- United States

- /

- Medical Equipment

- /

- NasdaqCM:ESTA

Establishment Labs (ESTA) Up 21.4% After Mia Femtech Study Shows Low Complication Rates—Is Growth Accelerating?

Reviewed by Sasha Jovanovic

- Earlier this month, Establishment Labs Holdings Inc. announced the publication of a three-year prospective study in the Aesthetic Surgery Journal demonstrating very low complication and reoperation rates for its Mia Femtech platform among 100 patients.

- The study reported high patient and surgeon satisfaction with no cases of major complications or implant ruptures, highlighting the platform's safety and effectiveness profile through robust clinical follow-up.

- We’ll explore how these clinically validated results may strengthen Establishment Labs Holdings' growth narrative by supporting broader surgeon and patient adoption.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Establishment Labs Holdings Investment Narrative Recap

To be a shareholder in Establishment Labs Holdings, you need to believe in the company’s ability to turn leading product safety and patient satisfaction into real commercial momentum, especially as differentiated solutions like Mia Femtech gain medical community recognition. The recent three-year safety study meaningfully reinforces the company’s biggest short-term catalyst, broader U.S. and international adoption, but does not eliminate immediate risks, such as sustained high spending and working capital needs, that could impact consistent profitability.

Among recent events, the October FDA approval of Motiva SmoothSilk implants stands out as highly relevant to this clinical milestone, since it clears the path for matched clinical and regulatory progress. Together, these developments could accelerate U.S. and global surgeon adoption, though market conditions and cost controls will remain critical focus areas.

However, investors should also note that faced with rising expenses and ongoing cash needs, management’s ability to…

Read the full narrative on Establishment Labs Holdings (it's free!)

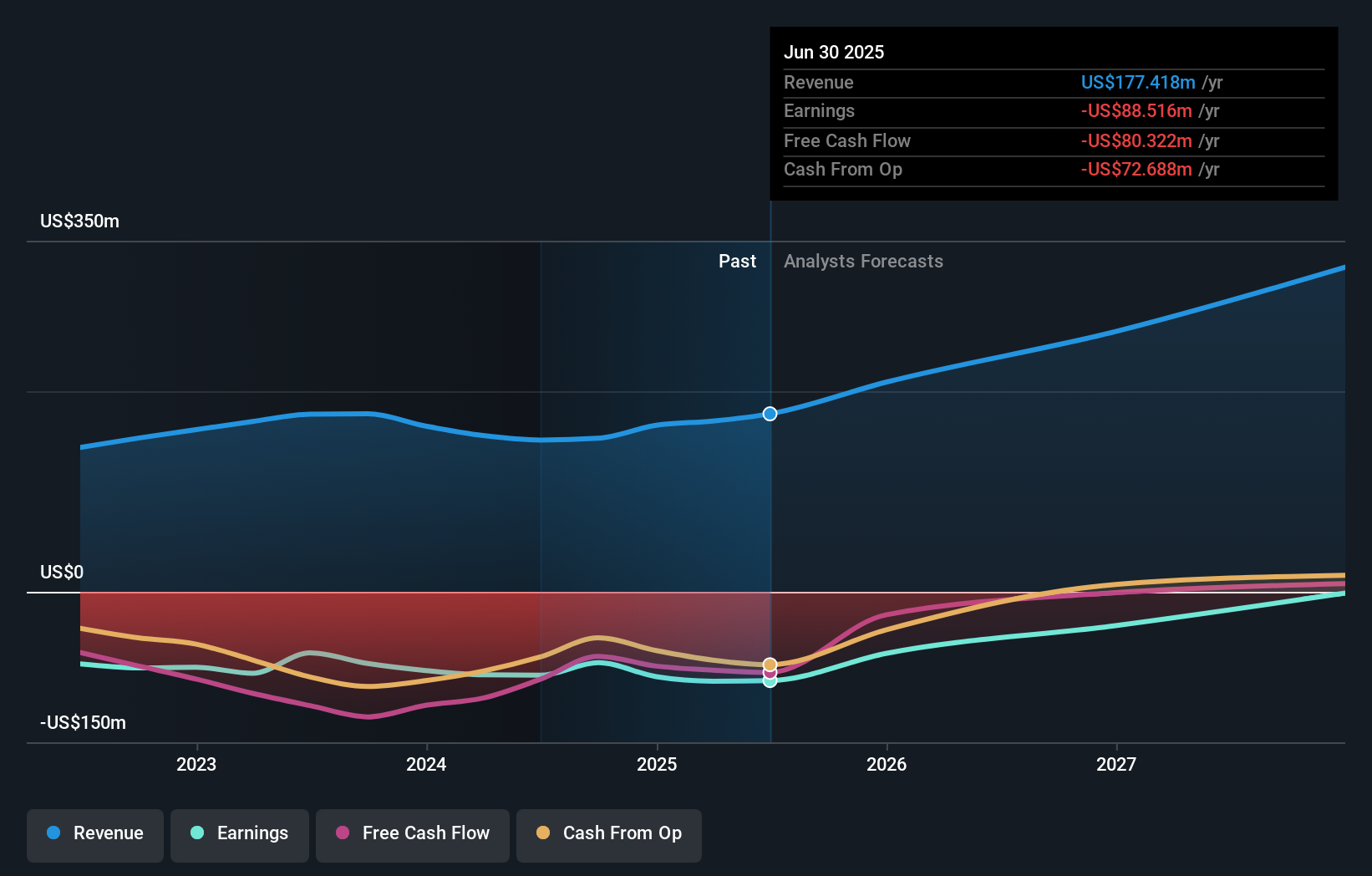

Establishment Labs Holdings is projected to reach $381.9 million in revenue and $27.5 million in earnings by 2028. This outlook is based on an assumed 29.1% annual revenue growth rate and a $116 million increase in earnings from the current level of -$88.5 million.

Uncover how Establishment Labs Holdings' forecasts yield a $55.44 fair value, a 17% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community submitted three fair value estimates for Establishment Labs Holdings, ranging from US$31.67 to over US$1,791,022. With such a wide spread of opinions, keep in mind that high working capital demands and near-term spending pressures remain key topics that could shape future cash flow and growth. Explore the full set of perspectives to better understand differing outlooks.

Explore 3 other fair value estimates on Establishment Labs Holdings - why the stock might be worth 33% less than the current price!

Build Your Own Establishment Labs Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Establishment Labs Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Establishment Labs Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Establishment Labs Holdings' overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Establishment Labs Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ESTA

Establishment Labs Holdings

A medical technology company, manufactures and markets medical devices for aesthetic and reconstructive plastic surgeries.

High growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives