- United States

- /

- Healthcare Services

- /

- NasdaqGS:CLOV

How Investors Are Reacting To Clover Health Investments (CLOV) Expansion of AI-Powered Medicare Offerings for 2026

Reviewed by Sasha Jovanovic

- Clover Health Investments recently announced its 2026 Medicare Advantage offerings, featuring expanded PPO plan options with $0 to low monthly premiums and stable or improved benefits for every member across five states.

- A significant aspect of this update is the company’s emphasis on provider choice, accessibility, and the integration of AI-powered tools to support better health outcomes for chronic conditions among seniors.

- We'll explore how Clover Health’s continued investment in technology-driven care through its Clover Assistant platform may influence the company’s long-term investment narrative.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Clover Health Investments Investment Narrative Recap

To own shares in Clover Health Investments, you need confidence in its technology-driven approach to value-based healthcare and its ability to convert rapid Medicare Advantage membership growth into profit. While the newly announced 2026 Medicare Advantage offerings reinforce Clover’s brand among cost-conscious seniors and highlight the strength of its AI-powered care model, the near-term path to profitability remains the key catalyst, this news does not materially reduce the risk stemming from rising medical and pharmacy cost pressures that could impact margins.

Among recent company news, Clover’s Community Pharmacy Pilot Program stands out, as it aligns with the broader push of the new plan offerings to improve chronic care delivery using the Clover Assistant. These efforts support the company’s view that scalable tech-based solutions can boost growth, but the effectiveness of such pilots in lowering cost ratios and improving sustainability is still playing out.

Yet, given shifts in benefit expense ratios and the uncertainty of controlling medical costs, investors should also be aware that...

Read the full narrative on Clover Health Investments (it's free!)

Clover Health Investments' narrative projects $3.0 billion in revenue and $10.7 million in earnings by 2028. This requires 22.8% yearly revenue growth and a $52.8 million increase in earnings from the current level of -$42.1 million.

Uncover how Clover Health Investments' forecasts yield a $3.20 fair value, a 19% upside to its current price.

Exploring Other Perspectives

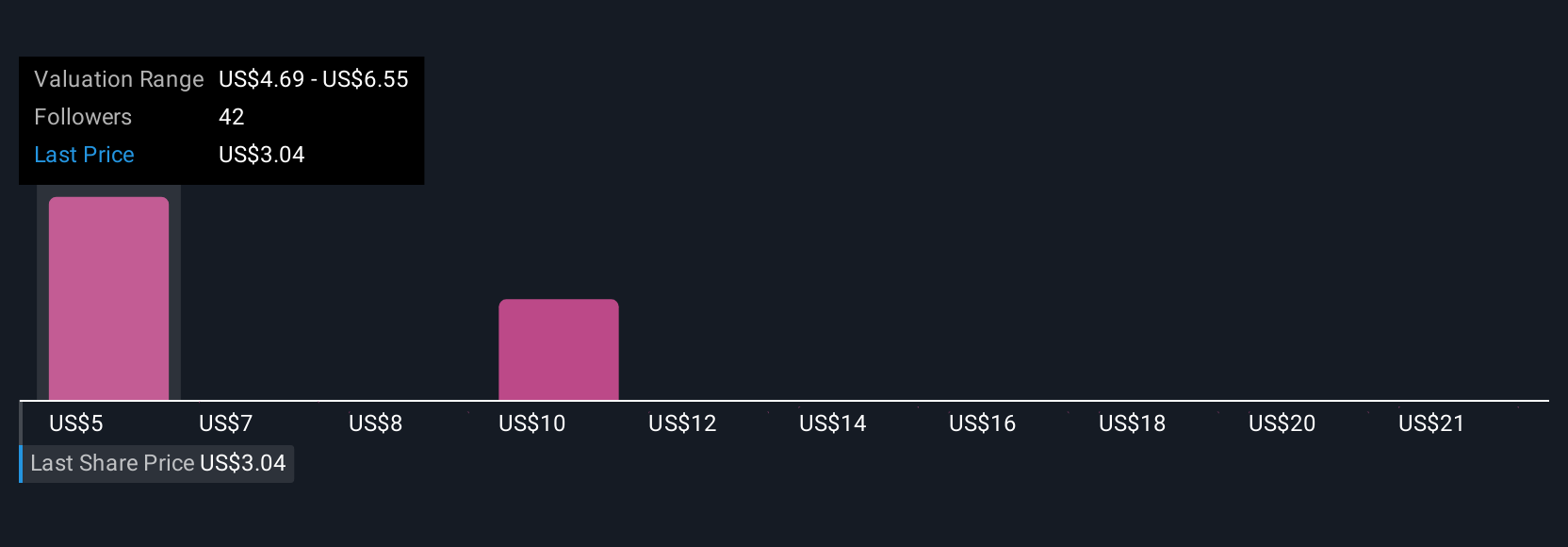

Twelve distinct fair value estimates from the Simply Wall St Community span from US$3.20 to US$23.32 per share. With many users seeing upside but margin risks from escalating healthcare expenses underscored by analysts, you can weigh these varied arguments to assess your stance.

Explore 12 other fair value estimates on Clover Health Investments - why the stock might be worth just $3.20!

Build Your Own Clover Health Investments Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Clover Health Investments research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Clover Health Investments research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Clover Health Investments' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CLOV

Clover Health Investments

Provides medicare advantage plans in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives