- United States

- /

- Healthtech

- /

- NasdaqGM:CCLD

CareCloud, Inc. (NASDAQ:CCLD) Held Back By Insufficient Growth Even After Shares Climb 158%

CareCloud, Inc. (NASDAQ:CCLD) shareholders would be excited to see that the share price has had a great month, posting a 158% gain and recovering from prior weakness. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 5.8% in the last twelve months.

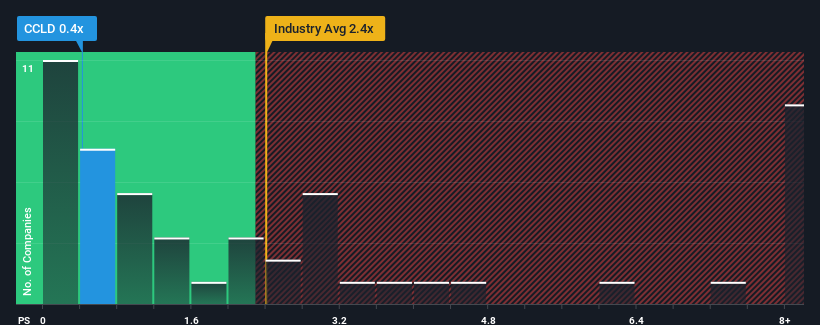

Even after such a large jump in price, CareCloud may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.4x, considering almost half of all companies in the Healthcare Services industry in the United States have P/S ratios greater than 2.4x and even P/S higher than 5x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for CareCloud

How CareCloud Has Been Performing

CareCloud could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on CareCloud will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, CareCloud would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 15% decrease to the company's top line. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 6.0% over the next year. With the industry predicted to deliver 12% growth, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why CareCloud's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What Does CareCloud's P/S Mean For Investors?

The latest share price surge wasn't enough to lift CareCloud's P/S close to the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that CareCloud maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

You need to take note of risks, for example - CareCloud has 4 warning signs (and 1 which is potentially serious) we think you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:CCLD

CareCloud

A healthcare information technology (IT) company, provides technology-enabled business solutions, Software-as-a-Service offerings, and related business services to healthcare providers and hospitals primarily in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives