- United States

- /

- Healthtech

- /

- NasdaqGS:GDRX

GoodRx Holdings, Inc. (NASDAQ:GDRX) Stock Rockets 26% As Investors Are Less Pessimistic Than Expected

The GoodRx Holdings, Inc. (NASDAQ:GDRX) share price has done very well over the last month, posting an excellent gain of 26%. Looking back a bit further, it's encouraging to see the stock is up 36% in the last year.

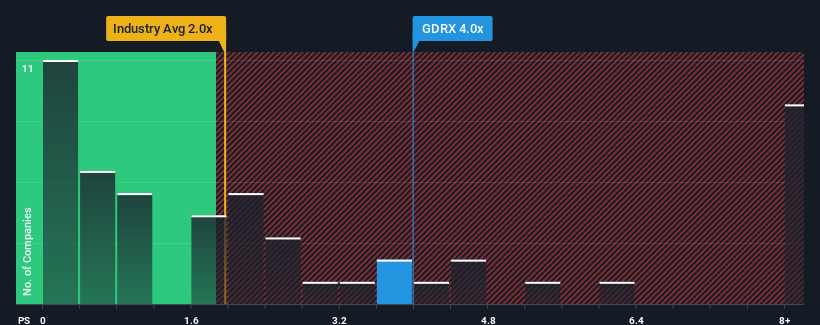

Following the firm bounce in price, you could be forgiven for thinking GoodRx Holdings is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 4x, considering almost half the companies in the United States' Healthcare Services industry have P/S ratios below 2x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for GoodRx Holdings

What Does GoodRx Holdings' Recent Performance Look Like?

GoodRx Holdings hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think GoodRx Holdings' future stacks up against the industry? In that case, our free report is a great place to start.How Is GoodRx Holdings' Revenue Growth Trending?

GoodRx Holdings' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 2.1%. Still, the latest three year period has seen an excellent 36% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 7.9% each year as estimated by the analysts watching the company. With the industry predicted to deliver 13% growth each year, the company is positioned for a weaker revenue result.

In light of this, it's alarming that GoodRx Holdings' P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On GoodRx Holdings' P/S

GoodRx Holdings' P/S has grown nicely over the last month thanks to a handy boost in the share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've concluded that GoodRx Holdings currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. At these price levels, investors should remain cautious, particularly if things don't improve.

Having said that, be aware GoodRx Holdings is showing 1 warning sign in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:GDRX

GoodRx Holdings

Offers information and tools that enable consumers to compare prices and save on their prescription drug purchases in the United States.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives