- United States

- /

- Medical Equipment

- /

- NasdaqCM:EKSO

Not Many Are Piling Into Ekso Bionics Holdings, Inc. (NASDAQ:EKSO) Stock Yet As It Plummets 31%

Unfortunately for some shareholders, the Ekso Bionics Holdings, Inc. (NASDAQ:EKSO) share price has dived 31% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 82% share price decline.

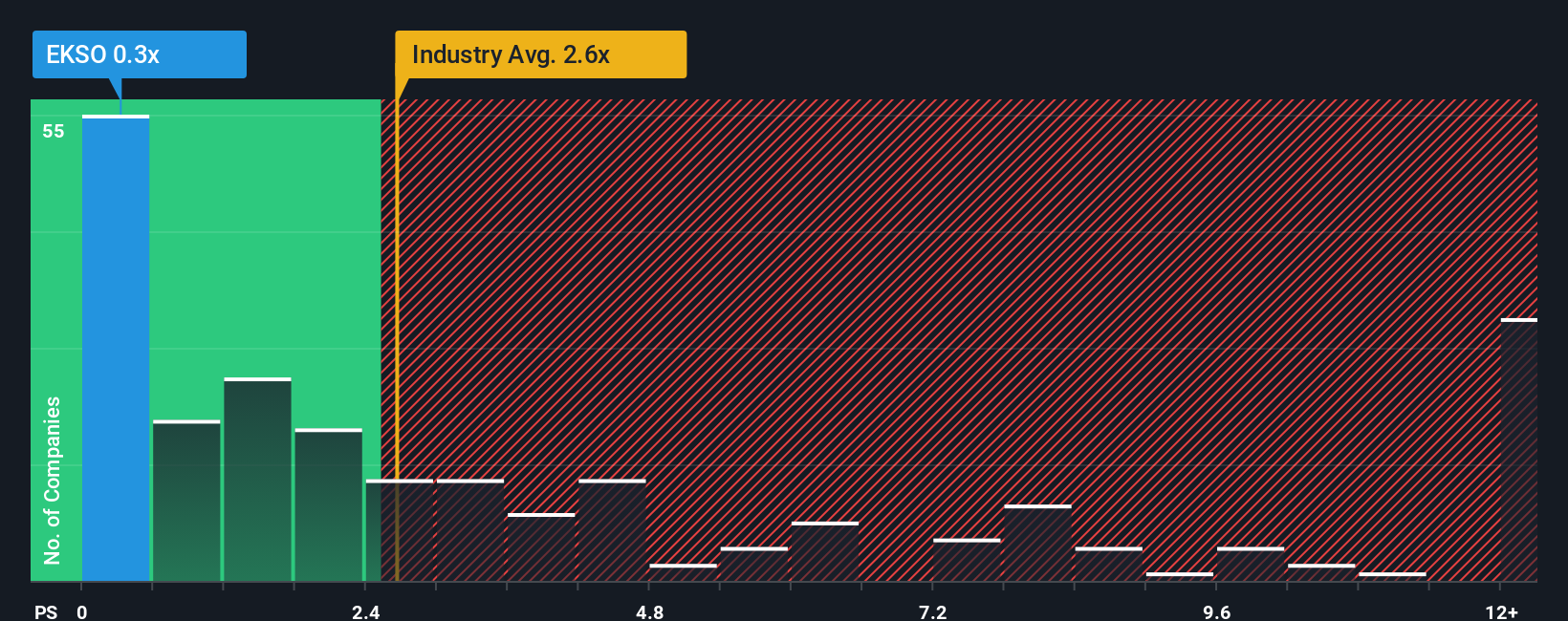

Since its price has dipped substantially, Ekso Bionics Holdings may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.3x, since almost half of all companies in the Medical Equipment industry in the United States have P/S ratios greater than 2.6x and even P/S higher than 7x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for Ekso Bionics Holdings

How Has Ekso Bionics Holdings Performed Recently?

While the industry has experienced revenue growth lately, Ekso Bionics Holdings' revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Ekso Bionics Holdings will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Ekso Bionics Holdings would need to produce anemic growth that's substantially trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 2.1%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 47% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 21% each year during the coming three years according to the dual analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 10% each year, which is noticeably less attractive.

With this in consideration, we find it intriguing that Ekso Bionics Holdings' P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Shares in Ekso Bionics Holdings have plummeted and its P/S has followed suit. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

A look at Ekso Bionics Holdings' revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Having said that, be aware Ekso Bionics Holdings is showing 5 warning signs in our investment analysis, and 3 of those are a bit concerning.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Ekso Bionics Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:EKSO

Ekso Bionics Holdings

Designs, develops, sells, and rents exoskeleton products in the Americas, Germany, Europe, the Middle East, Africa, the Asia Pacific, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026