- United States

- /

- Healthtech

- /

- NasdaqCM:DRIO

DarioHealth Corp. (NASDAQ:DRIO) Screens Well But There Might Be A Catch

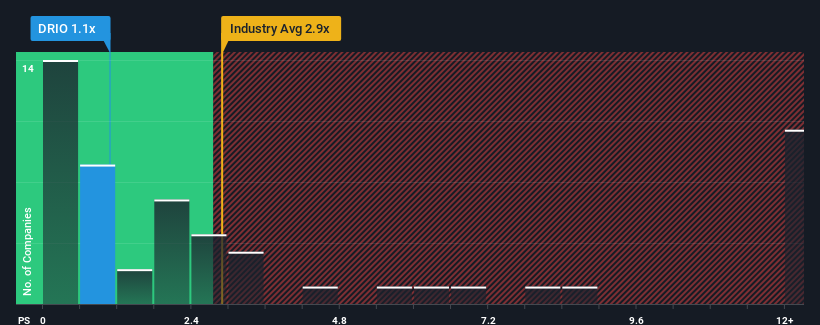

DarioHealth Corp.'s (NASDAQ:DRIO) price-to-sales (or "P/S") ratio of 1.1x might make it look like a buy right now compared to the Healthcare Services industry in the United States, where around half of the companies have P/S ratios above 2.9x and even P/S above 9x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for DarioHealth

What Does DarioHealth's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, DarioHealth has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on DarioHealth will help you uncover what's on the horizon.How Is DarioHealth's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like DarioHealth's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 33% gain to the company's top line. Pleasingly, revenue has also lifted 32% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 22% per year during the coming three years according to the three analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 11% each year, which is noticeably less attractive.

With this information, we find it odd that DarioHealth is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

A look at DarioHealth's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

You need to take note of risks, for example - DarioHealth has 4 warning signs (and 1 which is concerning) we think you should know about.

If you're unsure about the strength of DarioHealth's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:DRIO

DarioHealth

Operates as a digital health company in the United States, Canada, the European Union, Australia, and New Zealand.

Moderate risk and fair value.

Similar Companies

Market Insights

Community Narratives