- United States

- /

- Healthtech

- /

- NasdaqGS:GDRX

Is GoodRx Poised for a Turnaround After Recent Share Price Rebound in 2025?

Reviewed by Bailey Pemberton

If you have been watching GoodRx Holdings lately, you are probably weighing whether its current price reflects a hidden bargain or just more risk. At $4.39, the stock has certainly traveled a bumpy road. Despite a nice pop of nearly 4% over the last week, and almost 10% across the past month, the longer-term chart remains tough to ignore. Down roughly 37% over the last year and an eye-catching 92% since its five-year high, GoodRx has given investors moments of excitement mixed with plenty of caution.

Much of this wild ride can be traced to broader trends shaping the healthcare tech sector and evolving market sentiment on growth stories. Investors have responded to changing risk perceptions, competition, and shifting regulation that has affected companies like GoodRx. When looking just at the valuation checklist, GoodRx scores a 3 out of 6, indicating it meets half the markers for being undervalued. That is not a slam dunk, but it is enough to grab the attention of anyone looking for value in a market this dynamic.

But are those three green checks enough to call GoodRx a bargain, or do the other half of the tests signal caution? In the next section, I will walk you through the main ways investors value companies like GoodRx and see where it stands on each method. And if you are looking for an even sharper edge, stay tuned for my take on a smarter approach to understanding a stock's true value by the end of this article.

Why GoodRx Holdings is lagging behind its peers

Approach 1: GoodRx Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to today's value. This approach aims to capture both current cash-generating ability and growth expectations, offering a comprehensive view of intrinsic worth.

For GoodRx Holdings, the latest reported Free Cash Flow (FCF) stands at approximately $123.24 million. Analyst forecasts suggest FCF could reach $188.89 million by 2029. While precise FCF estimates from analysts cover the next several years, projections beyond 2029 are extrapolated and indicate continued moderate growth. For example, projected FCF for 2035 is $217.68 million. This reflects a generally positive outlook, but is based on increasingly speculative estimates as projections extend further into the future.

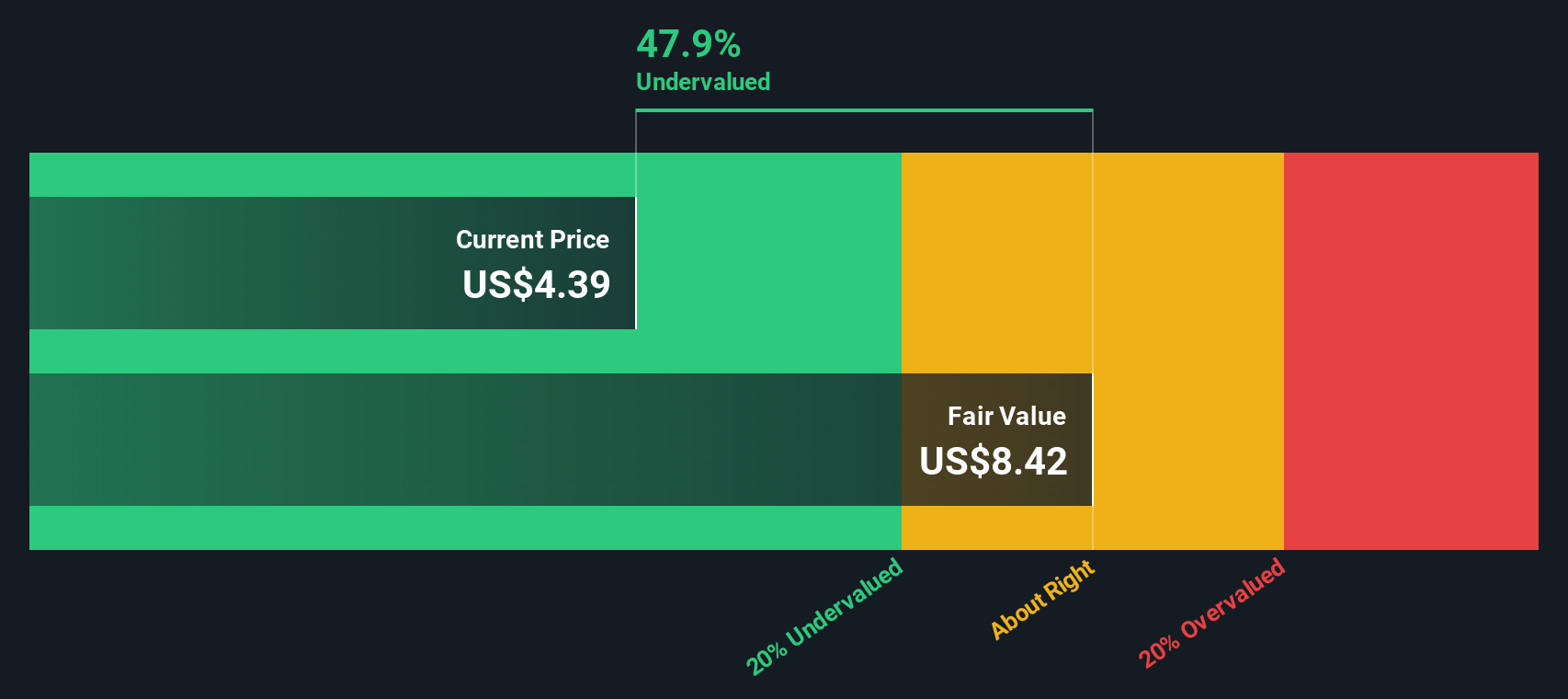

After discounting these future cash flows back to present value using the 2 Stage Free Cash Flow to Equity approach, the DCF model yields an intrinsic value of $8.45 per share. With the current share price at $4.39, GoodRx trades at a notable 48.1% discount to its calculated fair value. According to this model, the stock appears strongly undervalued at present levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests GoodRx Holdings is undervalued by 48.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: GoodRx Holdings Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation measure for profitable companies like GoodRx Holdings. By relating a company’s share price to its earnings, the PE ratio helps investors gauge whether a stock is trading at a reasonable value based on its current profitability. Since GoodRx generates positive earnings, the PE ratio is especially relevant here.

What counts as a "normal" or "fair" PE ratio often depends on expectations for growth and the level of risk attached to a business. Higher growth companies can command a higher PE, while more uncertainty or risk generally justifies a lower multiple. That is why looking at benchmarks is important but never tells the full story on its own.

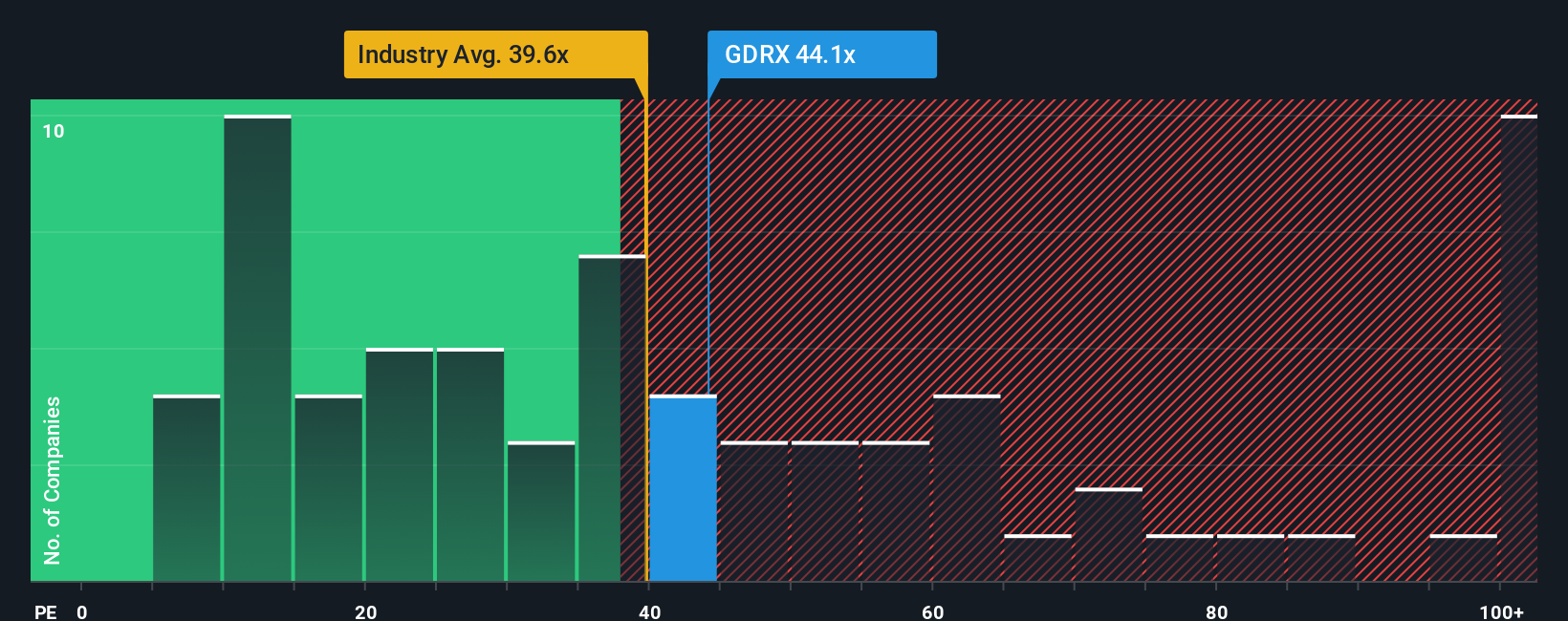

Currently, GoodRx trades at a PE ratio of 44.1x. For context, this is higher than the Healthcare Services industry average of 39.3x and somewhat below the peer average of 60.6x. However, the key metric to focus on is Simply Wall St’s proprietary "Fair Ratio," which in this case is 37.5x. Unlike basic comparisons, the Fair Ratio adjusts for factors such as GoodRx’s earnings quality, growth outlook, profit margin, risk profile, and even its market cap. Because it is tailored to the company’s exact situation, it offers a clearer, more actionable sense of value than broad industry or peer benchmarks.

In this case, GoodRx’s actual PE ratio of 44.1x is moderately higher than its Fair Ratio of 37.5x. That suggests investors are paying a bit of a premium for the stock, likely reflecting hope for accelerated growth or improved profitability in the future. Based on this metric, the stock appears slightly overvalued using the PE approach.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your GoodRx Holdings Narrative

Earlier we mentioned there is an even smarter way to understand value beyond just crunching numbers, so let us introduce you to Narratives. A Narrative is simply your story or your thoughtful perspective about why GoodRx Holdings might be worth more or less than its current price. On the Simply Wall St platform, millions of investors use Narratives on the Community page to combine their view of the company’s future (like revenue, earnings, and profit margins) with their fair value estimate, so the numbers are no longer isolated from the underlying business story.

Narratives make investing accessible and engaging by letting you connect your assumptions. For example, you may consider how fast you believe GoodRx can grow or how new product launches could impact margins. These factors combine with a dynamic fair value and actionable buy or sell signals. As soon as key news or earnings are released, Narratives update in real time, so your outlook always reflects the most recent information.

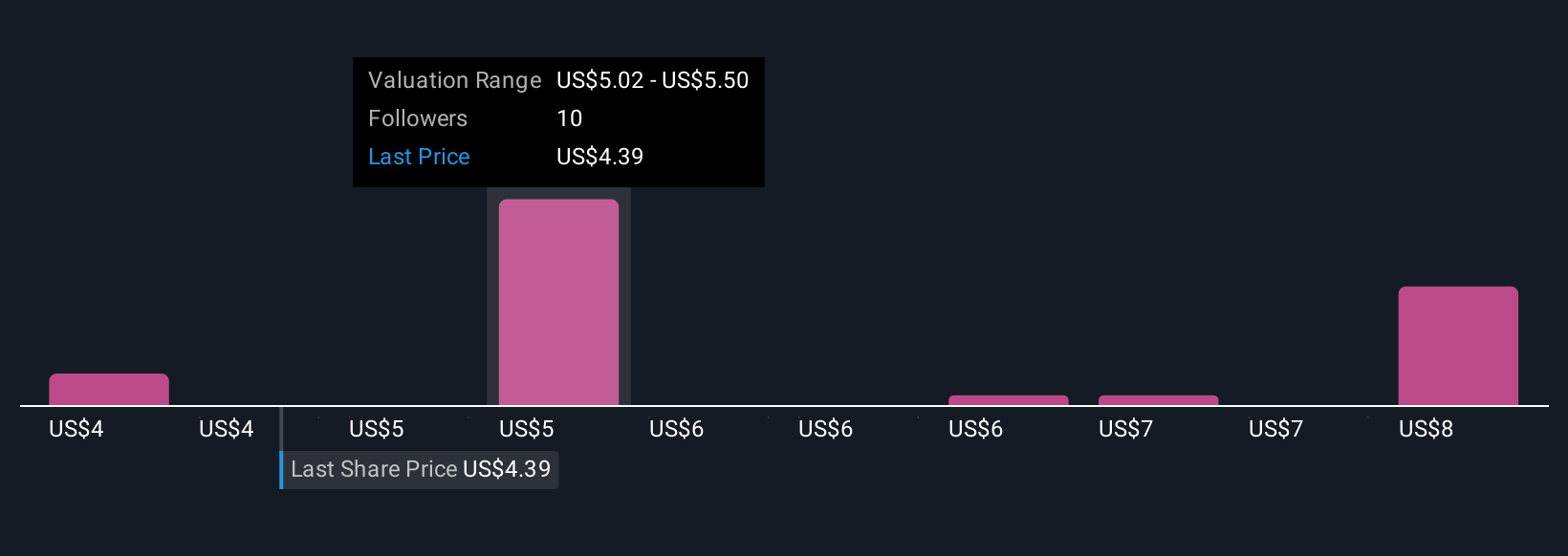

For GoodRx Holdings, one investor may set a bullish Narrative, expecting a price target of $7.00 based on rapid expansion in digital health. Another investor, feeling more cautious about new competitors, may use a Narrative to support a price target of $3.40. Comparing your Narrative and its fair value to the actual share price provides clear guidance for your next move, keeping you focused on your view of the business and not just market mood swings.

Do you think there's more to the story for GoodRx Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GDRX

GoodRx Holdings

Offers information and tools that enable consumers to compare prices and save on their prescription drug purchases in the United States.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)