- United States

- /

- Healthtech

- /

- NasdaqGS:GDRX

GoodRx Holdings And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

As the U.S. stock market continues its upward trajectory, with major indexes marking their biggest weekly rise since June, investors are increasingly exploring diverse opportunities to capitalize on this momentum. Penny stocks, a term that may seem outdated yet remains significant, represent smaller or newer companies that can potentially offer substantial returns when they are built on solid financial foundations. In this article, we will explore three penny stocks that exhibit strong balance sheets and potential for growth, presenting intriguing options for investors looking to uncover hidden value in today's market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.76 | $375.03M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.745 | $614.83M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.8508 | $146.26M | ✅ 4 ⚠️ 2 View Analysis > |

| LexinFintech Holdings (LX) | $3.42 | $636.04M | ✅ 4 ⚠️ 2 View Analysis > |

| Puma Biotechnology (PBYI) | $4.95 | $250.95M | ✅ 3 ⚠️ 3 View Analysis > |

| Performance Shipping (PSHG) | $1.99 | $27.72M | ✅ 4 ⚠️ 2 View Analysis > |

| CI&T (CINT) | $4.44 | $580.28M | ✅ 5 ⚠️ 0 View Analysis > |

| Cricut (CRCT) | $4.85 | $1.02B | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.8112 | $6.08M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.62 | $82.24M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 353 stocks from our US Penny Stocks screener.

Let's review some notable picks from our screened stocks.

GoodRx Holdings (GDRX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GoodRx Holdings, Inc. provides tools and information to help consumers in the United States compare prices and save on prescription drugs, with a market cap of approximately $953.81 million.

Operations: The company's revenue primarily comes from its Healthcare Software segment, which generated $800.65 million.

Market Cap: $953.81M

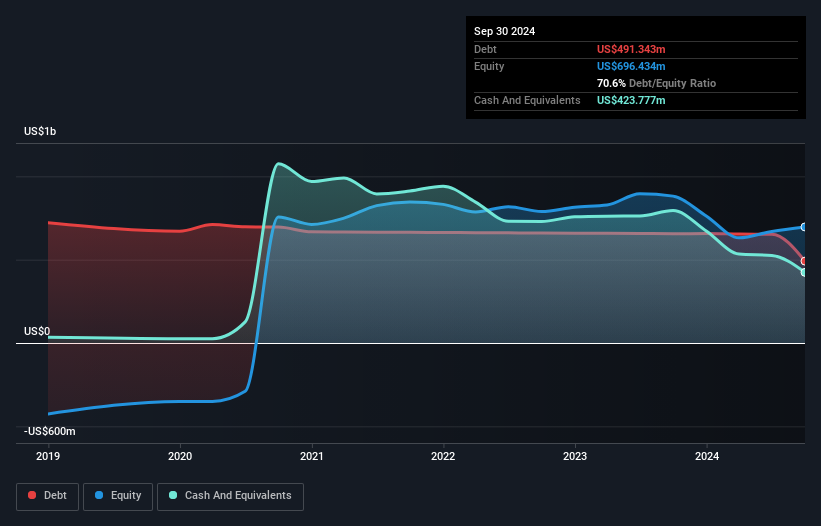

GoodRx Holdings, Inc. has demonstrated financial resilience with its short-term assets exceeding both short and long-term liabilities, and its interest payments well covered by EBIT. The company recently reported third-quarter sales of US$196.03 million with a net income of US$1.12 million, reflecting profitability growth over the past year despite a significant one-off loss impacting results. GoodRx's strategic initiatives include expanding its RxSmartSaver program to Kroger pharmacies and offering reduced prices for medications like Repatha®. Although trading below estimated fair value, GoodRx's management team is experienced, with stable weekly volatility observed in the stock performance.

- Dive into the specifics of GoodRx Holdings here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into GoodRx Holdings' future.

Taboola.com (TBLA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Taboola.com Ltd. operates an artificial intelligence-based algorithmic engine platform across various countries, including Israel, the United States, and the United Kingdom, with a market cap of approximately $1.14 billion.

Operations: The company generates revenue of $1.88 billion from its advertising segment.

Market Cap: $1.14B

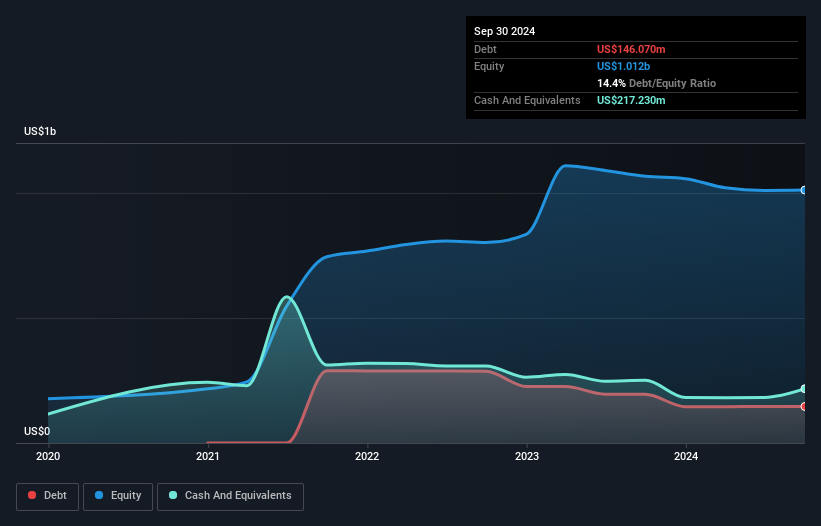

Taboola.com Ltd. has transitioned to profitability, with its recent third-quarter earnings showing US$496.76 million in sales and a net income of US$5.24 million, compared to a loss the previous year. The company's debt is well-managed, with operating cash flow covering it by 284.7%, and short-term assets exceeding liabilities by US$25.9 million. Recent strategic moves include the launch of DeeperDive, an AI-powered answer engine enhancing reader engagement and creating new ad revenue streams for publishers like BuzzFeed Asia and India Today Group. Taboola's innovative partnerships continue to position it competitively in the digital landscape.

- Click to explore a detailed breakdown of our findings in Taboola.com's financial health report.

- Explore Taboola.com's analyst forecasts in our growth report.

Riskified (RSKD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Riskified Ltd. develops and provides an e-commerce risk intelligence platform for online merchants across various global regions, with a market cap of approximately $732.04 million.

Operations: The company's revenue is generated entirely from its Security Software & Services segment, amounting to $338.84 million.

Market Cap: $732.04M

Riskified Ltd. operates with a market cap of approximately US$732.04 million, generating revenue exclusively from its Security Software & Services segment, reaching US$338.84 million in 2025. Despite being unprofitable with a negative return on equity of -11.83%, the company has reduced losses over the past five years by 21.7% annually and maintains a cash runway exceeding three years due to positive free cash flow growth at 43.9% per year. Recent earnings guidance projects revenue between US$338 million and US$346 million for 2025, while recent buybacks have reduced outstanding shares by 9.36%.

- Unlock comprehensive insights into our analysis of Riskified stock in this financial health report.

- Gain insights into Riskified's outlook and expected performance with our report on the company's earnings estimates.

Turning Ideas Into Actions

- Click here to access our complete index of 353 US Penny Stocks.

- Ready For A Different Approach? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GDRX

GoodRx Holdings

Offers information and tools that enable consumers to compare prices and save on their prescription drug purchases in the United States.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success