- United States

- /

- Medical Equipment

- /

- NasdaqGM:EDAP

Analysts Are Betting On EDAP TMS S.A. (NASDAQ:EDAP) With A Big Upgrade This Week

Celebrations may be in order for EDAP TMS S.A. (NASDAQ:EDAP) shareholders, with the analysts delivering a significant upgrade to their statutory estimates for the company. The revenue forecast for next year has experienced a facelift, with analysts now much more optimistic on its sales pipeline. Investors have been pretty optimistic on EDAP TMS too, with the stock up 20% to US$8.03 over the past week. It will be interesting to see if today's upgrade is enough to propel the stock even higher.

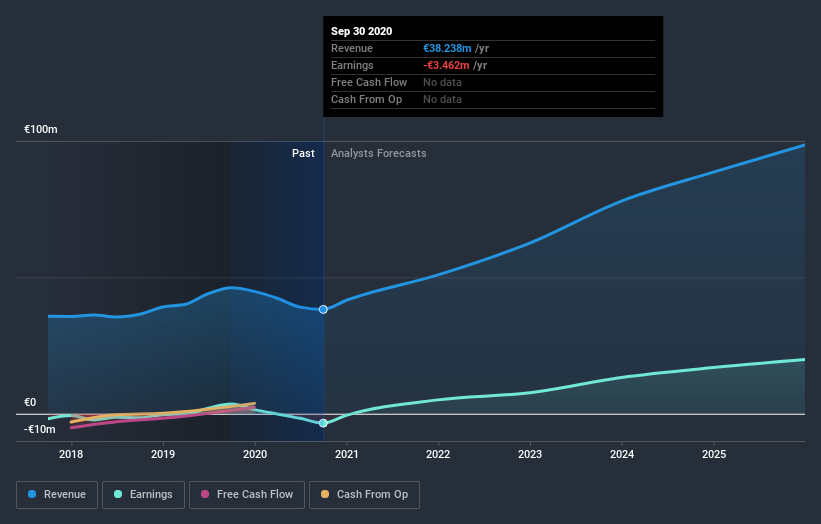

After this upgrade, EDAP TMS' dual analysts are now forecasting revenues of €51m in 2021. This would be a sizeable 33% improvement in sales compared to the last 12 months. Prior to the latest estimates, the analysts were forecasting revenues of €46m in 2021. It looks like there's been a clear increase in optimism around EDAP TMS, given the solid increase in revenue forecasts.

View our latest analysis for EDAP TMS

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. The analysts are definitely expecting EDAP TMS' growth to accelerate, with the forecast 33% growth ranking favourably alongside historical growth of 6.0% per annum over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 9.8% per year. Factoring in the forecast acceleration in revenue, it's pretty clear that EDAP TMS is expected to grow much faster than its industry.

The Bottom Line

The highlight for us was that analysts increased their revenue forecasts for EDAP TMS next year. The analysts also expect revenues to grow faster than the wider market. Given that analysts appear to be expecting substantial improvement in the sales pipeline, now could be the right time to take another look at EDAP TMS.

Unanswered questions? At least one of EDAP TMS' dual analysts has provided estimates out to 2025, which can be seen for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you decide to trade EDAP TMS, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade EDAP TMS, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if EDAP TMS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:EDAP

EDAP TMS

Develops, produces, markets, distributes, and maintains a portfolio of minimally invasive medical devices for the treatment of urological diseases in Asia, France, the United States, and internationally.

Flawless balance sheet and slightly overvalued.