the Community page.

This approach helps you decide exactly when to buy or sell by comparing your calculated Fair Value to the current share price. Crucially, these Narratives update automatically whenever important news or earnings updates are released.

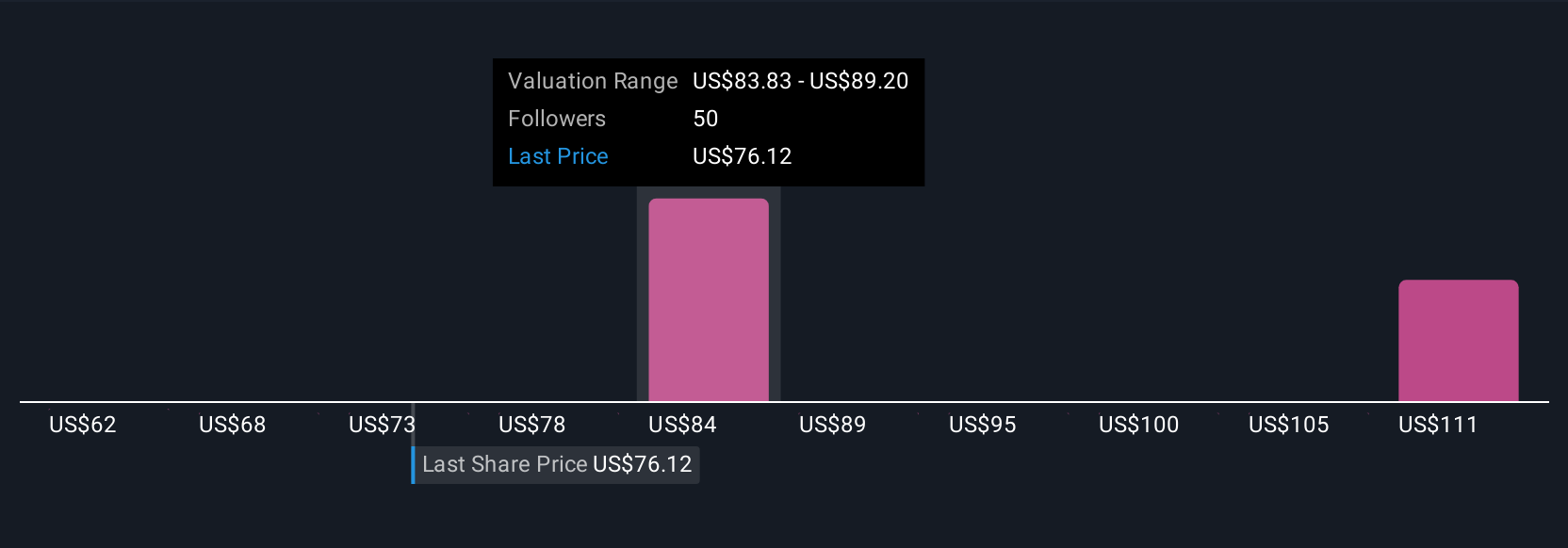

For example, some investors believe GE HealthCare Technologies could be worth as much as $106 if new partnerships and advanced imaging technologies deliver on growth potential. Others put fair value closer to $73 if challenges like global tariffs and regulatory risks weigh on future results.

Do you think there's more to the story for GE HealthCare Technologies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GEHC

GE HealthCare Technologies

Engages in the development, manufacture, and marketing of products, services, and complementary digital solutions used in the diagnosis, treatment, and monitoring of patients in the United States, Canada, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.