- United States

- /

- Healthcare Services

- /

- NasdaqGS:CLOV

Will New Jersey Pharmacy Pilot with IPC Digital Health Change Clover Health Investments' (CLOV) Narrative

Reviewed by Simply Wall St

- Earlier this month, Clover Health Investments announced the launch of a community-based pharmacy pilot program in New Jersey in partnership with IPC Digital Health, aiming to help seniors manage medications using local pharmacy networks and advanced technology.

- This initiative highlights Clover Health's ongoing efforts to personalize care for seniors and strengthen its footprint in key regional markets through technological innovation.

- We'll examine how this new pharmacy program and its focus on technology-enabled local care can influence Clover Health's overall investment narrative.

Clover Health Investments Investment Narrative Recap

To see value in Clover Health Investments, a shareholder needs to believe in the company’s ability to leverage technology and local partnerships to improve care delivery efficiency and drive profitable growth in Medicare Advantage. The recent New Jersey pharmacy pilot, while positive for the company’s tech-enabled care narrative, does not materially shift the immediate catalyst: sustaining Medical Loss Ratio (MLR) improvements while expanding membership remains central, though near-term financial results still hinge on maintaining these performance gains and controlling costs.

Among the recent announcements, the launch of the community-based pharmacy program directly ties into Clover’s ongoing investment in regional markets and aims to support better medication adherence for seniors via data-driven insights. By further integrating local pharmacists with digital tools, Clover is reinforcing its technology platform as a selling point, yet its profitability and ability to deliver planned margin improvements will still depend on how effectively these initiatives translate to measurable cost controls.

But on the other hand, investors should be mindful that if recent Medical Loss Ratio gains do not persist as Clover invests for growth...

Read the full narrative on Clover Health Investments (it's free!)

Clover Health Investments is projected to reach $2.5 billion in revenue and $122.3 million in earnings by 2028. This outlook is based on analysts’ expectations of 22.2% annual revenue growth and a $168.6 million increase in earnings from the current level of -$46.3 million.

Exploring Other Perspectives

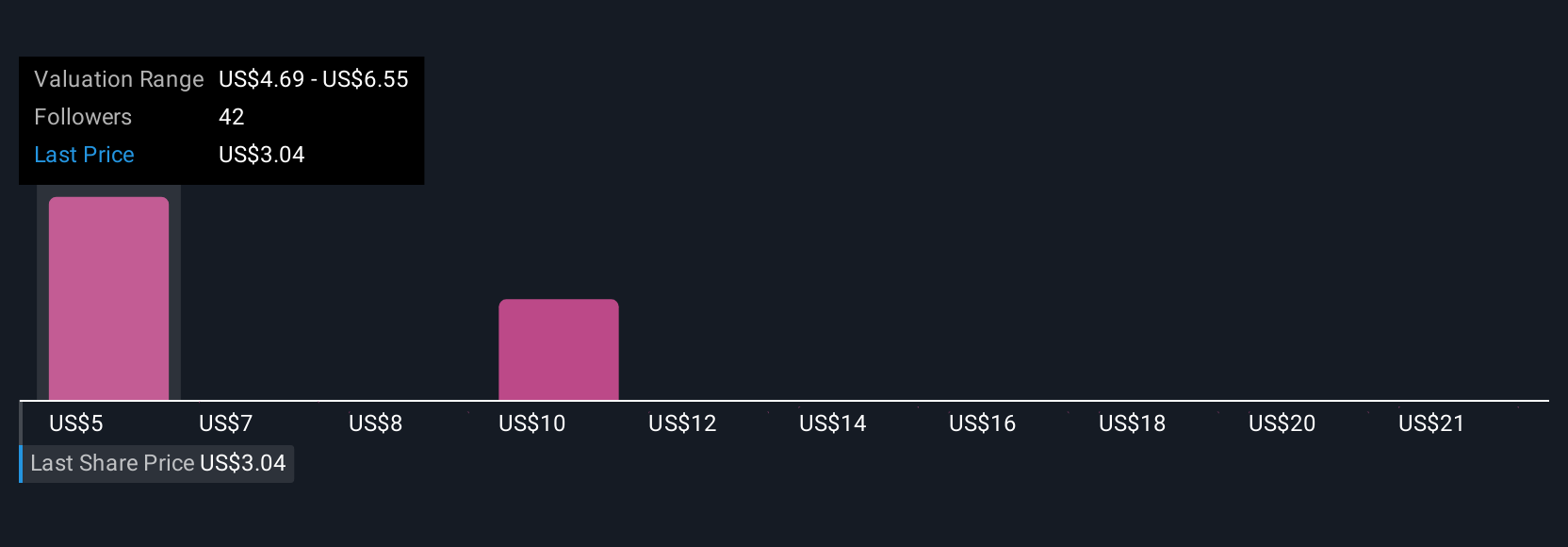

Eleven members of the Simply Wall St Community valued Clover Health Investments between US$4.99 and US$23.32 per share. With many focusing on sustained MLR improvements, you will find a wide range of interpretations about performance drivers worth considering.

Build Your Own Clover Health Investments Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Clover Health Investments research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Clover Health Investments research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Clover Health Investments' overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CLOV

Clover Health Investments

Provides medicare advantage plans in the United States.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives