- United States

- /

- Biotech

- /

- NasdaqCM:EDSA

US Penny Stocks To Watch In February 2025

Reviewed by Simply Wall St

As the S&P 500 hovers near record highs and treasury yields drop following retail sales data, investors are keeping a close eye on the broader U.S. market trends. Penny stocks, often associated with smaller or newer companies, remain an intriguing investment area despite their vintage name. These stocks can offer a blend of affordability and growth potential when backed by solid financials, making them worth considering for those seeking opportunities in this unique segment of the market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.8964 | $6.3M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $131.87M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.81 | $46.67M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.84 | $86.14M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.395 | $46.2M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8977 | $80.89M | ★★★★★☆ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.40 | $24.65M | ★★★★★☆ |

| PHX Minerals (NYSE:PHX) | $4.17 | $154.8M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.61 | $382.26M | ★★★★☆☆ |

Click here to see the full list of 710 stocks from our US Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Edesa Biotech (NasdaqCM:EDSA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Edesa Biotech, Inc. is a clinical-stage biopharmaceutical company focused on the research, development, manufacture, and commercialization of pharmaceutical products for inflammatory and immune-related diseases, with a market cap of $6.45 million.

Operations: Currently, there are no reported revenue segments for this clinical-stage biopharmaceutical company.

Market Cap: $6.45M

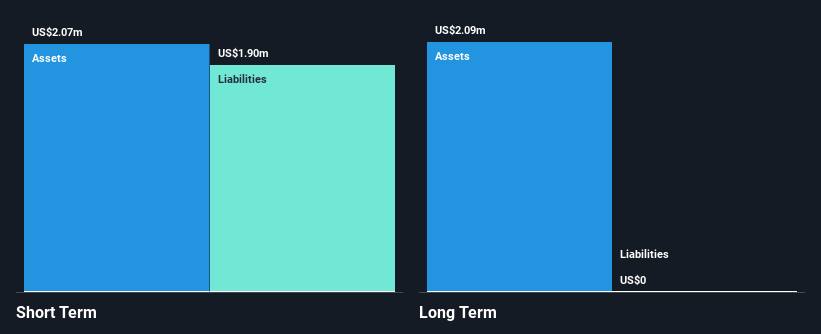

Edesa Biotech, Inc., a pre-revenue clinical-stage biopharmaceutical company with a market cap of US$6.45 million, recently raised US$14.99 million through private placements to bolster its financial runway amid concerns over its ability to continue as a going concern. Despite being debt-free and having an experienced management team, the company faces challenges such as high share price volatility and insufficient short-term asset coverage for liabilities. With earnings forecasted to decline by 6.5% annually over the next three years and no significant revenue streams, Edesa remains unprofitable with limited cash runway extension prospects without further capital raising efforts.

- Take a closer look at Edesa Biotech's potential here in our financial health report.

- Learn about Edesa Biotech's future growth trajectory here.

Cerus (NasdaqGM:CERS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cerus Corporation is a biomedical products company with a market cap of $319.43 million.

Operations: The company generates revenue primarily from its Blood Safety segment, which totaled $176.23 million.

Market Cap: $319.43M

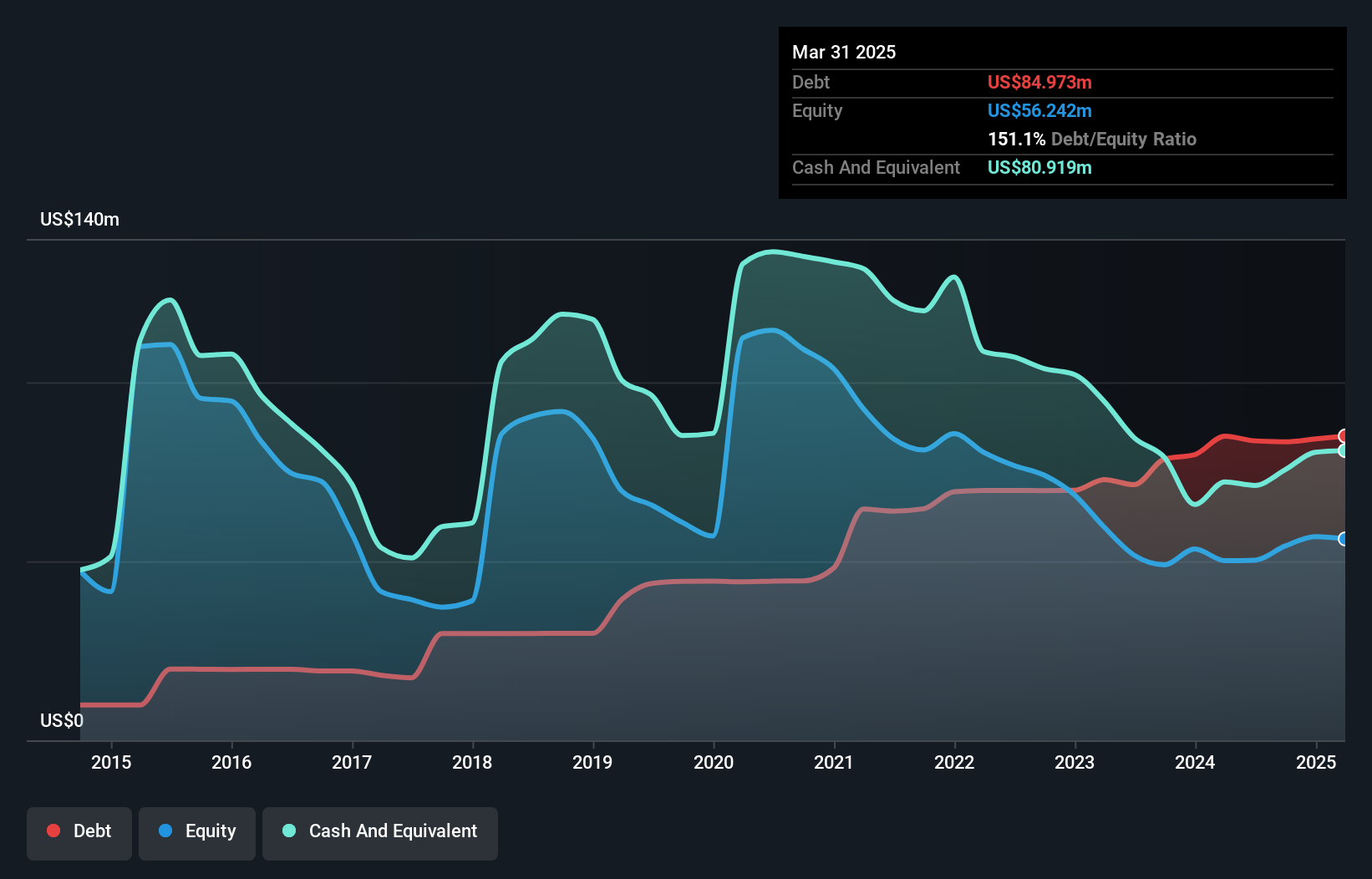

Cerus Corporation, with a market cap of US$319.43 million, is focused on its Blood Safety segment, generating US$176.23 million in revenue. Despite being unprofitable, the company has reduced losses by 17.6% annually over five years and maintains a satisfactory net debt to equity ratio of 14.4%. Recent guidance suggests revenue growth with expectations for full-year 2025 product revenue between US$194 million and US$200 million. The company's short-term assets exceed both short- and long-term liabilities, providing financial stability while an experienced management team supports strategic direction amidst executive board changes.

- Dive into the specifics of Cerus here with our thorough balance sheet health report.

- Explore Cerus' analyst forecasts in our growth report.

Forge Global Holdings (NYSE:FRGE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Forge Global Holdings, Inc. operates a financial services platform in California and has a market cap of approximately $149.73 million.

Operations: The company generates revenue primarily from its Integrated Private Markets Service Provider segment, which accounted for $79.80 million.

Market Cap: $149.73M

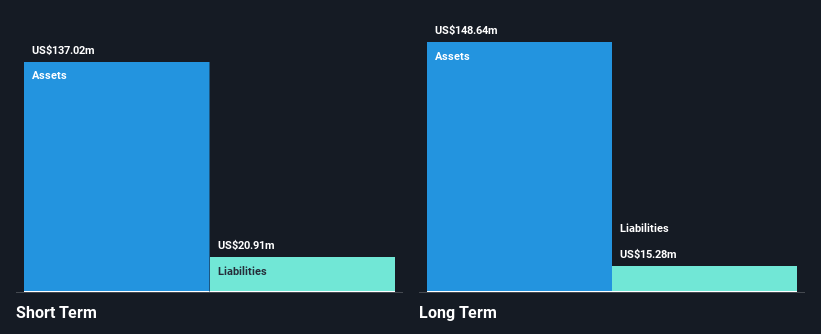

Forge Global Holdings, Inc., with a market cap of approximately US$149.73 million, faces challenges as it remains unprofitable and its losses have increased by a significant rate over the past five years. Despite this, Forge has no debt and maintains sufficient short-term assets to cover liabilities. The company recently appointed James Nevin from LSEG as CFO to enhance financial oversight amid efforts to regain NYSE compliance following a delisting notice due to low share prices. Revenue is expected to grow annually by 25.79%, though profitability is not anticipated in the near term.

- Click here to discover the nuances of Forge Global Holdings with our detailed analytical financial health report.

- Review our growth performance report to gain insights into Forge Global Holdings' future.

Next Steps

- Jump into our full catalog of 710 US Penny Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Edesa Biotech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:EDSA

Edesa Biotech

A clinical-stage biopharmaceutical company, engages in the research and development, manufacture, and commercialization of pharmaceutical products for inflammatory and immune-related diseases.

Excellent balance sheet moderate.

Market Insights

Community Narratives