- United States

- /

- Medical Equipment

- /

- NasdaqGS:COO

Cooper Companies (COO) Valuation: Reassessing Upside After Earnings Beat, Strong 2026 Outlook and Strategic Review

Reviewed by Simply Wall St

Cooper Companies (COO) just gave investors a lot to digest in one go, with an earnings beat, an upbeat 2026 outlook, a sweeping strategic review, and a new incoming board chair.

See our latest analysis for Cooper Companies.

Those upbeat results and the strategic review have helped the stock stage a near term recovery, with a 30 day share price return of 11.32%. However, the 1 year total shareholder return of negative 21.38% shows the longer term picture is still one of rebuilding rather than runaway momentum.

If Cooper’s reset has you rethinking healthcare exposure, it might be worth scanning other potential opportunities across healthcare stocks to see how the rest of the sector stacks up.

With shares still down sharply over 12 months despite an earnings beat, upbeat 2026 guidance and an ongoing strategic review, is Cooper now trading below its long term potential, or has the market already priced in the recovery?

Most Popular Narrative Narrative: 6% Undervalued

Cooper Companies last closed at $78.04, slightly below the most followed fair value estimate of $83.00. This frames a modest upside story rather than a deep value play.

Free cash flow is poised to inflect higher as a multi year capital expenditure cycle winds down following the ramp up of MyDAY capacity, with management guiding for approximately $2 billion in free cash flow over the next three years. This improved cash generation, tied to strong cost discipline and revenue momentum, will further benefit shareholders via debt reduction and share repurchases.

Want to see what kind of revenue climb, margin reset, and future earnings multiple are baked into that price tag? The narrative’s projections may surprise you.

Result: Fair Value of $83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying pricing pressure and a slower contact lens market, combined with ongoing fertility and IUD weakness, could quickly cap the upside to the recovery story.

Find out about the key risks to this Cooper Companies narrative.

Another Angle on Value

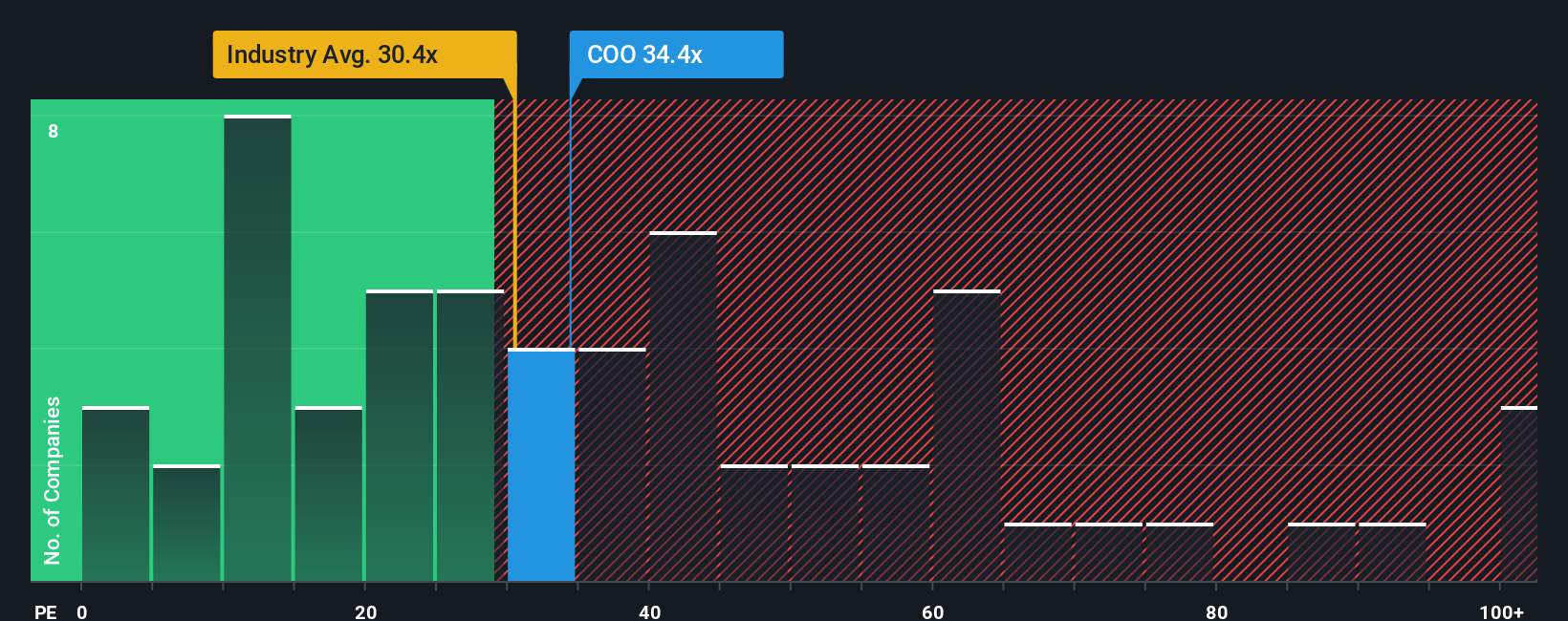

On earnings multiples, the picture looks far less forgiving. Cooper trades around 40.8 times earnings, well above the Medical Equipment industry at 29.2 times and a fair ratio of 31.3 times, implying investors are still paying up and leaving less room for error.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cooper Companies Narrative

If this view does not fully resonate or you would rather dive into the numbers yourself, you can build a complete narrative in minutes at Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Cooper Companies.

Looking for more investment ideas?

Cooper might be on your radar, but do not stop there. Use the Simply Wall Street Screener to uncover other opportunities before the market spots them.

- Unlock potential multibaggers by targeting these 3595 penny stocks with strong financials that match your risk tolerance and growth ambitions.

- Ride the next wave of innovation by focusing on these 27 AI penny stocks shaping the future of automation and intelligent software.

- Strengthen your portfolio’s income stream with these 15 dividend stocks with yields > 3% offering attractive yields backed by solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COO

Cooper Companies

Develops, manufactures, and markets contact lens wearers.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026