- United States

- /

- Medical Equipment

- /

- NasdaqGM:CERS

Cerus Corporation (NASDAQ:CERS) Stock Rockets 29% But Many Are Still Ignoring The Company

Despite an already strong run, Cerus Corporation (NASDAQ:CERS) shares have been powering on, with a gain of 29% in the last thirty days. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 14% over that time.

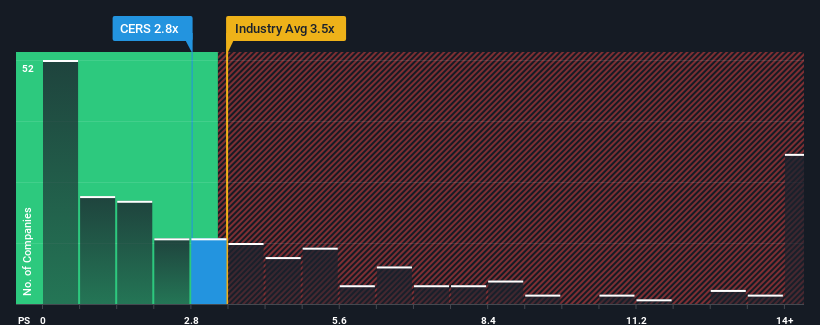

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Cerus' P/S ratio of 2.8x, since the median price-to-sales (or "P/S") ratio for the Medical Equipment industry in the United States is also close to 3.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Cerus

How Cerus Has Been Performing

Cerus hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Cerus.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Cerus' is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 3.5%. Even so, admirably revenue has lifted 70% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 12% per annum during the coming three years according to the four analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 9.5% each year, which is noticeably less attractive.

With this in consideration, we find it intriguing that Cerus' P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Cerus appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Looking at Cerus' analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Cerus you should know about.

If you're unsure about the strength of Cerus' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:CERS

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives