- United States

- /

- Medical Equipment

- /

- NasdaqCM:CTSO

Further Upside For Cytosorbents Corporation (NASDAQ:CTSO) Shares Could Introduce Price Risks After 28% Bounce

Cytosorbents Corporation (NASDAQ:CTSO) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. Notwithstanding the latest gain, the annual share price return of 4.5% isn't as impressive.

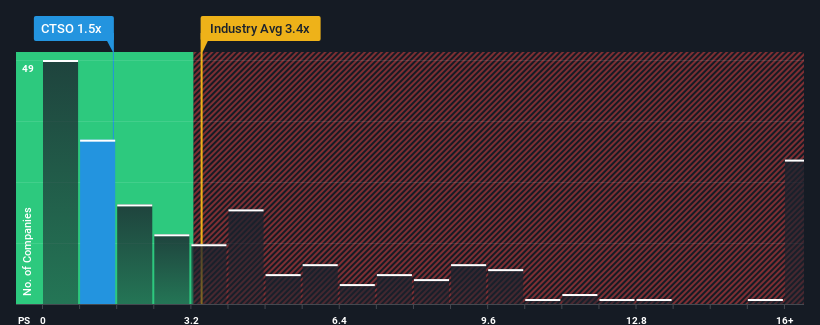

Even after such a large jump in price, Cytosorbents may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.5x, since almost half of all companies in the Medical Equipment industry in the United States have P/S ratios greater than 3.4x and even P/S higher than 8x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Cytosorbents

How Has Cytosorbents Performed Recently?

With revenue growth that's inferior to most other companies of late, Cytosorbents has been relatively sluggish. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Cytosorbents' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Cytosorbents' to be considered reasonable.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 15% drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 18% per year as estimated by the three analysts watching the company. With the industry only predicted to deliver 9.7% per year, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that Cytosorbents' P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Cytosorbents' P/S?

Despite Cytosorbents' share price climbing recently, its P/S still lags most other companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Cytosorbents' analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Cytosorbents (of which 1 is concerning!) you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CTSO

Cytosorbents

Engages in the research, development, and commercialization of medical devices with its blood purification technology platform incorporating a proprietary adsorbent and porous polymer technology in the United States, Germany, and internationally.

High growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026