- United States

- /

- Medical Equipment

- /

- NasdaqCM:CTSO

Take Care Before Jumping Onto Cytosorbents Corporation (NASDAQ:CTSO) Even Though It's 28% Cheaper

Unfortunately for some shareholders, the Cytosorbents Corporation (NASDAQ:CTSO) share price has dived 28% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 54% share price decline.

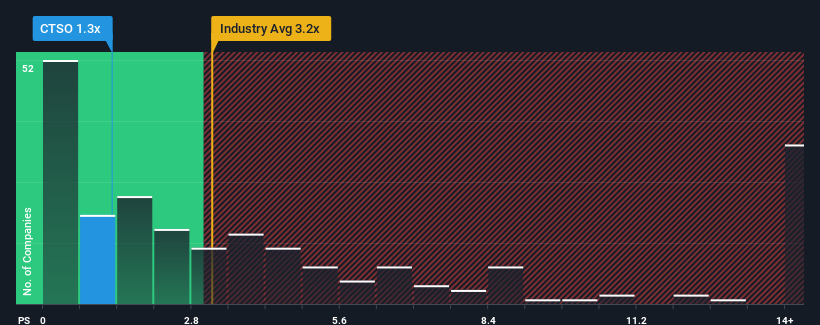

Following the heavy fall in price, Cytosorbents may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.3x, since almost half of all companies in the Medical Equipment industry in the United States have P/S ratios greater than 3.2x and even P/S higher than 8x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Cytosorbents

What Does Cytosorbents' Recent Performance Look Like?

Recent times haven't been great for Cytosorbents as its revenue has been rising slower than most other companies. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Cytosorbents' future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Cytosorbents?

The only time you'd be truly comfortable seeing a P/S as low as Cytosorbents' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a decent 2.7% gain to the company's revenues. However, due to its less than impressive performance prior to this period, revenue growth is practically non-existent over the last three years overall. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 13% per annum during the coming three years according to the five analysts following the company. That's shaping up to be materially higher than the 9.8% per year growth forecast for the broader industry.

With this information, we find it odd that Cytosorbents is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Cytosorbents' P/S

Cytosorbents' recently weak share price has pulled its P/S back below other Medical Equipment companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

To us, it seems Cytosorbents currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Cytosorbents (of which 1 can't be ignored!) you should know about.

If these risks are making you reconsider your opinion on Cytosorbents, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CTSO

Cytosorbents

Engages in the research, development, and commercialization of medical devices with its blood purification technology platform incorporating a proprietary adsorbent and porous polymer technology in the United States, Germany, and internationally.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives