- United States

- /

- Medical Equipment

- /

- NasdaqGS:COO

Cooper Companies (COO): Assessing Valuation After Buyback Expansion and New Analyst Downgrades

Reviewed by Kshitija Bhandaru

Cooper Companies (COO) has expanded its share repurchase program by an additional $1 billion, bringing the total to $2 billion. The company has also drawn attention after Goldman Sachs initiated coverage with a Sell rating and flagged concerns about future growth.

See our latest analysis for Cooper Companies.

Cooper Companies has seen only modest momentum lately, with analysts reacting to its latest buyback announcement and cautious outlooks following recent earnings. After a year in which the total shareholder return slipped by nearly 0.3%, the stock's longer-term performance has remained relatively lackluster. This hints that investor sentiment is still waiting for stronger growth signals.

If the recent activity in healthcare and medtech is catching your attention, it’s a great moment to scan the field and discover See the full list for free.

With tepid momentum and shifting analyst opinions, the question for investors now becomes clear: is Cooper Companies undervalued after its recent setbacks, or is the market already accounting for all its future growth potential?

Most Popular Narrative: 15.3% Undervalued

The most widely followed narrative suggests Cooper Companies’ fair value is $83.19, which is a notable premium over the current share price of $70.46. This signals analysts see room for upside, provided the business executes on ambitious new product launches and operational improvements.

Investments in automation, digital solutions, and integration of recent acquisitions (notably in CooperSurgical and the fertility segment) are coming to fruition, leading to expected operating efficiencies, working capital improvements, and operating margin expansion. These factors support higher future earnings and free cash flow conversion.

What drives this double-digit discount to market price? Analysts are betting on a blend of automation, new product rollouts, and cost discipline to boost profit margins. The real surprise is in the numbers these projections unlock. Get the inside track on the forecasts fueling such a bullish price target.

Result: Fair Value of $83.19 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent pricing pressure in Asia Pacific and unpredictable product transitions could undermine the positive outlook for Cooper Companies' future growth and margins.

Find out about the key risks to this Cooper Companies narrative.

Another View: Multiples Raise Red Flags

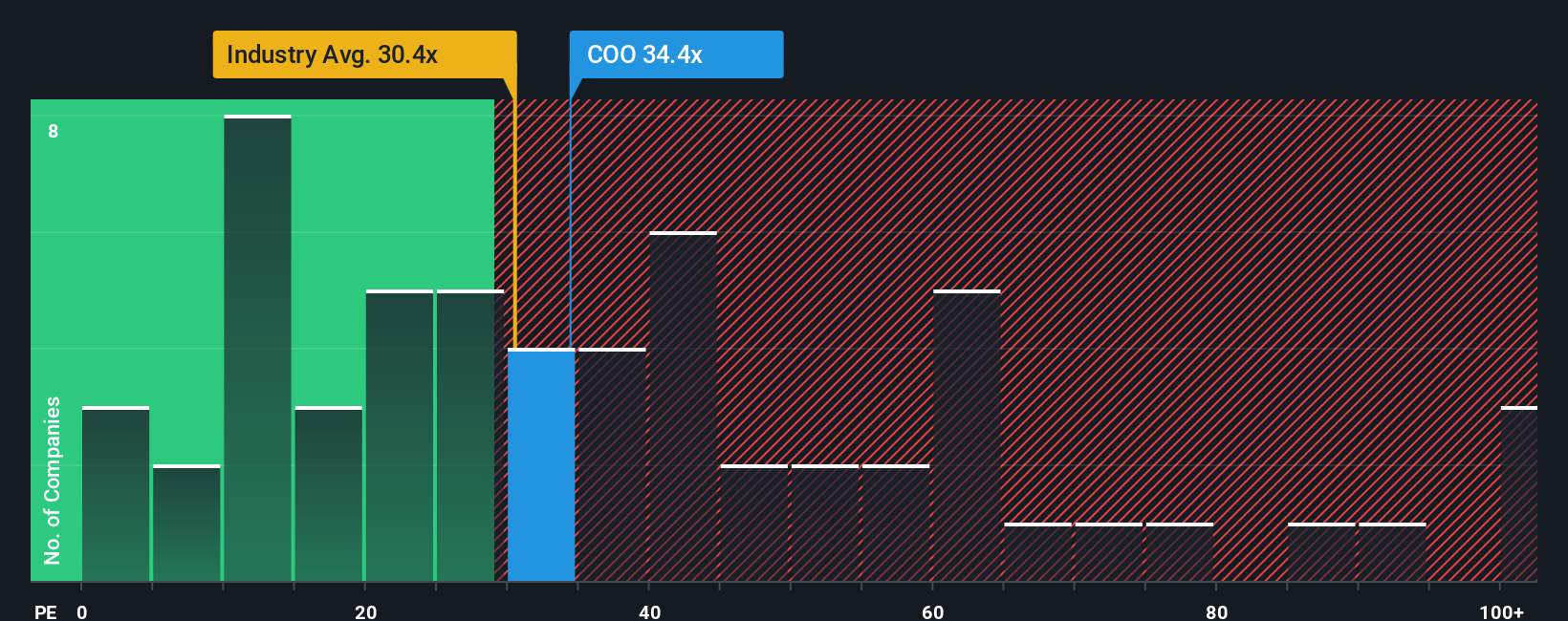

While discounted cash flow analysis points to a significant undervaluation, the market’s preferred yardstick tells a different story. Cooper Companies trades at a price-to-earnings ratio of 34.4 times, which is not only above the industry average of 30.4 times but also comfortably above the peer average of 27.8 times. Even compared to the fair ratio of 28.9 times, a level the market could realistically revert toward, COO stands out as fairly expensive. Does this premium signal investor confidence in future growth, or does it expose the stock to valuation risk if expectations fall short?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cooper Companies Narrative

If you see things differently or want to test your own perspective, you can dig into the numbers and craft a personal narrative in just minutes, and Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Cooper Companies.

Looking for more investment ideas?

Don't let valuable opportunities slip by. Broaden your outlook and spot trends early with these top picks tailored to different investing styles on Simply Wall Street:

- Position yourself for growth by reviewing these 896 undervalued stocks based on cash flows, where strong cash flows could drive tomorrow’s winners.

- Enhance your income potential with these 19 dividend stocks with yields > 3%, featuring stocks that reward shareholders with solid yields above the market average.

- Stay ahead of the innovation curve and get acquainted with these 24 AI penny stocks, companies leveraging artificial intelligence to transform their industries now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COO

Cooper Companies

Develops, manufactures, and markets contact lens wearers.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives