- United States

- /

- Medical Equipment

- /

- NasdaqGS:DXCM

DexCom (NasdaqGS:DXCM) Announces US$750M Buyback and Reiterates 2025 Earnings Guidance

Reviewed by Simply Wall St

DexCom (NasdaqGS:DXCM) recently announced a $750 million share buyback program and reaffirmed its revenue growth guidance of 14% for 2025, coinciding with its earnings report for the first quarter showing increased sales but decreased net income. In the past month, the company's share price saw a 4% rise, bolstered by broader market gains, as the S&P 500 extended a notable winning streak and investor sentiment was uplifted by strong employment data. Despite fluctuations due to Dexcom's mixed earnings results, the stock's movement is largely in tandem with market optimism toward technology stocks.

Every company has risks, and we've spotted 1 possible red flag for DexCom you should know about.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent announcement of a US$750 million share buyback program by DexCom comes amid efforts to support its share price stability. The company's reaffirmed revenue growth guidance of 14% for 2025 aligns with expectations of expanding their customer base through new CGM product launches and global expansion efforts. Although DexCom's short-term share price rose 4% in the past month, its total return over the longer three-year period was a 25.90% decline. This performance highlights the challenges the company has faced as it aims to regain investor confidence and catch up with broader market or industry gains.

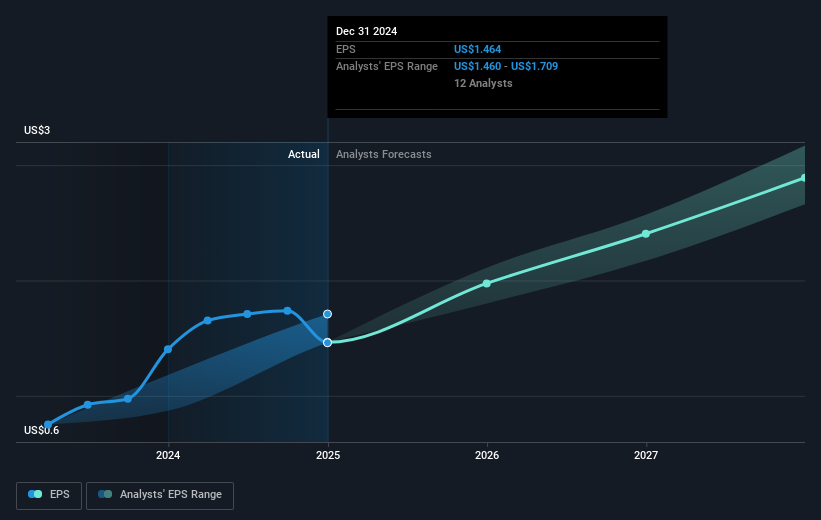

Despite DexCom's existing stock movement, analysts' consensus price target of US$99.13 suggests potential upside from the current US$71.30 share price. However, any prospective rise will depend on the fulfillment of revenue and earnings projections. Analysts anticipate revenue to eventually reach US$6.10 billion, with earnings set to rise to US$1.2 billion by 2028. This growth outlook, supported by international market success and improved product offerings, will hinge on overcoming existing margin and operational hurdles. Investors should weigh these forecasts against the company's ability to execute its expansion plans and maintain stable growth amid industry and market dynamics.

The valuation report we've compiled suggests that DexCom's current price could be quite moderate.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade DexCom, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DXCM

DexCom

A medical device company, focuses on the design, development, and commercialization of continuous glucose monitoring (CGM) systems in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives