- United States

- /

- Medical Equipment

- /

- NasdaqCM:ESTA

The Price Is Right For Establishment Labs Holdings Inc. (NASDAQ:ESTA) Even After Diving 26%

Establishment Labs Holdings Inc. (NASDAQ:ESTA) shares have had a horrible month, losing 26% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 39% in that time.

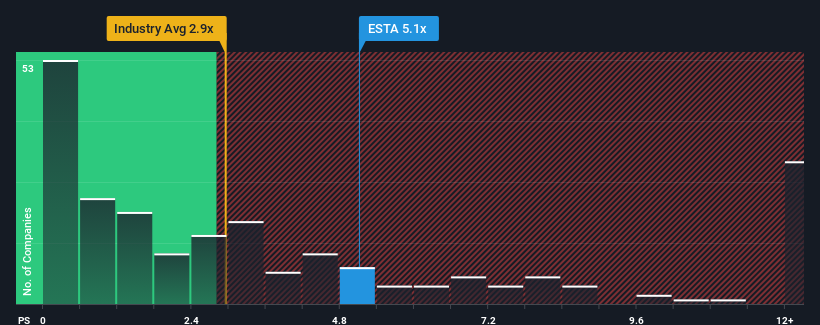

In spite of the heavy fall in price, when almost half of the companies in the United States' Medical Equipment industry have price-to-sales ratios (or "P/S") below 2.9x, you may still consider Establishment Labs Holdings as a stock not worth researching with its 5.1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Our free stock report includes 1 warning sign investors should be aware of before investing in Establishment Labs Holdings. Read for free now.View our latest analysis for Establishment Labs Holdings

What Does Establishment Labs Holdings' Recent Performance Look Like?

Establishment Labs Holdings could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. If not, then existing shareholders may be very nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Establishment Labs Holdings.How Is Establishment Labs Holdings' Revenue Growth Trending?

Establishment Labs Holdings' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Although pleasingly revenue has lifted 31% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 26% per year over the next three years. That's shaping up to be materially higher than the 9.4% per annum growth forecast for the broader industry.

With this in mind, it's not hard to understand why Establishment Labs Holdings' P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Establishment Labs Holdings' P/S Mean For Investors?

A significant share price dive has done very little to deflate Establishment Labs Holdings' very lofty P/S. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into Establishment Labs Holdings shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

It is also worth noting that we have found 1 warning sign for Establishment Labs Holdings that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Establishment Labs Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:ESTA

Establishment Labs Holdings

A medical technology company, manufactures and markets medical devices for aesthetic and reconstructive plastic surgeries.

High growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives