- United States

- /

- Medical Equipment

- /

- NasdaqCM:ESTA

Does Establishment Labs’ (ESTA) Increased Liquidity Access Signal a Shift in Risk Management Strategy?

Reviewed by Sasha Jovanovic

- On September 29, 2025, Establishment Labs Holdings Inc. amended its credit agreement with Oaktree Fund Administration, unlocking immediate access to a new US$25 million Tranche D Term Loan and raising the required minimum liquidity from US$25 million to US$30 million.

- This adjustment boosts Establishment Labs' financial flexibility and could support operational initiatives by removing a previous revenue threshold for loan availability.

- We'll explore how this increased liquidity requirement and immediate loan access could influence Establishment Labs' investment outlook and risk profile.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Establishment Labs Holdings Investment Narrative Recap

Shareholders in Establishment Labs Holdings Inc. are typically drawn to its ambitions for global expansion and leadership in breast aesthetics, particularly through innovative products and growing patient adoption in the U.S. The recent amendment to its credit agreement, unlocking a US$25 million term loan and raising minimum liquidity requirements, strengthens short-term financial flexibility, but does not directly address the most pressing risk: sustained high expenses and ongoing unprofitability, which continue to challenge the path to consistent positive earnings.

Of the recent company announcements, the Q2 2025 earnings release remains most relevant. The report highlighted rising sales to US$51.3 million year-on-year, but also persistent net losses. While stronger liquidity from the new loan may help fund ongoing operational initiatives, its impact is limited if cost pressures are not addressed, especially as margins and profitability are under scrutiny for the company’s near-term outlook.

By contrast, investors should remain aware that higher liquidity requirements can signal concerns around future cash burn, which…

Read the full narrative on Establishment Labs Holdings (it's free!)

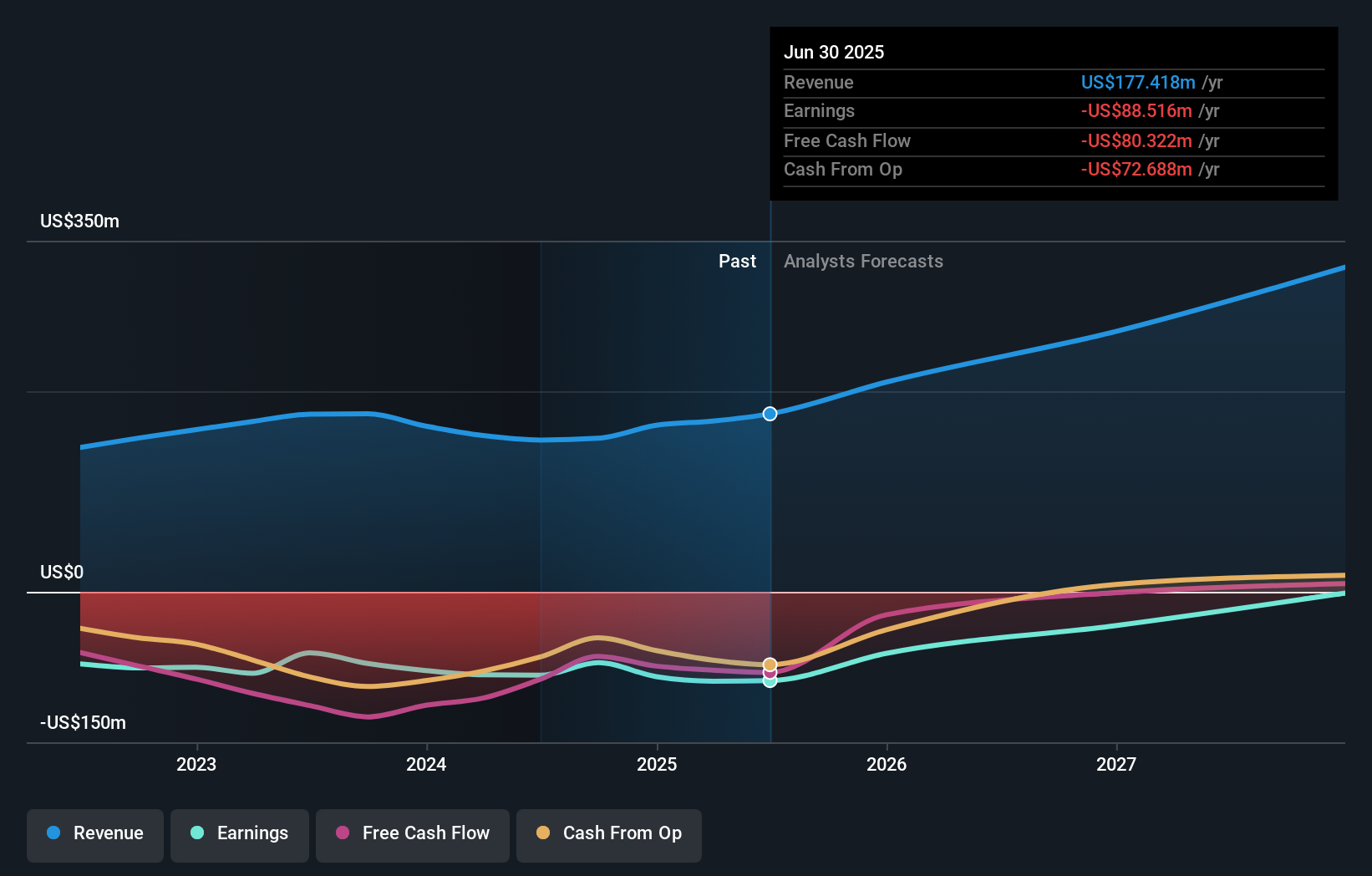

Establishment Labs Holdings is projected to achieve $381.9 million in revenue and $27.5 million in earnings by 2028. This outlook depends on a 29.1% annual revenue growth rate and a $116 million increase in earnings from the current level of -$88.5 million.

Uncover how Establishment Labs Holdings' forecasts yield a $55.44 fair value, a 34% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members set fair value estimates for Establishment Labs Holdings ranging from US$13.54 to over US$1,791,022.96 across 3 unique viewpoints. With ongoing net losses and liquidity challenges highlighted in recent news, consider how such differing perspectives shape market expectations for future performance.

Explore 3 other fair value estimates on Establishment Labs Holdings - why the stock might be a potential multi-bagger!

Build Your Own Establishment Labs Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Establishment Labs Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Establishment Labs Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Establishment Labs Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Establishment Labs Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ESTA

Establishment Labs Holdings

A medical technology company, manufactures and markets medical devices for aesthetic and reconstructive plastic surgeries.

High growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives