- United States

- /

- Medical Equipment

- /

- NasdaqCM:FEMY

Health Check: How Prudently Does Femasys (NASDAQ:FEMY) Use Debt?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Femasys Inc. (NASDAQ:FEMY) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Femasys

What Is Femasys's Net Debt?

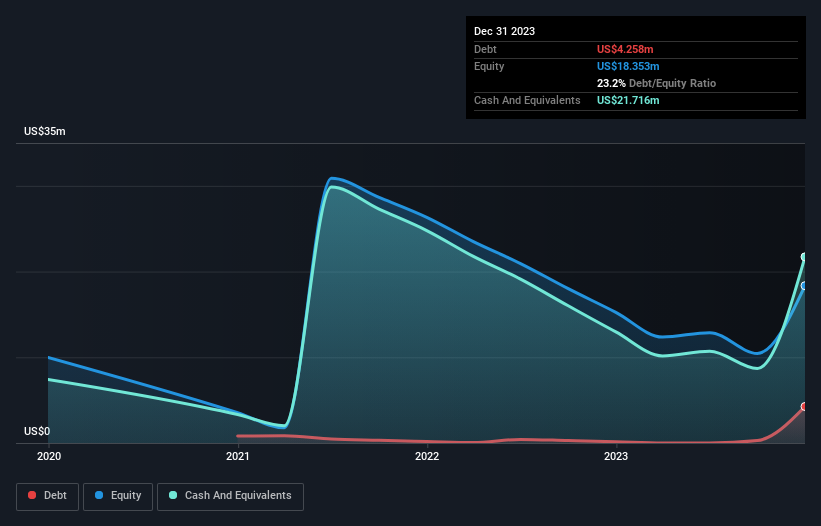

The image below, which you can click on for greater detail, shows that at December 2023 Femasys had debt of US$4.26m, up from US$141.3k in one year. But it also has US$21.7m in cash to offset that, meaning it has US$17.5m net cash.

How Healthy Is Femasys' Balance Sheet?

The latest balance sheet data shows that Femasys had liabilities of US$3.05m due within a year, and liabilities of US$6.35m falling due after that. Offsetting this, it had US$21.7m in cash and US$322.9k in receivables that were due within 12 months. So it actually has US$12.6m more liquid assets than total liabilities.

This surplus liquidity suggests that Femasys' balance sheet could take a hit just as well as Homer Simpson's head can take a punch. On this view, lenders should feel as safe as the beloved of a black-belt karate master. Succinctly put, Femasys boasts net cash, so it's fair to say it does not have a heavy debt load! There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Femasys's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Over 12 months, Femasys made a loss at the EBIT level, and saw its revenue drop to US$1.1m, which is a fall of 11%. We would much prefer see growth.

So How Risky Is Femasys?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And we do note that Femasys had an earnings before interest and tax (EBIT) loss, over the last year. And over the same period it saw negative free cash outflow of US$11m and booked a US$14m accounting loss. However, it has net cash of US$17.5m, so it has a bit of time before it will need more capital. Overall, its balance sheet doesn't seem overly risky, at the moment, but we're always cautious until we see the positive free cash flow. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. We've identified 5 warning signs with Femasys (at least 2 which shouldn't be ignored) , and understanding them should be part of your investment process.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:FEMY

Femasys

A biomedical company, develops therapeutic and diagnostic solutions to address unmet women healthcare needs in the United States and internationally.

Moderate risk with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026