- United States

- /

- Healthcare Services

- /

- NasdaqCM:COSM

Slammed 27% Cosmos Health Inc. (NASDAQ:COSM) Screens Well Here But There Might Be A Catch

Cosmos Health Inc. (NASDAQ:COSM) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 82% share price decline.

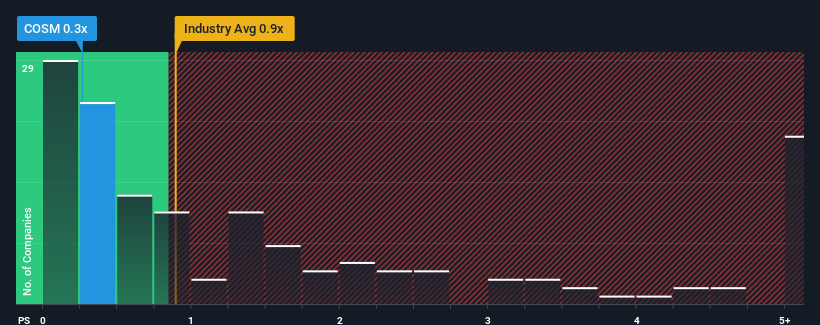

Following the heavy fall in price, given about half the companies operating in the United States' Healthcare industry have price-to-sales ratios (or "P/S") above 0.9x, you may consider Cosmos Health as an attractive investment with its 0.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Cosmos Health

What Does Cosmos Health's P/S Mean For Shareholders?

Cosmos Health hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Cosmos Health's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Cosmos Health's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 9.0%. This means it has also seen a slide in revenue over the longer-term as revenue is down 2.6% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 23% as estimated by the lone analyst watching the company. With the industry only predicted to deliver 7.7%, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Cosmos Health's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

Cosmos Health's recently weak share price has pulled its P/S back below other Healthcare companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

To us, it seems Cosmos Health currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Don't forget that there may be other risks. For instance, we've identified 5 warning signs for Cosmos Health (2 make us uncomfortable) you should be aware of.

If these risks are making you reconsider your opinion on Cosmos Health, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Cosmos Health, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:COSM

Cosmos Health

Manufactures, develops, and trades branded nutraceutical products in Greece, the United States, Croatia, Bulgaria, Ireland, the Cayman Islands, the UAE, the United Kingdom, and Cyprus.

Slight and slightly overvalued.

Market Insights

Community Narratives